Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

How We Approach Investing In Start Ups

Osbon Capital manages client investments like a college endowment would be managed: with capital preservation, growth and longevity as the primary goals. Nearly all of our investments are in highly liquid major publicly listed securities because they fit well with these client goals. However, from time to time unique direct investment opportunities can arise, and when they do, they can represent a good opportunity for a client to step outside of their traditional allocation. Here’s how we look at special situation investments:

Win with Small Firms — 6 Big Ways

The story of small versus big is as enduring as the David and Goliath legend. Investors who are thinking about changing advisors or picking an advisor for the first time can choose from dozens of big firms and thousands of small firms. So, which is best for you…small or big? Several years ago, Malcolm Gladwell floated the idea that small firms have a real business advantage over larger competitors. We agreed then and feel even more strongly that way now. Here are six reasons why.

Stay with International

US-based investors holding international investments are sorely tested these days. Stock markets outside the US have not been generous in returns recently, certainly not as good as US stocks. Furthermore, the dollar is up 9% this year, wiping out what gains are available overseas. Headlines aren’t helping. Brexit talk, regime change and America First have contributed to the concern for international investors. Have we reached a point where the reasons to abandon international investments outweigh all possible benefits? Here are the reasons to stay with international investments.

Less Gold. More Yield.

Gold remains an important asset class in global investment markets. With 190,000 tons mined and a market price of $1200 an ounce, the market value of gold is over $7 trillion dollars. While gold is a meaningful asset class, it has become smaller compared to the rest of the market because its price has been going down since 2011. Is it time to give up on gold? We say no, and here’s why.

6 Easy Steps for Investing With Your Kids

It’s never too early to start educating your children on investing. From their younger vantage point, kids have their own set of investment advantages. This week’s article lays out an easy hands-on process to get kids thinking about investing (versus spending) and help them prepare for the day when they manage their own finances. Here’s how you can start:

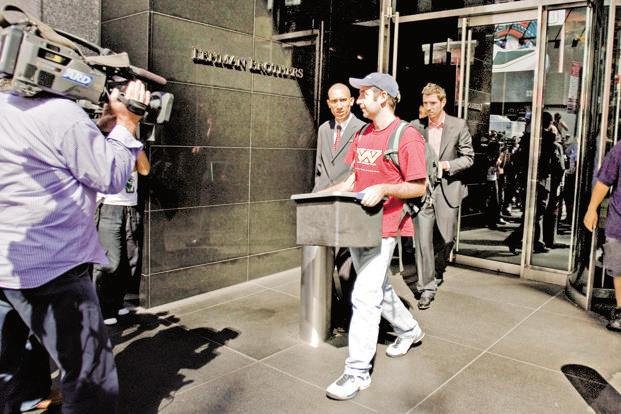

Ten Years Post-Crisis, What Have We Learned?

September 2018 is the month to mark – not celebrate – the ten-year anniversary of the financial crisis. The crisis started on three specific days. First, Fannie Mae and Freddie Mac were put into government conservatorship on September 6th. Next, Lehman Brothers filed for bankruptcy on September 15th. Finally, AIG was bailed out by the government on September 16. Just recalling these events can give you the chills. What have we learned since then?

Price Targets Are Obsolete: Why are they still a thing?

Apple is in the news again this week because of its Gathering Round conference where the company announces new products and upgrades. With every event like this comes a new round of price targets and buy/hold/sell recommendations from Wall Street analysts. Our question is why do they bother? Individual price targets are notoriously unreliable and can be dangerously wrong.

Peak Passive? Not so fast.

The FT ran a story this week asking if we’ve hit “peak passive.” Similar to peak oil, peak “X” refers to an asset class hitting a sort of critical mass or market saturation. It also vaguely implies that there is no more room to grow and down is the only direction possible. With millions of investors relying on portfolios of passive index ETFs, this could be a mass catastrophe in the making. Or is it? Let’s take an objective look at the perils and possibilities of passive.

Determining your liquid assets

Between boomers wrapping up careers and entrepreneurs thinking about new ones, many are considering retiring from current roles to follow other pursuits, passions and opportunities. For these folks, a critical question is how much cash to hold. Cash reserves provide a sense of security, a buffer against a challenging investment climate and dry powder for interesting one-off opportunities. How much is enough? Is there such a thing as too much? The answer is often a dynamic moving target. Here are some considerations: