Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

2024 will bring more positive novel surprises. New years always do. In 2023, it was the dramatic acceleration in AI, which touches nearly every industry, and the early stages of an answer to the obesity epidemic with GLP-1s. Here is a list of what’s on our minds going into 2024.

Catching a Thought Virus

Our own State Street right here in town is calling out investors and professionals in its just-released Folklore of Finance thought piece. Are you or your advisors guilty of sabotaging your own investment success? See if you are prey to these false folklores.

The 21st Century Family Investment Office

If you are not getting the Family Investment Office treatment perhaps it’s time for a change. Many people want FIO-level professionalism and end up trying to do it themselves at great expense, time, and risk. Ask yourself the question, “What would I do if I put few extra ‘zeros’ on the end of my accounts?”. The New Family Investment Office It may be time for…

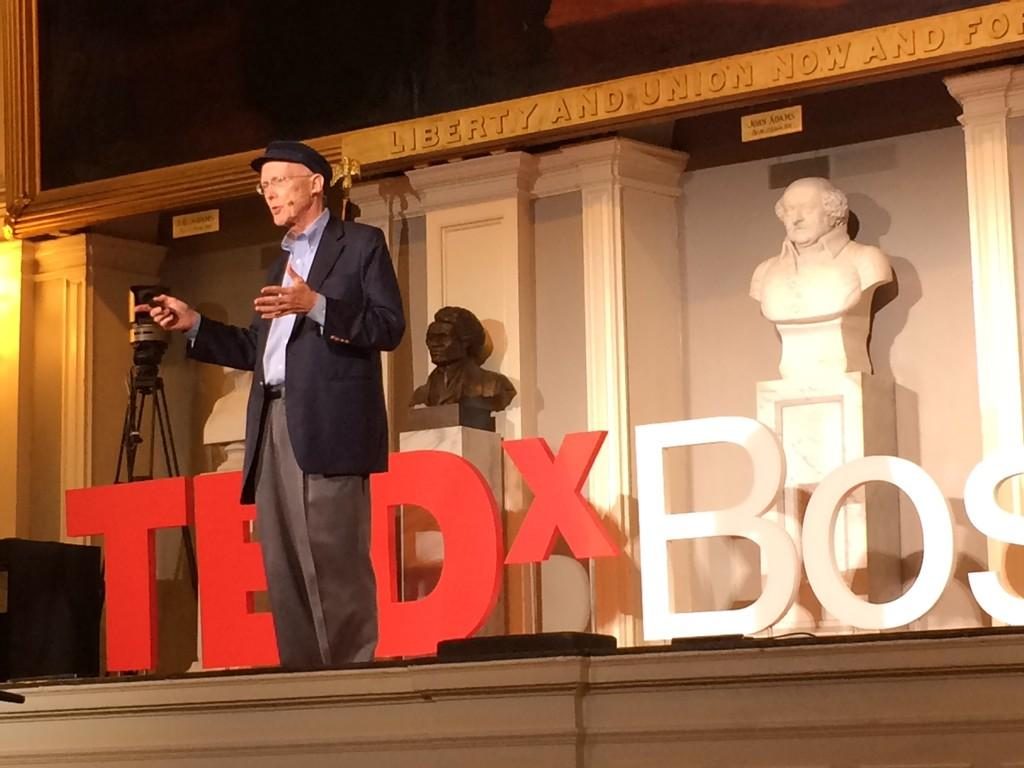

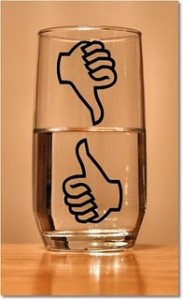

Lose The Gloom with TEDxBoston

Whenever you see a quick market drop or a flood of bad news, like we did this week, it’s a good time to look around for the great things that are happening right now. The good news is, there ARE plenty of great things to be excited about. TED Talks are a prime example. Last week the TEDxBoston group gathered in Faneuil Hall’s “Great…

How Can I Benefit From The Indexing Flood?

Indexing trickle turning into a flood – what’s that got to do with me? For index investors – the so-called passive investors and their providers – the industry news this year continues to be an unbroken boulevard of green lights. Money is gushing into index products, investor expenses are plummeting, investments are worth more than ever. What’s going on, and…

Does The Biggest Pension Plan Know Something You Don’t?

CalPERS, the largest US public pension fund at $300 billion+ just rocked the investment world by announcing it will eliminate its hedge fund program. With its money and clout CalPERS has access to the best investments anywhere and everyone wants them as a client. Now they are saying no to hedge funds. Why? Is CalPERS trying to tell us something about…

5 Questions To Pass The Barrons Test

Barrons, the weekly journal published by Dow Jones since 1921 is widely considered to be a leader in financial journalism. When it published its recent “How To Pick A Financial Advisor” I decided to put Osbon Capital to the test. You can see the questions and answers yourself right here: Here are the subjects Barron’s recommends you discuss with any…

Overcoming Investment FOMO

Fear of missing out (FOMO) is a natural human feeling. No one wants to miss a big event, or in investing, a big payout. Which makes us wonder: Should I buy Twitter? Facebook? Google? Alibaba? Are there others I should know about but am missing out on somehow? How can I be sure to get in on the next big…

Getting It Half Right Is Still Wrong

We all see the light in different ways at different times. Here’s how it went for Osbon Capital editor Steve Mott. I don’t remember exactly how I was introduced to index investing, but I was well ahead of the curve. I liked the idea of owning all the big company stocks without having to figure out which ones would be…

You Have More Than You Think

Where, you might ask? Look at the Social Security website and online benefits calculator from an asset point of view. Since the Social Security administration stopped sending out paper statements to you on your birthday, you can now go online and get personal benefit information along with valuable extras. 13 million people have already registered and collected their data. One…