Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

EMMA will make you smarter

Did you ever have the sense you were somehow being taken advantage of when buying or selling a municipal bond? It’s not a good feeling. But with EMMA, the Electronic Municipal Market Access, you will never experience that again. This online system lets you see all muni bond trade prices as they happen. In terms of providing transparency and protecting your interests, it…

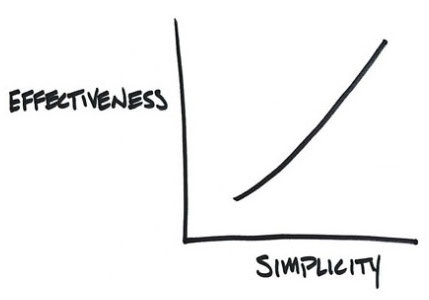

The Secrets to Better Investing are Not Secrets

Most providers of investment guidance want you to believe that they have some kind of mysterious secret, a magic key that unlocks a hidden universe of market-beating performance. Maybe it’s proprietary company research, access to exclusive hedge funds, or the decoder ring for price/volume charts. The complexity of these secrets may make them seem important and compelling, but we know…

The Best Kept Secret In Higher Education

If you or your child could get a Harvard education at 25 percent of its usual cost and with no application required, would you do it? Do you even believe it is possible? With a dismally low acceptance rate at Harvard University and tuition bills that should only be opened while sitting down, a Harvard education just doesn’t seem attainable for…

Team Osbon Results at The Wall St Decathlon 2015

This past weekend, 85 men, 9 women and 39 teams got together at DaSilva Memorial Field at St John’s University in New York for the 7th annual Wall St Decathlon. Benefiting the Memorial Sloan Kettering Pediatric Cancer Research Center, the event has raised over $6M since its debut in 2009 and raised over $1.3M this year alone. What is the Wall…

5 Reasons Hiring A Professional Takes You Further

Have you ever tried fixing something in your home and found yourself in over your head? Talk to anyone who’s ever tried to do a home construction project without help and you’ll likely hear one thing over and over, “I wish I had hired a pro.” Pros have the experience, tools, discipline and judgment to map out strategy, execution and operational details on…

What happens when markets change?

Markets change. Goals remain. You’ve probably noticed this line on our emails or web site. These four words are so much more than a marketing slogan. They’re the factual and philosophical basis for all we do. Markets do change. Everyday. It’s our job to keep your portfolio on track toward your long term goals as markets shift, drift, jump and…

Why I am relentlessly optimistic

I’d like to take you inside the mind and life of a 27 year old. Me, that is. From my perch as a partner in Osbon Capital and a proud resident of the Fort Point area in Boston the world looks bright, promising and full of opportunity. Here’s why. Things cost less People complain about high and rising real estate…

Should I worry about bonds?

Yes. When interest rates go up, the value of existing bonds fall. Period. So with rates historically low today, holding bonds may be riskier now than we have grown to expect over the last several decades. Here’s how we got here and how you can get through the future of interest rates without knowing where rates will go or when….

The Osbon Experience: 24/7 Communication

Communication is a critical element of any relationship. If you become a client of Osbon Capital, what kind of communication can you expect? How often? Where? How? Our policy is simple: “Any reason, any time, any way, however your prefer.” Here’s how it works. In-person We’d like to see you face-to-face at least once a year. An in-person meeting is the…