Catching a Thought Virus

Inoculate Yourself Against the Latest Thought Virus

Inoculate Yourself Against the Latest Thought Virus

What’s behind the recent stock market swoon that started September 18th? Robert Shiller, Nobel-prize winning economist, suggests it may not be any meaningful economic problem. It might be a “thought virus” comprising a global growth slowdown, deflation and secular stagnation. So what’s a thought virus and what’s the recommended treatment?

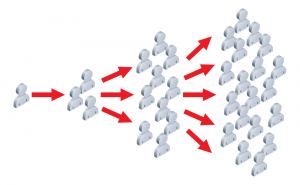

Thought contagion

Shiller’s recent editorial in the Times, When A Stock Market Theory is Contagious talks about the stock market being driven by “popular narrative, true or not.” He calls such stories “thought viruses” and labels them pernicious and contagious. A ‘thought virus’ is an idea distinguished by its seeming common sense, endless repetition in the media, and fervent pronouncement by pundits and seers. Such is the case right now with the growth scare ‘virus’ and its nasty cousins, stagnation and deflation. After all, the ‘thought virus’ says, we have evidence, we can predict the future and all the experts agree. If only investing were that simple. Look at 2011.

Oooops

Shiller goes on to describe a previous thought virus in 2011, causing the stock market to drop 22% from May to August of that year, much more than our current Fall swoon. Conventional wisdom had it that Congress would not pass a debt ceiling extension and that the US would default. Recession and other horrible things would happen. We didn’t default, but S&P downgraded our debt one notch for the first time ever. The world did not end. In fact, stocks have soared 60% since then. Great for long-term investors, fatal for market timers and short sellers, and a great example of how misleading and dangerous a thought virus can be for your portfolio.

A word from Buffett

Are we experiencing real problems now, or just growth scare, stagnation, or deflation viruses? Some experts have lined up enough evidence to make it sound real, but is it? And will stock prices fall farther based on this line of thinking? No one can know. One of Warren Buffett’s first rules is that the stock market and the economy do not move in sync, and that “just because you can tell me what the econo my is doing doesn’t mean you can tell me what stock prices are.” Truer words….

my is doing doesn’t mean you can tell me what stock prices are.” Truer words….

What can you do?

It’s best to inoculate yourself against thought viruses so they don’t infect your investment portfolio. How is this possible? By focusing on and acting on what you can control, and ignoring what you can’t control. A professional can help you establish personalized guidelines for sorting out the signal from the noise in your investments. Basic anti-virus steps in the Osbon Capital family investment office are diversification, timeline planning, and contribution and withdrawal management. Throw in cost control, tax efficiency, consolidated reporting, and mandated no-conflict of interest rules and you are better able to sleep at night while others feel feverish over an endless loop of negative thought.

John Osbon – josbon@osboncapital.com

Weekly Articles by Osbon Capital Management:

"*" indicates required fields