Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

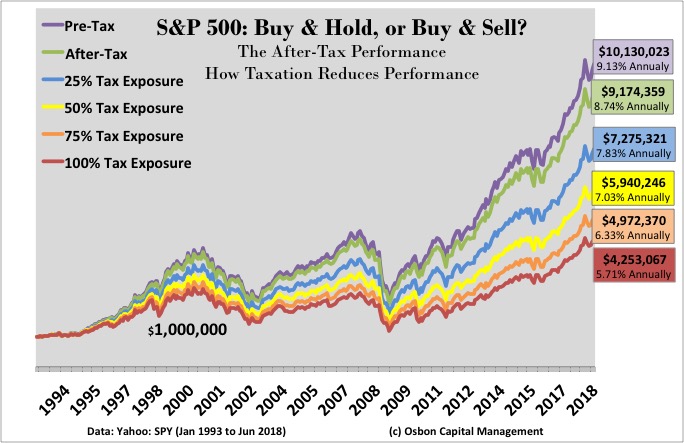

Raise Your Expectations Again

Five years ago I wrote, “Raise Your Expectations.” This week I am again urging investors to look at their after-tax investment returns. This is not the number your advisor or fund company may want you to focus on, but it’s really the only one that matters. Because it’s so important to your investment results, let’s revisit the after-tax topic and see why it’s still a problem the financial services industry tends to sweep under the rug.

Inflation Today. Is it CPI or MyPI?

It’s easy to think of inflation as financial weather – something we must endure and can’t control. While it’s true we can’t individually control the prices that grocers, automakers and landlords charge, we can, and should, control what we spend. We’re all familiar with the Consumer Price Index, or CPI. It tracks the cost of groceries, rent, utilities and other goods and services most of us use. When the cost of men’s sweaters go up, so does the index.

Five Reasons Investing Gets Harder as You Get Wealthier

It’s a paradox of wealth. As your net worth grows and you start thinking investing will finally get easier, you may find the opposite is true. It turns out that choosing the right investments and financial advisors can become more difficult, or at least more confusing, as you amass assets. Here are five reasons why. 1. Instant popularity. With increased…

Trust and Estate Strategies

However unpleasant or dull the idea might seem, the trust and estate planning process is the true backbone of your family’s wealth. What happens after you’re no longer around to make family wealth decisions will either be based on your clearly documented instructions or the decisions of a judge. Shouldn’t you be the one to decide what happens? Here are…

What If Amazon Enters The Asset Management Business This Year

Amazon’s entry is not a joke and it could happen soon according to a Vanguard executive who was in town last week for the Vanguard investment confab. Not only that, a number of prominent retailers could launch wealth management offerings as financial advice is commoditized and scaled even further to reach the smallest investor. Costco and Walmart come to mind. The executive acknowledged that Vanguard is actively planning to compete with technology-driven companies that have never been in wealth management. They take the threat seriously.

When the music stops

Markets hum along to their own beat and rhythm, until they don’t. From time to time, the music suddenly stops. It might be fears of a trade war that trigger a sudden silence and jarring price dislocations. It might be Korea, protests in Jerusalem, or bankruptcy fears in China. We typically get no advance warning, and never know how long…

Investing Is Much More Than Numbers And Graphs

I’ve always felt an advisor must do much more than open accounts, analyze investments, trade securities and send quarterly reports. I’ve continually looked for deeper, better ways to relate to and communicate with clients – ways that help both parties understand and maximize the benefits of investing. That’s what led me to a fantastic leadership retreat this past weekend created by ex-Google employee #107 called Search Inside Yourself (SIY).

Bubbles Are Not Irrational

The word “bubble” can be an emotional trigger for investors, immediately stoking fear and anxiety. Pundits and economists may refer to bubbles as irrational market anomalies, but there’s much more to the story than that. Here is some context so that you can understand the investor mindsets and strategies that spawn them.

6 Reasons To Say No To News

It seems almost self-evident that whoever has the best access to current news sources gains a significant advantage as an investor. Because information is power. Or is it? The business model of the news cycle is increasingly reliant on triggering your emotional reflexes. How does today’s news help or hinder investors?