Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

The Big Cash Glut

The term “too big to fail” was coined following the collapse of Lehman Brothers bank in the heat of the 2008 financial crisis. The Fed chose this term to describe a company with so much complexity and interconnectedness that if they failed they would create an unacceptable amount of financial damage for the rest of the economy. This switch to…

Total Picture Investing

We’ve noticed a significant jump lately in the number of people interested in long term investment planning. Given how COVID has upended so many plans, this is not all that surprising. It’s clear that many are thinking about semi-retirement, full retirement, or working from home in perpetuity. Many are considering what it would be like to focus on a new…

SPACs Must Be Evaluated Like Any Investment

There is a lot of talk about the stock market of 2000 and concerns of a bubble. Yet out of that dot com bubble came Amazon, Apple and many other invaluable innovative technology companies. Twenty years later that internet-crazed market is much more valuable than it was in 2000 and many more investment choices are available. In a similar way…

Where To Allocate New Capital

With markets hitting fresh highs, a perennial investment question remains: “where do investors allocate new capital in 2021?” Successful investing today is closely linked to an ability to embrace optimism and celebrate the coming waves of disruption and innovation. Broad skepticism and pessimism have not been winning strategies. As the internet age enters its cloud computing and artificial intelligence years,…

Value Is Where You Find It

In elementary terms, value investing means investing when you feel the price is below what it should be. This value philosophy has created many successful billionaire investors like Seth Klarman, Warren Buffett and others. It’s an intuitive philosophy. One should always seek to invest at levels consistent with the value concept. The challenge today is many traditional metrics of value…

Looking Ahead Towards 2021

The calendar has changed to 2021, but in reality, not much else has. The whole world needs vaccines and that will take all year to deploy. The business models of technology-focused companies will continue to get stronger even though we will be ‘back to normal’ by the end of the year. Bonds have zero to negative yields, the Fed continues…

Themes To Consider In 2021

As we close this calendar year and head into 2021, we have an opportunity to reflect on the major changes taking place. Change is a constant. However, the change experienced this year has accelerated due to COVID. We have included links to five of our most valuable investment articles of 2020 (below) to highlight trends we’ve identified and expect to…

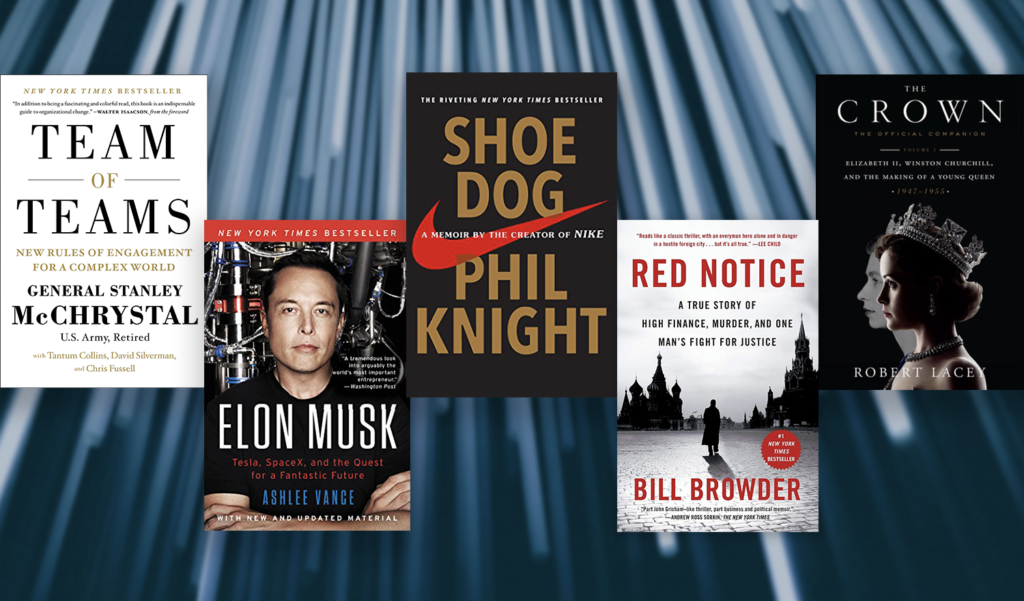

Five Books to Add To Your List This Holiday Season

Elon Musk, Phil Knight, General McChrystal, Bill Browder and the Royal Family have excellent lessons to share on overcoming adversity. When you read about General McChrystal’s experience, you can see that we live in an increasingly complex world where adaptability has become more valuable than efficiency. Here are five engaging books for your holiday reading list covering the theme of…

International Market Opportunities

As the post-Covid digital world continues to find its footing, many of the same growth themes have emerged in nearly every major country. Access to cloud computing, remote talent pools and expanded internet coverage have continued to level the playing field for global entrepreneurs. Here are some of the major trends to consider when investing internationally. Revenue growth Revenue growth…