Getting It Half Right Is Still Wrong

We all see the light in different ways at different times. Here’s how it went for Osbon Capital editor Steve Mott.

We all see the light in different ways at different times. Here’s how it went for Osbon Capital editor Steve Mott.

I don’t remember exactly how I was introduced to index investing, but I was well ahead of the curve. I liked the idea of owning all the big company stocks without having to figure out which ones would be the big winners, so I started buying Vanguard’s S&P 500 index fund in the early 1990s.

With dividend reinvesting and additional purchases, my modest nest egg grew with minimal attention and effort. As the dot.com wave rolled to shore, I added QQQ, the index fund tracking the hot NASDAQ exchange. I set up monthly automatic purchases to take advantage of dollar cost averaging.

Markets were very strong at the time, so my balance continued to grow as I smugly watched on the fascinating new contraption on my desk, the internet. My monthly contributions bought fewer shares each month as prices rose, but I didn’t care. My net worth continued to slowly grow.

And then…

We know what happened next: the bubble burst. Prices slid for months. My dollar cost averaging continued for a while. I added money each month, but still my account balance fell. It was painful. The pride I had felt in being an early adopter of indexing turned to doubt, then regret.

As prices continued to fall, I panicked and fled. I not only stopped my monthly contributions, I started selling some of my existing holding and buying bond funds, because of their safety.

Then 9-11 hit. Further discouraged and fearful, I sold more holdings, feeling safer in cash than stocks that had let me down. Honestly, I was relieved to be out of the market.

I waited for something good to happen. And it did. The economy found its footing eventually and stock prices turned around. After watching significant gains for about 6 months, I started buying back shares of the S&P 500 index…at prices well above where I had sold months earlier.

A costly education

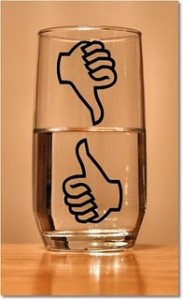

This is all ancient history now and lessons are written all over the margins. Ultimately I got it half right. I trusted the indexes to deliver the benefits of capitalism. I knew enough to keep buying shares. But when the markets turned sour, I panicked. Instead of buying more at lower and lower prices, I sold. And then I hid on the sidelines until I was sure the bad stuff was done. When I bought back in, I did so at higher prices.

Thanks to my very human instincts, I sold low and bought high. Vanguard has a great tool for calculating this behavior.

It was through this experience that I learned that buying the right stuff is only half the battle. The other half is overcoming emotions in turbulent times and staying invested when it’s so much easier to quietly retreat. My poor behavior under pressure cost me real money, and taught me that I needed help. I sought the help of a professional advisor. (My advisor is not Osbon Capital, but a firm with a similar investment approach in my hometown.)

Having an advisor did not prevent the markets from going down. The great recession hit hard. But with my advisor acting as an emotional buffer between me and my account, I resisted any temptation to sell in 2009. I am happy to have a voice of reason I can turn to when markets are uncertain.

It’s not particularly flattering to recount this story, but as I meet more and more investors trying to protect and build their wealth on a DIY basis, it seems like a good story to share.

Steve Mott

Weekly Articles by Osbon Capital Management:

"*" indicates required fields