Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

2024 will bring more positive novel surprises. New years always do. In 2023, it was the dramatic acceleration in AI, which touches nearly every industry, and the early stages of an answer to the obesity epidemic with GLP-1s. Here is a list of what’s on our minds going into 2024.

Look out. Here come the individuals.

This week’s article is written by guest author, Steve Mott. Steve is a long time editor for Osbon on the Money. Individual investors are pouring money into the stock market again. It’s been a long wait. Many bailed out during the financial crisis at its worst, and have been waiting for it to be “safe” to invest again. Now with…

The People of Plenty

The People of Plenty Is there anything more delicious than snooping on the financial lives of the super-rich? You can do it by looking here at the aggregate tax returns of the 400 top earners in the United States, sometimes called the Fortunate 400. It’s an interesting glimpse into a world few can ever experience firsthand. Average annual income of…

Tortoise 2, Hare 0

Tortoise 2, Hare O Many investors feel like you can’t beat Vanguard. Bond King Bill Gross of Pimco may agree. Especially after losing his second big title to the index juggernaut. What happened? Ouch, again As the recent Bloomberg title read, Gross Loses World’s Largest Mutual Fund Title to Vanguard. Vanguard’s Total Stock Market Fund is now larger than Pimco’s Total…

Too Big to Jail?

Nobody’s too happy with the big banks these days. The public distrusts them and the regulators have been levying hefty fines for misdeeds before, during and after the financial crisis. The fines are big, but who’s really paying the price? How does $93B in fines affect you? Fines on the six major Wall Street firms – JP Morgan, Bank of…

Liquidity reality check

How much liquidity do you need in your investment portfolio? If something changes unexpectedly and you need cash right away, can your portfolio provide it, and with what consequences? Here’s a quick look at sensible liquidity planning. Two definitions first Liquidity is defined as the ability to withdraw money quickly (one day to one week) with no severe adverse investment…

Looks Small and Plays Big

At Osbon Capital, John Osbon is the conductor, but where’s his orchestra? We often hear the question: How many employees do you have? Our reply – zero – is a surprise to some. The business is operated by two partner owners. John Osbon manages all client portfolios and investment strategy while Max Osbon is the operational guru. Our payroll is…

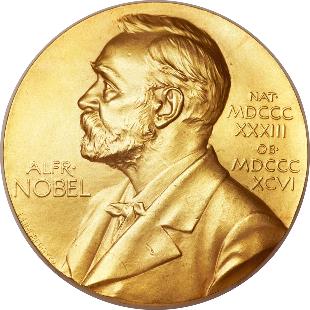

What the Nobel Prize in Economics means for you

The announcement of Eugene Fama as a Nobel laureate in economics was bound to happen someday, and it finally has. Fama’s pioneering research regarding how the market arrives at security prices constitutes a fundamental principle of finance. It’s also at the core of indexing. Fama was already a professor at the University of Chicago Booth School of Business when I…

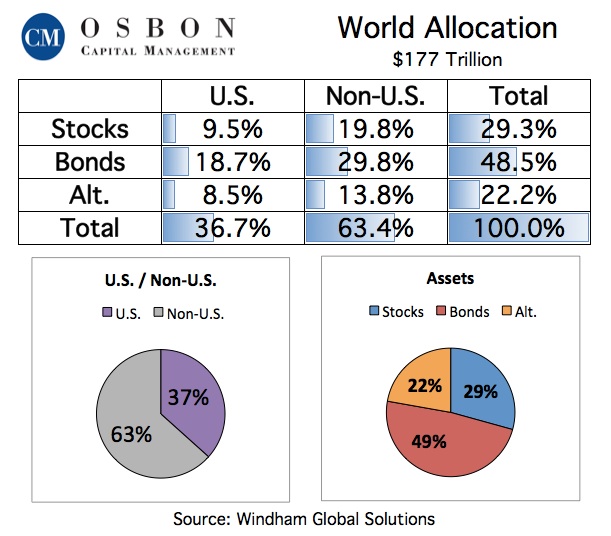

The World According to Windham

If you are suffering from too much news (“infobesity”) and too many dire predictions (“calamity fatigue”) then the annual Windham Global Solutions client conference last week would have been a welcome break. It was for us. Windham, our asset allocation and risk management advisor, had a full menu of meaty topics over two days. Here are some highlights. Windham is a…

Small can be big

Small cap can be big We know that a typical long-term stock portfolio returns more, on average, than a typical bond portfolio. But what kind of stocks consistently outperform the broad stock market as a whole? Hint: Think smaller. 87 years Since 1926, a dollar invested in small cap stocks has grown to $18,365 – a hefty annualized return of…