Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

Too much time is spent talking about price. Fundamentals are ultimately what drive equity prices higher over time. To say this another way, a company’s stock price can’t continue to rise unless it continues to be successful. The famous quote by Warren Buffett is, “In the short run, the market is a voting machine, but in the long run (...)

More Quantum

More Quantum I became interested in quantum computing earlier this year when it became clear that AI was reaching its physical limits. You can read past posts on quantum here and here. AI growth today is constrained by total NVidia chip supply and total electrical grid capacity, not to mention the tens of billions of dollars needed to build and…

ETF Loophole, Superabundance Example, More Nuclear

ETF Loophole My primary focus in writing these articles is to document emergent trends and share my perspective about their implications. Emergent trends cannot be systematically predicted. They are spontaneous evolutions based on changes in the underlying foundational rules that precede something flourishing into an entirely new field. In this case, I see a massive upcoming emergent opportunity created by…

Milei and Nuclear

Failure Is An Opportunity The status quo is sticky. Incumbent politicians have reelection advantages, for example. The same is often true for the policies people vote into place. The reason is simple: change is hard. It takes effort and it introduces uncertainty. Big changes typically only occur in the face of a crisis. In Argentina’s case, its own repeated failures…

Cuts, AI Wallet

Yesterday the Fed cut the overnight rate by 50bps from 5.5% to 5%. This sets a pace and precedence for the last two meetings of 2024, Nov 7th and Dec 18th. Two more 50bp cuts would bring short term rates down to 4%. Two 25bp cuts would bring us to 4.5%. Mega cap tech has had the upper hand over…

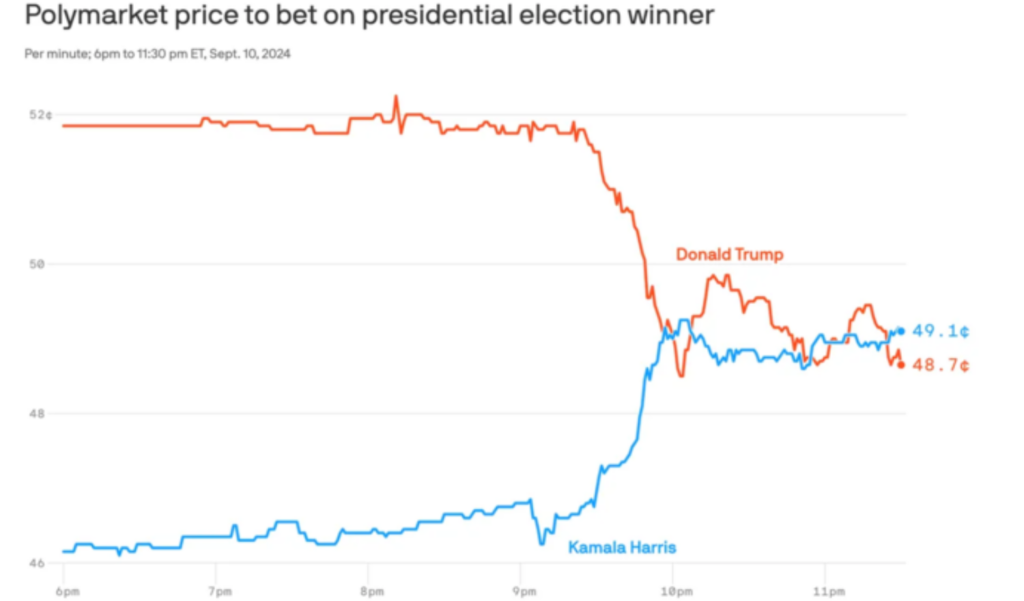

Rates, Agentic AI, Polymarket

Rates Next week the Fed will almost certainly issue its first rate cut, likely 25bps, which will bring the rate between 5-5.25%. There are many takes on historical rate cut precedence, what has happened to markets in the past during rate cut cycles, but I am going to focus on just a few variables that I think are important or…

Exponential Impact

Exponential Impact Investing philosophy and research invariably comes with a certain degree of mild and persistent anxiety. There’s always a fear that growth has topped out and can’t possibly go any further. It’s helpful to keep in mind that technological progress (human ingenuity) is the ultimate driver of continued growth regardless of where you might see slowing growth. GDP growth…

More Summer Bites, AI Ping Pong and Quantum

AI Ping Pong Is An Analogy DeepMind recently published a paper on a robot that uses AI, computer vision and an articulating arm to play competitive ping-pong against opponents of various skill levels. Here is a link to the videos. Two things stood out to me. First, they chose to build the robot using a fairly standard articulating robotic arm…

Quick Summer Bites

Keeping it short this week. Inflation Global shipping rates went parabolic during Covid (10x). Two years later those rates fell -90% snapping back to pre-Covid levels. After two years of normal prices, shipping rates have spiked once again up 5x compared to their historical norms. This is partly due to industry specific issues, but also heavily influenced by war, particularly…

Japan, AI Management

Big Week By now you’ve probably seen many detailed recounts of the Japanese carry trade that rocked markets this week. Too many people put too much money into the same trade. The problem with overcrowded trades is there are always leveraged buyers who end up as forced sellers. That’s why panic selling looks so brutal, investors are unloading assets at…