Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

Would you play poker for $1 million?

“Timing the market is basically playing poker with the best players in the world who play around the clock with nearly unlimited resources,” says Ray Dalio. He should know. He’s the billionaire founder of the largest hedge fund company in the world, the $160 billion Bridgewater Associates. If you’re trading your own investment account, you may be the weak hand in…

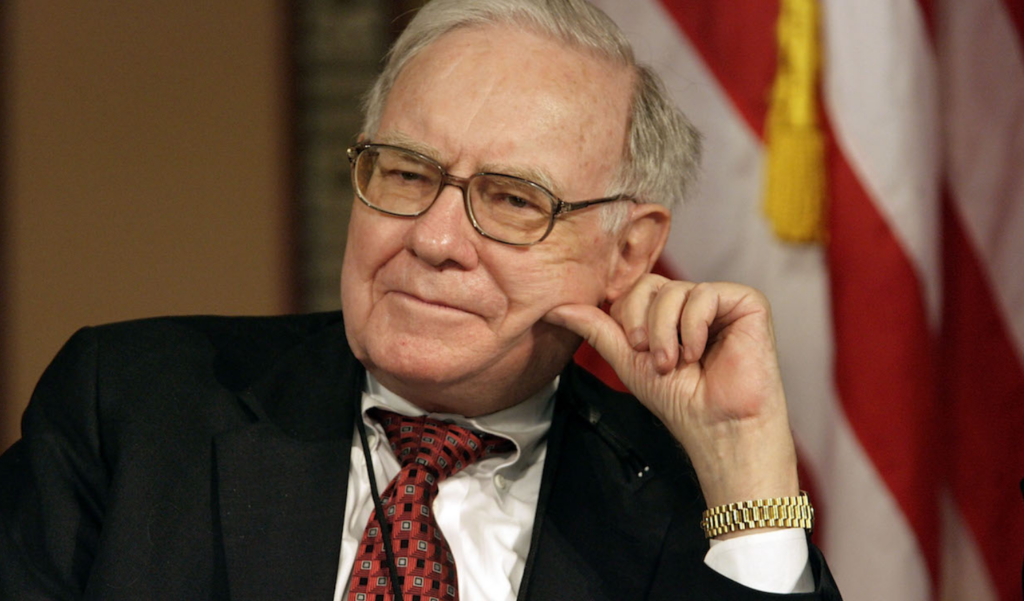

What would Warren tell you?

If you sent a letter to Warren Buffett asking for some investment advice, what do you think you’d get in the return mail? A board member of the San Francisco employee pension fund found out. What exactly did Mr. Buffett’s handwritten note say? The $20 billion pension fund had been considering an investment in hedge funds. The board member described…

Top 5 Cognitive Biases Of Investing To Watch Out For

Last week, State Street’s Center for Applied Research released a fascinating thought piece on the common human traits that lead investors to sabotage their success. Falling prey to one or more of these naturally occurring cognitive biases can drastically change your investment outcome. Fortunately, simple awareness can be enough to help save us from ourselves.

Investment Thanksgiving

Happy Thanksgiving! There’s much to be thankful about on this most American holiday. Since we always write about money as investment advisors, on this day of thanks we came up with questions that can help you understand why YOU are thankful about your money.

Can you pass State Street’s ‘Success Sabotage’ test?

Our own State Street right here in town is calling out investors and professionals in its just-released Folklore of Finance thought piece. Are you or your advisors guilty of sabotaging your own investment success? See if you are prey to these false folklores.

What’s your TWA rating?

What’s your TWA rating? TWA is back. No, not the airline. This TWA is about your capacity to manage your own investments. Do you have the time, willingness and ability to be successful? Few do. There’s a way to find out. Time: Can you spare it? Do you have the time to manage your own investments? Of the 168 hours…

FOMO’s Evil Twin: COMO

We know that fear of missing out (FOMO) can drive bad decisions and behaviors, but how does that translate to dollars and cents for investors? What’s the COMO (cost of missing out) on your investment portfolio? New studies answer that question, and the news is not good. COMO at work COMO – cost of missing out – is the financial…

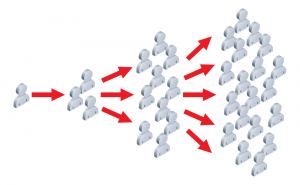

Catching a Thought Virus

Our own State Street right here in town is calling out investors and professionals in its just-released Folklore of Finance thought piece. Are you or your advisors guilty of sabotaging your own investment success? See if you are prey to these false folklores.

The 21st Century Family Investment Office

If you are not getting the Family Investment Office treatment perhaps it’s time for a change. Many people want FIO-level professionalism and end up trying to do it themselves at great expense, time, and risk. Ask yourself the question, “What would I do if I put few extra ‘zeros’ on the end of my accounts?”. The New Family Investment Office It may be time for…