Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

2024 will bring more positive novel surprises. New years always do. In 2023, it was the dramatic acceleration in AI, which touches nearly every industry, and the early stages of an answer to the obesity epidemic with GLP-1s. Here is a list of what’s on our minds going into 2024.

The Advisor as Alpha

There’s a lot of talk these days about alpha and “smart alpha.” Alpha is basically return in excess of market performance. It’s a lot like happiness – everybody feels they deserve it, but it’s not been so clear where it comes from or how to get it. Fortunately, there’s evidence now about how to get alpha. Vanguard, major ETF provider…

Are High Frequency Traders Ripping You Off?

High Frequency Traders: Fight Back As author Michael Lewis reminded us this week with the release of his book, Flash Boys, high frequency traders (HFTs) are systematically sucking value out of the markets. Are you a victim, and what can you do about it? First, how does this work? Think about it like this: You call ahead to the supermarket…

5 Ways that Indexing Cuts Taxes

April 15th has to be one of the least liked days of the year. Not that paying taxes is a bad thing, but paying too much in taxes is. If you have a nagging feeling that somehow you’re paying unnecessary taxes, consider five ways that indexing would cut the tax tab. 1. Buy and hold – The prime source of taxes on…

Drones, bitcoins on wheels, and the rebirth of privacy

What happens when 75,000 professionals at SXSW (South by Southwest) from 74 countries with backgrounds in music, technology, and film get together for 10 days in Austin, TX? Quite a lot! Normally we write about investing but this week we’ve got a very different topic. I spent a week at SXSW 2014 and here are some of my favorite highlights. Intellectual…

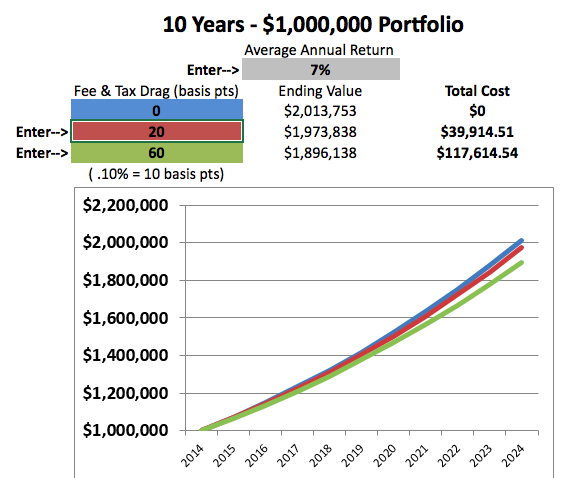

Cost Control Calculator

Small expenses can seem inconsequential in the short run, however inefficient investments with higher fees and poor tax management can take a big bite out of your portfolio in the long run. Focus on the things you can control – fees and taxes. And use our Osbon Cost Control Calculator (below) to see just how much these small improvements add…

America’s greatest stock picker says “index”

Warren Buffett’s annual shareholder letter – always anxiously awaited by shareholders and others – was published last Saturday. As arguably the greatest stockpicker in history, (Berkshire Hathaway book value has compounded at about 20 percent annually since 1965) why does Mr. Buffett use the letter to recommend that investors take the exact opposite approach via indexing? We can always count…

Good guy. Bad guesses.

Byron Wien is a brave man. Every year the Vice Chairman of Blackstone Advisory Partners announces 10 predictions, ranging from domestic policy developments and global power struggles to market and economic performance. How’d he do in 2013? In a word, awful. By our count, seven of his predictions related directly to investible markets. One of the seven picks – big…

6 Reasons To Say No To News

It seems almost self-evident that whoever has the best access to current news sources gains a significant advantage as an investor. Because information is power. Or is it? Does news help or hinder investors? Thanks to Bloomberg, CNBC, Reuters, and other financial media, investors have access to an endless stream of stories about bubbles, high valuations, low valuations, what stocks…

Warren Buffett’s Index Bet: Year 6

Before the great recession, the Oracle of Omaha made a $1 million charity wager that an unassuming Vanguard S&P 500 index fund would outperform a portfolio of handpicked hedge funds over a ten-year timeframe. Six years in, who’s leading and who’s leaking oil? Without knowing it, Warren Buffett and the leaders of hedge firm Protégé Partners picked a great time…