Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

A Micro-Bubble Is Popped

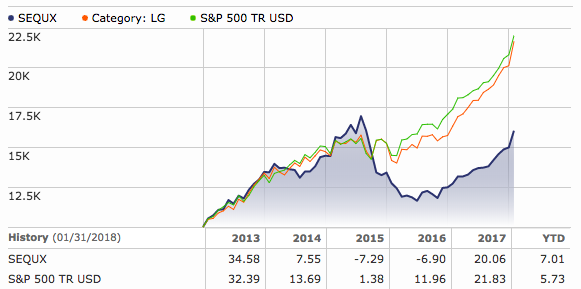

It’s been 20 days since the Dow peaked at 26, 400. After a wild ride, the index is back within a few percentage points of that level. While very little has changed in the diversified portfolio of long-term investors, some casualties of the market flip-flops have floated to the surface. One is LJMIX. Here’s the story of a fund that took a few bad days and turned them into bona fide disasters. What can we learn from its mistakes?

Three Ways to Protect a Windfall

The sudden arrival of a large sum of money can be exciting and disorienting at the same time. The big dollar amount may short-circuit some of your normal financial decision rules and patterns. With that in mind, we offer you three solid ways to protect a windfall and prevent future regrets about how you spend and invest it.

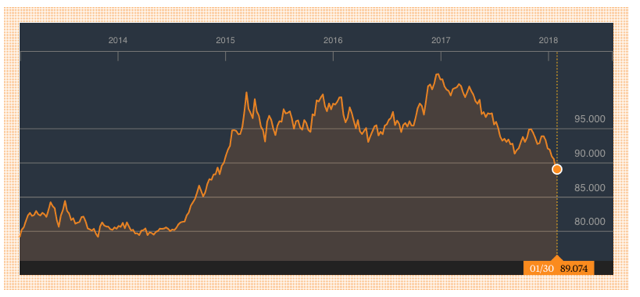

The Road Ahead for the Almighty Dollar

Big changes in dollar strength can have big economic effects at home and around the world. The strong dollar was called into question last week in Davos and emerged unchanged. What will investors be looking for the dollar to do in 2018? Here’s our checklist.

How Yields Have Changed – 2018

It’s week four of the investing year. This week the government reopened. The president and eight cabinet members are in Davos. The news for stocks has been all positive so far this year, but what about bonds? What kind of cash flow can investors expect from fixed-income investments in 2018?

Set Your Anti-Goals for 2018

While your neighbors are trying to keep their resolutions for the new year, we suggest you take a slightly different path. Think about the financial behaviors you want AVOID in 2018. By resolving to NOT do a few things you can reduce your financial stress and improve your investment results. Here are some suggestions as the year begins.

An Old School Melt-Up

Jeremy Grantham is well known as a value investor and a permabear. He buys only cheap value investments. He has been famous for talking down US investments for years. However, on January 3rd of this year, he wrote “a very personal” view of a possible near-term melt-up. Jeremy is well worth listening, especially when he changes his mind.

The Year Ahead: 10 Trends

To kick off the year we’ve decided to publish our crystal ball list for 2018. From blockbuster IPOs to Blockchain billionaires, here are ten of our favorite developments.

New Tax Law: 529s and More

I have been spending as much time as possible reading about the newly enacted tax bill, the first tax reform signed in 31 years. All sides agree that the bill lowers tax rates for corporations and individuals. After that, there is little consensus on the broad effect of tax reform, who it really helps or harms, and how long it will last. The devil is in the details. Here are a couple items of special interest to investors.

What is Sayre’s Law?

With family in town for the holidays, you may find that the discussion turns to markets and politics at some point. The discussion may even get heated as common ground seems harder to find these days. In these moments, it’s helpful to remember Sayre’s Law. Sayre’s Law dictates that: “In any dispute, the intensity of the feeling is inversely proportional to the value of the issues at stake.” Here’s more: