Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

2024 will bring more positive novel surprises. New years always do. In 2023, it was the dramatic acceleration in AI, which touches nearly every industry, and the early stages of an answer to the obesity epidemic with GLP-1s. Here is a list of what’s on our minds going into 2024.

Do You Have The Four Money Mindsets?

Tips are good. Mindsets are better. If you’re trying to reach a fitness goal – losing 15 pounds, for instance – you may get a temporary boost from a diet or exercise tip. If this doesn’t work, you might think that some people have an inherent ability to live healthy and active lifestyles. I can tell you from personal experience…

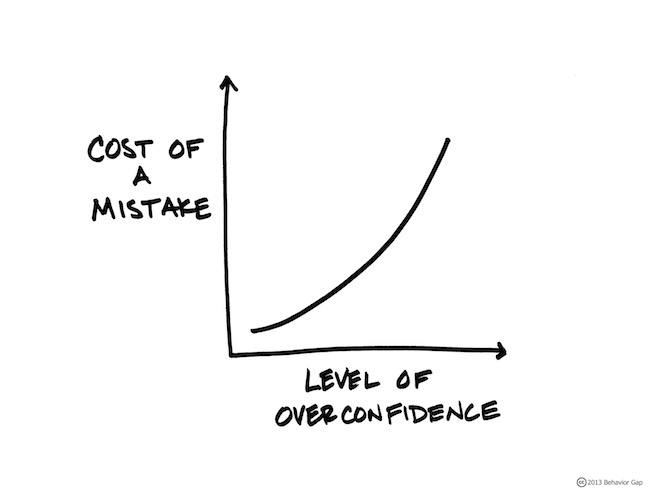

Is Overconfidence Costing You?

Investment overconfidence, that is. If you are managing your own investments overconfidence is very likely costing you. A lot. How can you tell? Just measure in dollars and cents how much you lost or failed to earn because you bought or sold the wrong security at the wrong time. Almost all wrong moves like these have their roots in overconfidence….

Does Your Money Control You?

Money is emotional, both when scarce and when plentiful. You may find that after working long and hard you have more money than you initially imagined, or maybe finally have the money you want. All along the way the exchange of your time and talent for money creates an emotional connection. But what kind of connection? Is your money starting…

Great News For The New Year

I am pleased to announce that after three years of working at Osbon Capital, Max Osbon is now an equal partner. This is great news for the business, and great news for you as well. Here’s why. Why partner? Since establishment in 2005, Osbon Capital has been structured and managed for the benefit of clients. As a family investment firm, all decisions are made with longevity, aligned interests and…

One Crucial Last Step Before The New Year Begins

January 1 is just hours away. You may mark this milestone by making resolutions for a better diet, more exercise, or a more productive lifestyle. But before you get too focused on turning over a new leaf, we suggest you take a moment to deal with the old leaves, yesterday’s baggage that holds you back. Here’s a quick exercise that…

Mike Bloomberg Uses ETFs. Do you?

Mike Bloomberg and Jack Bogle addressed a full house crowd this month at the Bloomberg ETFs In Depth conference in New York. The four hour event was a multi-course meal of hot button topics from debates on financial innovation, to Josh “Retired Broker” Brown’s favorite emerging market: Detroit. Here are my highlights: Good enough for Mike Bloomberg Bloomberg LP founder and three-term mayor…

What The High Profile Mutual Fund Freeze Means For You

When the news broke that Third Avenue Management suspended redemptions in its junk bond mutual fund, it raised eyebrows and questions. Here’s a quick look at what happened and why it matters. What happened? Third Avenue’s Focused Credit Fund sought to deliver a robust yield to investors by holding relatively high risk corporate (junk) bonds. Unfortunately the fund’s managers chose…

Your End of Year Checklist

It’s a great feeling to hit the ground running when the new year begins. If that means starting a new exercise regimen or diet, January 1 is the perfect day to begin. For financial fitness, it’s important to get things in order before the New Year rings in, especially anything related to 2015 taxes. Are you ready for the New…

Six Myths And Realities From The Fidelity Team

Last week I had the opportunity to spend the day with Fidelity’s top investment research minds at its portfolio construction day. Today I’ll share six major myths presented at this session. This is an article heavy in details, proceed only if you’re interested a deep dive into the mechanics of portfolio design. Myth #1: Time Horizon Doesn’t Matter When Creating The Best…