Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

Week 3: Tech Empire Building, Auto Challenges and Bill Miller on Bitcoin

Briefing: Markets are negatively surprised by faster than expected Fed tightening and a worse than predicted Omicron variant. | Meta and Microsoft are aggressively investing in their future vision of the metaverse. | Cars are turning into highly complicated rolling computers facing many production challenges. Tesla and the semiconductor industry as a whole are in a position of strength. |…

Week 2: Large But Not In Charge, Socially Aware Investing and AP Photography NFTs

Briefing: The S&P 500 does not allow unprofitable companies into the index, so we took a look at the current list of the top ten unprofitable US companies. Six of those companies are in the Nasdaq Index. | A recent survey related to corporate leadership showed that the general American public wants better quality jobs and better wages. | Associated…

Week 1: Byron Wien’s Predictions and The Great Robotics Rollout

Happy New Year and Welcome to Week 1 of 2022! Briefing: Byron Wien released his annual markets surprise list highlighting global energy challenges as a recurring theme. | We have seen the first proofs of concept of a diverse set of robotic workers ready for everything from grills to warehouses. | The Oculus headset outsold the Xbox for the first…

Week 51: Inspiring Workers, Giving and Gratitude

Inspiring workers: wages and labor participation There’s a lingering question in the US around unemployment, and many wonder how long we can have both a shortage of workers and a relatively high unemployment rate. In the US, we peaked at 158.7mm workers in February 2020, just before the onset of COVID. Today we are back to the 155.1mm US worker…

Week 50: Terra Luna, Stablecoins and Quad Witching

Briefing: The Quad Witching is tomorrow, Friday the 17th, and it typically brings volatility in the weeks leading up. It’s a reminder of the massive derivatives market and its effect on market prices. | Stablecoins received a shout-out at the Federal Reserve Press Conference. | The most interesting emerging stablecoin is $UST powered by Terra Luna out of South Korea….

Week 49: The Infinite Machine, A Different Look at NFTs and Market Selloffs

Briefing: The Infinite Machine about the creation of Ethereum is a must-read. | NFT is an overused term, so we’re writing about it this week to add clarity to the underlying principles that make this technology valuable. | Market selloffs happen regularly. As long as underlying fundamentals haven’t changed, it’s usually a buying opportunity. The Infinite Machine I recommend a…

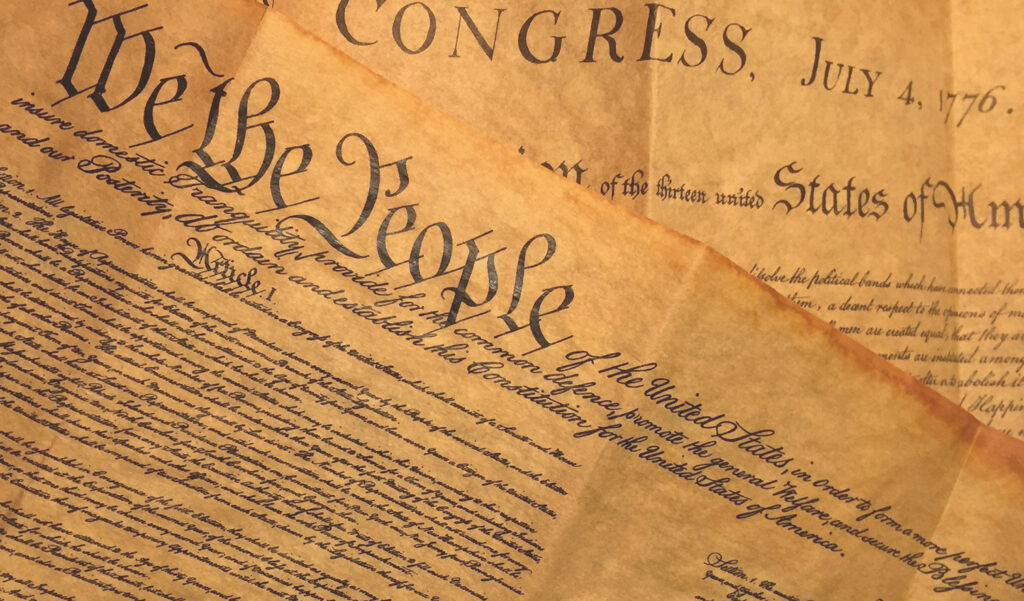

Week 48: Constitution Update, Don’t Fight The Fed, Metaverse Growth

Briefing: The ConstitutionDAO did not win the Sotheby’s US Constitution bid, but found a way to win anyway. | Don’t fight the Fed is an investment heuristic worth listening to. | The Metaverse continues on its growth trajectory. ConstitutionDAO Update Since week 46, you probably saw the result that ConstitutionDao did not win their bid to buy a physical copy…

Week 46: The US Constitution, Tracking Web3.0 Hacks, and so on.

Briefing: A discord channel raised $30m+ in four days to buy the only privately held copy of the US Constitution from Sotheby’s, foreshadowing a world where DAOs with passionate leadership gain significant power. Tracking frauds, failures and security breaches in Web3.0. The largest hack to date was returned by the hacker. Don’t get carried away with parabolic commodity prices. They…

Week 45: Web3.0 Evolutions

We’re covering Web3.0 this week because the space is evolving rapidly and we want to mark the progress and evolution for our readers. This article covers some of the most notable and relevant updates that we think everyone will find valuable as we look into the future of Web3.0. Skepticism is an expensive habit It feels smart to look at…