Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

2024 will bring more positive novel surprises. New years always do. In 2023, it was the dramatic acceleration in AI, which touches nearly every industry, and the early stages of an answer to the obesity epidemic with GLP-1s. Here is a list of what’s on our minds going into 2024.

Bear or Bull, AI Art, Industrial Literacy

Bear or Bull There are many people out there who make a lot of money telling people the world is going to end. Unfortunately, we’re wired to heed these warnings, and there’s not much we can do to change that. The results tell a different story. In the face of even the worst circumstances, bull market growth outpaces bear market…

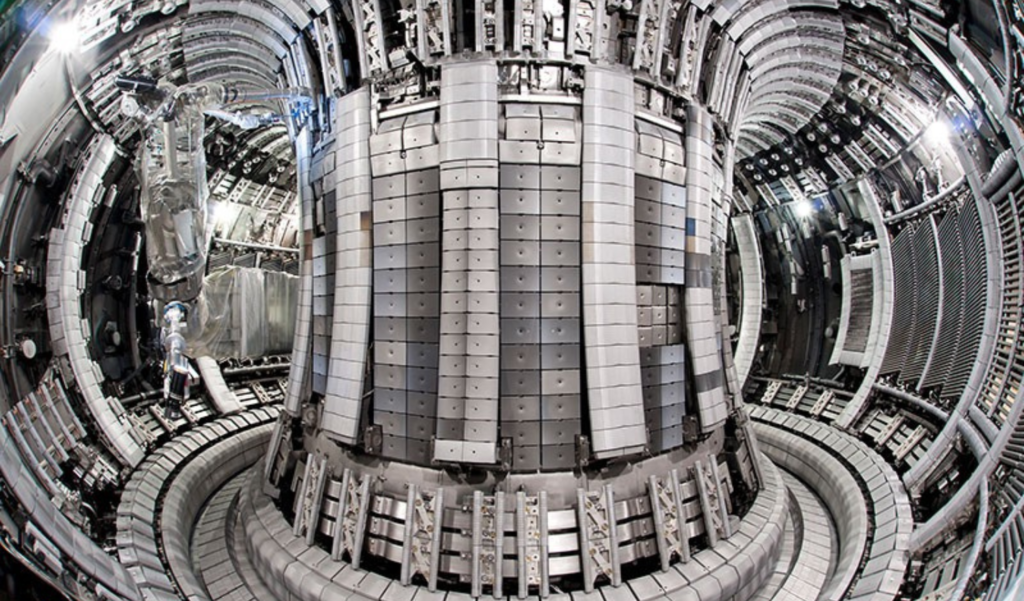

Fusion, Choices, Real Estate

Fusion While we deal with the fallout from Covid, political divides, the Ukraine invasion, supply chain issues, inflation and monetary policy changes, innovation and progress still manage to find a way to push forward. Bad news elicits strong emotional reactions, which drives more advertising revenue, and progress rarely gets the attention it deserves. The following is a positive story on…

Commodities, AI, Automation

Commodities Falling Commodity market prices have dropped swiftly over the past few weeks, which should help ease inflation worries. Oil is almost back where it was pre-Ukraine invasion, in the mid $ 90’s. Copper is down -30% from its high in February. Natural gas is down -40% over the past month, which translates to lower prices for fertilizer and electricity….

Buffett, Nike, Blockchains

Buffett’s History When markets are down, it can be a helpful exercise to review market history to see what lessons we can learn about how people handled volatility in the past. Warren Buffett’s 40 years of annual public letters are an excellent resource for reviewing market history, and you can view them here. Even the most successful investor of all…

Summer of Calm

Summer of Calm After many months of negative news and extremely negative market sentiment, we may finally be reaching a point where investors have a moment to breathe and digest all of the new changes. Recently, bond markets and commodity markets have fallen sharply from their intense highs, signaling a possible relief for inflation numbers. The Fed, the main player…

Druckenmiller, Markets, SWIFT

Stanley Druckenmiller, The Fed & Markets The Federal Reserve raised its interest rate by .75% yesterday, doubling the current rate from .75% to 1.50%. For context, the previous high was 2.25% in July 2019. We cut the rate to 1.5% by November 2019 and then sent it straight to 0% once Covid started. ‘Don’t fight the Fed’ is considered an…

Apple’s Dominance, Data Driven Decisions

Apple’s Dominance Continues Before we get into the main story about Apple, let’s take a quick look at the scope of its economic dominance. Using rough numbers, Apple currently produces $100B in revenue per quarter: 50% from the iPhone, 30% from laptops, ipads and wearables, and 20% from services. That services component is the fastest growing with the highest margin…

Inflation Holdouts, Volatility, Relationship Driven Banking

Inflation Holdouts It’s great to see some of the major commodity prices fall back below their all-time highs. Lumber is now below its pre-Covid all-time high. That doesn’t mean Home Depot is going to give you a deal. Retailers are slow to pass on falling costs. Copper, wheat and corn remain elevated but not at all-time highs. Today’s big underlying…

Opportunity, Forward Looking, AI

Opportunities Increasing All eyes are on the Fed and inflation metrics as investors try to find a place where they can confidently store and invest capital. The next CPI (inflation) print is on June 10th, representing the month of May. Public markets price every weekday, so this level of patience and interim uncertainty is difficult for investors. The Fed says…