Not All Bad News Is Created Equal

This week is a major earnings week. If you follow business news it’s quite likely you are going to hear the term “earnings recession” this week. If you do, please immediately remind yourself that an earnings recession is not the same thing as an economic recession. There’s no reason to panic over this R word. Let’s take a closer look at the details for a better perspective.

The other kind of recession

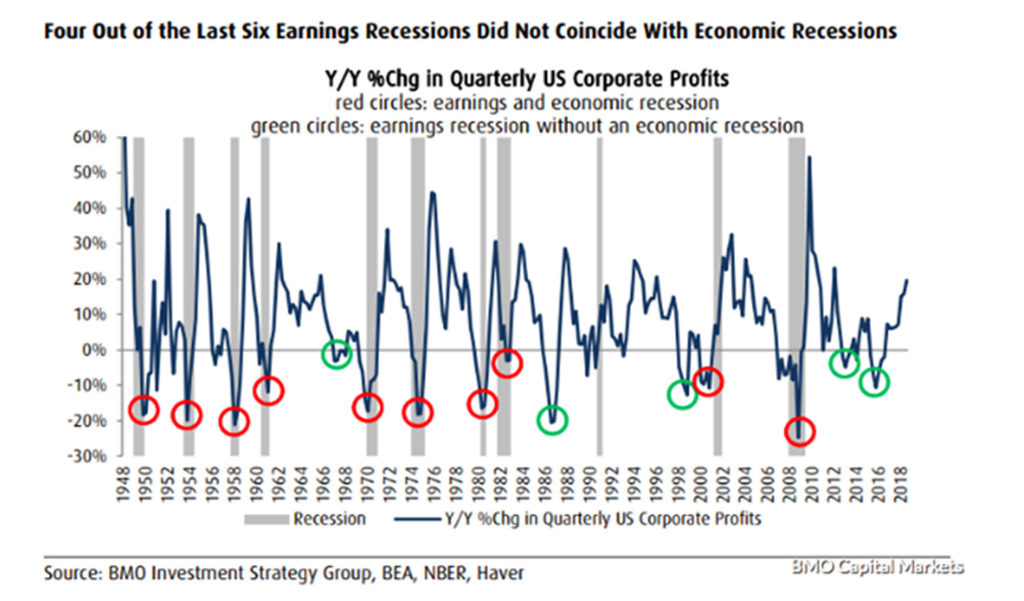

An earnings recession is defined as two consecutive quarters of year over year declines in total corporate profits. This is very different than an economic recession, which is two consecutive quarters of declining GDP. Two very different metrics. The economy can still expand when profits are down, and it often does.

So far, 25% of US companies have reported earnings. In the next two weeks we will be done with the majority of reports. If profits decline this quarter, we will need to wait another period to see whether it officially meets the two consecutive quarter standard. Either way, it is hardly worthy of headlines.

What goes around comes around

Most of the time an earnings recession is a slowdown in response to a previous stimulus. The stimulus this time was the tax cuts from last year. They provided a large boost to earnings that finally played itself out after one year. The pace of earnings growth was unsustainable and has come back down to Earth in the first quarter. Total earnings are expected to be down 4%. The second quarter is looking breakeven right now. Meanwhile, the economy continues to grow and few forecasters expect that to change in the next few months.

It has happened before

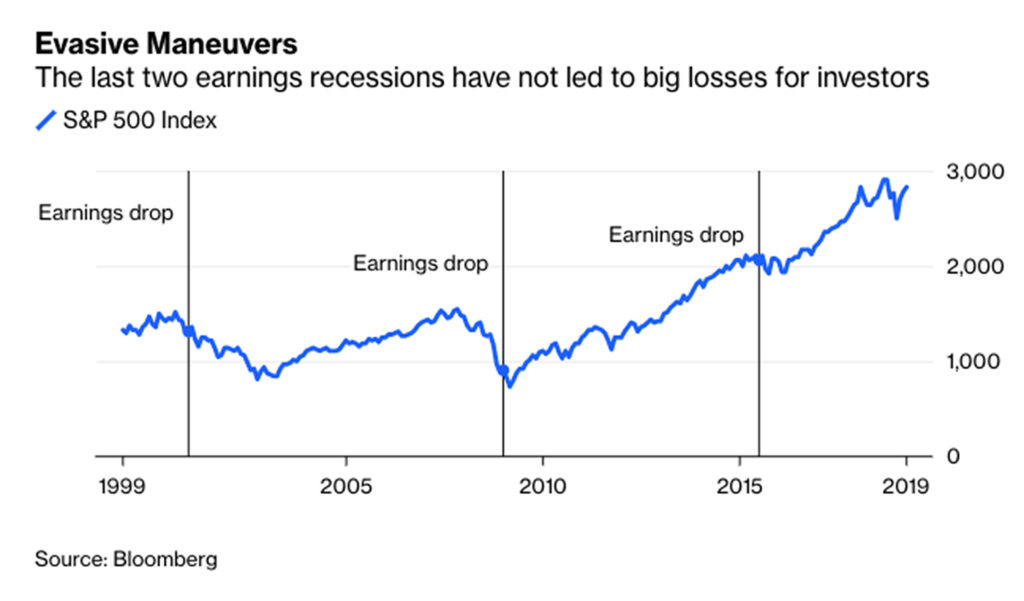

We went through an earnings recession in 2015-16. The cause that year was high oil prices and then their collapse. Oil companies had enormous profits and then losses. The stock market was the complete opposite story. The S&P 500 went from a bottom of 1900 to 2800 today.

Does one cause the other?

There have been six earnings recessions since 1987 but only two of them coincided with economic recessions. The link between the two is weak. Earnings recessions are poor predictors of economic recessions. If you invested regularly through those six earnings recessions you would have a lot more capital over time.

Our support for you

Our job is to pay attention to things like earnings recessions so you don’t have to worry about them. Big earnings declines make for great headlines and can scare people out of the habit of investing or even out of the markets altogether. But earnings recessions are a misleading indicator. Remember the broad economic positives: inflation is low, job growth is high, and GDP growth continues. As always, it’s our job to keep you informed and on a calm, consistent path through the ups and downs of investing.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields