Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

Ten Tips for College 2019

Guest Post This week’s post is guest authored by Dana, an engineer and former US Army Officer, and a close friend of Osbon Capital Management. My spouse and I applied to college in pre-internet days. We now realize how much times have changed! With our oldest child a high school senior this year, and with two others on deck, we…

How Much Financial Pressure Are You Putting On Yourself?

Warren Buffet says, “Don’t risk what you already have for what you don’t need.” Like most sage remarks, this seems so obvious, but has big implications for how we live and make decisions. When we overreach financially, we open the possibility of going backward instead of forward and experiencing much more stress and uncertainty than necessary. Is this happening to…

Not All Bad News Is Created Equal

This week is a major earnings week. If you follow business news it’s quite likely you are going to hear the term “earnings recession” this week. If you do, please immediately remind yourself that an earnings recession is not the same thing as an economic recession. There’s no reason to panic over this R word. Let’s take a closer look…

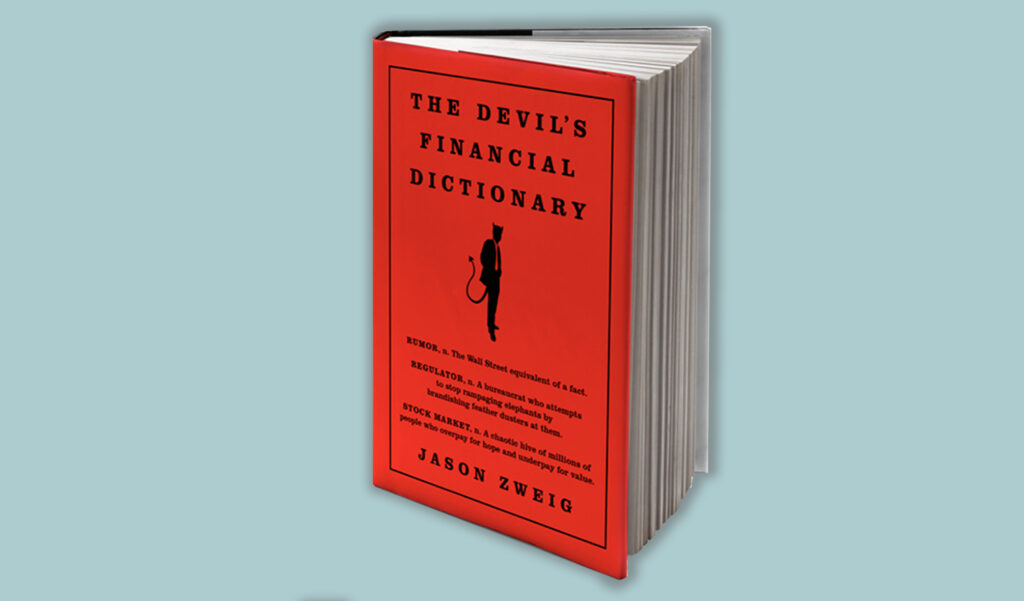

The Devil’s Financial Dictionary

Long time financial writer Jason Zweig published The Devil’s Financial Dictionary in 2015. The book is both factual and lighthearted. It’s easy to see our personal weaknesses in Zweig’s Dictionary. He says that the definitions are “mostly true.” He also uses a red dollar sign to flag things that may not be technically true, but still say something about the…

Investing With Retirement in Mind

A quick check of the top news stories over the weekend showed four prominent articles about retirement – how to retire, figuring out if you have enough, what to do if you are stuck, and so on. Apparently, retirement is on the minds of many investors, young and old. This news focus reminded me that retirement investing is a lifelong…

Avoid the Situations that Lead to Investment Mistakes

Why do people sometimes make bad decisions? Even smart, open-minded, thoughtful people can and do make poor choices. But why? This article is inspired by a conversation between two of my favorite thinkers, Shane Parish of Farnam Street and Adam Robinson, founder of the Princeton Review. Their research identifies situations where we are prone to mistakes and poor judgment —…

5 Ways to Focus on Financial Quality of Life

It’s easy to reduce your financial world to numbers and dollar signs, but there’s much more to the story than that. Expanding your focus to your Financial Quality of Life lets you approach financial information and decisions with a better understanding of your true opportunities and what they mean for you and your family. Here are five ways to give…

4 Ways To Maintain A Focus On The Long Term

As the first quarter nears an end the inevitable question arises, “How long can the strong Q1 returns go on?” Amid the uncertainty we see many investors holding cash with little interest in taking on risk. This cautious approach means safety in the short term, but perhaps at a big loss of opportunity for the long term. Here are four…

When Is Passive Too Passive?

Regular readers and clients know Osbon Capital Management as an early and continued champion of index investing. Five years ago the distinction between active management and passive indexing was fairly well defined. Passive meant holding a market cap weighted basket of stocks. Active investors practiced stock picking, and some market timing, hoping to avoid the losers and find the winners….