Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

2024 will bring more positive novel surprises. New years always do. In 2023, it was the dramatic acceleration in AI, which touches nearly every industry, and the early stages of an answer to the obesity epidemic with GLP-1s. Here is a list of what’s on our minds going into 2024.

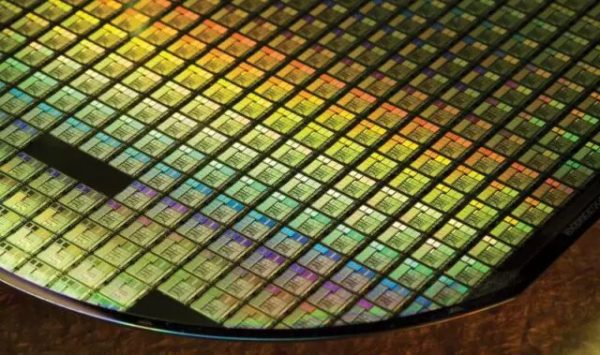

The Cloud Computing Age

The rise of public cloud computing was an inevitable next step following the development of the internet. Cloud computing allows companies to access sophisticated connected servers without the hassle of designing, constructing and maintaining complex data centers. With its ability to enable new business models, unlock exponential rates of growth and increase access, the public cloud transformation has a lot to offer.

Antidotes To Permabear Narratives

Perma-bear is a term used to describe an investor with a perpetually negative view of the future. Perma-bears are worth listening to because they can help us gauge where the worst of the worst risks could be lurking. In aggregate, they attract headlines but their track record has not been positive as they are far more often wrong. Let’s take…

The Triumph Of Intangible Assets

Over the past 20 years, intangible assets have become the dominant factor in company valuations. Today approximately 85% of the valuation of the S&P 500 is defined by intangibles, while in 1975, that percentage was just 17%. Intangibles are notoriously difficult to value. Given their slippery nature and their power to generate returns, it’s worth paying attention to the qualities…

Population Growth Is Cooling Off

Population trends are often absent from investment research reports. Population growth rates are best when measured in decades and centuries, which is perhaps too slow to be considered new information. Since 1900, the world population has exploded from 1.6 billion to 6.1 billion in 2000 and 7.8 billion today. However, population growth passed an inflection point nearly 50 years ago…

Deferring Capital Gains With Qualified Opportunity Zones (QOZs)

The U.S. Department of the Treasury Opportunity Zones, created by the Tax Cuts and Jobs Act in 2017, offers unique and creative tax opportunities for high net worth investors with capital gains. In exchange for investing in economically distressed areas, the IRS provides investors with substantial benefits that reduce, delay and avoid taxation. The right partner, the right location and…

Major Themes and Investment Opportunities Over The Next Five Years

As our economy develops in the post-COVID world, digital-first solutions are a primary focus for investors, entrepreneurs and executives. Public cloud infrastructure (Google Cloud and AWS) and robust broadband connectivity are still relatively new and have opened the doors to exciting new opportunities. SaaS (Software as a Service) companies are thriving, so are digital health solutions, eCommerce solutions and digital…

Securing Your Portfolio in a Complex World

The traditional risk types of investors – conservative, moderate, or aggressive – were created by the investment industry for the investment industry. It was a way of merely categorizing investors so advisors could efficiently allocate money. These risk models were not created with the customer in mind and are often way off the mark in terms of actual risk. A…

Disrupters, Adapters and Victims

Bill Gates states that we tend to overestimate what we can do in a year and underestimate what we can do in a decade. The migration from the private to the public cloud, e-commerce and the AI revolution are examples of genuinely revolutionary technology. These creations will produce significant gains in efficiency and richness in society over the coming decade….

Is Inflation Worry Justified?

Investors today may be worried about inflation. There is little to no official CPI inflation now, and there has not been any for some time. Around the world, the story is similar because major central banks are coordinating with the Fed. Debt growth and money printing has been explosive this year, causing obvious concern. Let’s look at the unstoppable trends…