Insights on markets, emergent trends, history, innovation, risk management, global economics, strategy, policy, and other topics that catch our attention. Inspired by ongoing research, conversations and events. Written and edited by Osbon Capital Management and published every Thursday morning.

"*" indicates required fields

Turning The Corner, FTX Fallout

Turning the corner on rates and inflation The Fed’s next rate hike meeting is on December 14th. More likely than not they will raise interest rates by another 50bp from 4% to 4.5%. This continues the fastest rate hike in modern history from .25% to +4% in less than 12 months. The next inflation report is on December 13th, just…

Marching Forward, FTX, AI

Marching Forward The latest inflation data will be out by the time you’re reading this. That data informs how the Fed will treat further rate rises. The Fed recently stated their preference for raising rates too far and fixing the ensuing damage with stimulus. In the meantime, I think we’ve all got the message that the Fed wants to slow…

Fundamentals, Copper, Rents

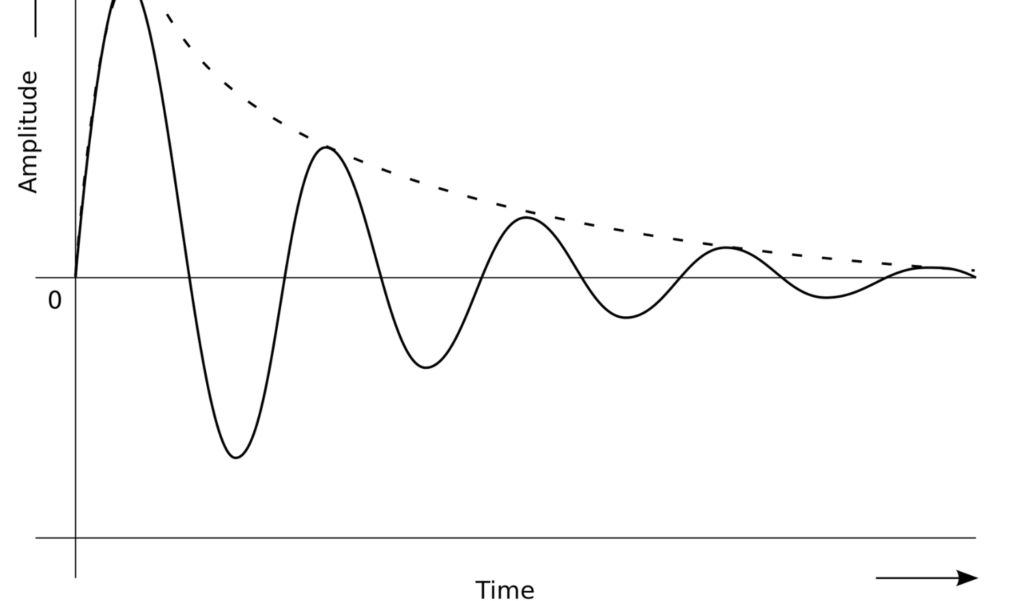

Fundamentals After yesterday’s Fed meeting, we’re now roughly 80% of the way through the rate hike cycle. The fed funds rate is now at 4%, up from .25% in March ‘22 and will likely peak around 5% early next year. Most companies’ revenue and earnings continue to climb steadily, but forward guidance is weak. Any company that issues weak guidance…

Timing and Earnings

Timing By the end of 2022, we will have raised rates from .25% to 4.75%, the fastest rate rise in modern times. Larry Summers said, “This is probably going to be a textbook case of crisis creation followed by crisis mismanagement.” Investor sentiment is very negative due to continued negative price momentum, the ongoing implications of Russia/Ukraine, inflation prints and…

Liquidity Priorities and Private Markets

Liquidity Priorities The Fed continues to battle inflation by raising interest rates. We’ve had five rate rises since March 2022, from .25% to 3.25% We have two more rate hikes to go before year-end, at which point we should be at 4.5%. The Fed’s intention was to shock the system, and it’s worked for the most part in that investor…

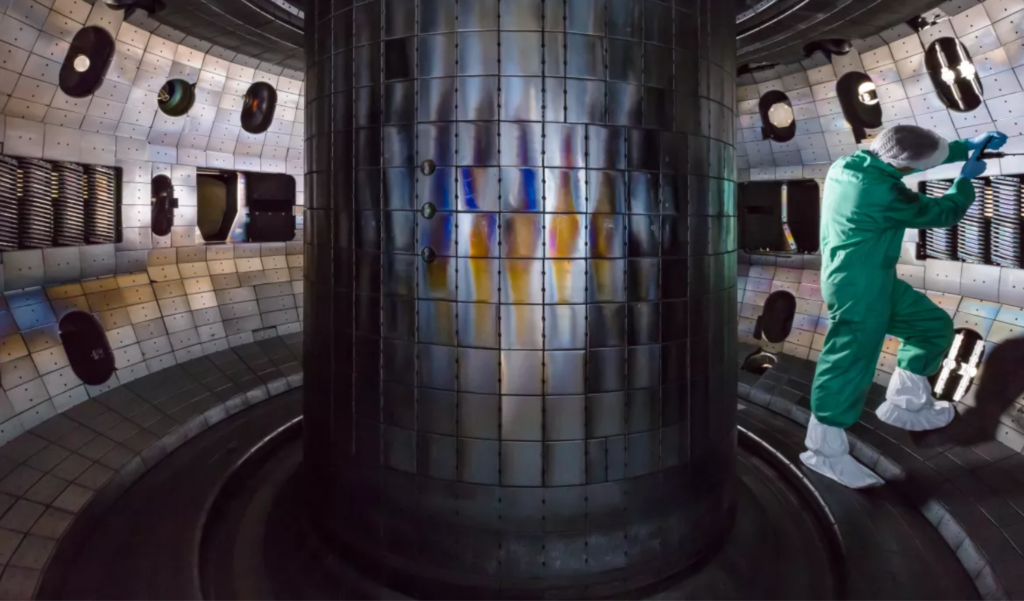

Waiting Game, Japan, Fusion

Waiting Game The timeline for the Fed is getting clearer as we approach the end of the rate hiking cycle. We have an expected .75% hike on November 2nd, a .50% hike on December 14th and a possible but unlikely .25% hike on February 1st. After a prolonged bear market, the end of the rate hikes on the horizon is…

Treasuries, Patience, Bits

Treasuries Treasury yields are drawing attention now that they yield between a 2-4% risk-free rate of return. Treasury Bills (TBills) are liquid and commonly used by financial professionals, but most people are only vaguely familiar with what they are and how they work. For example, Warren Buffett keeps Berkshire Hathaway’s cash in T-Bills. We last used TBills in 2018, when…

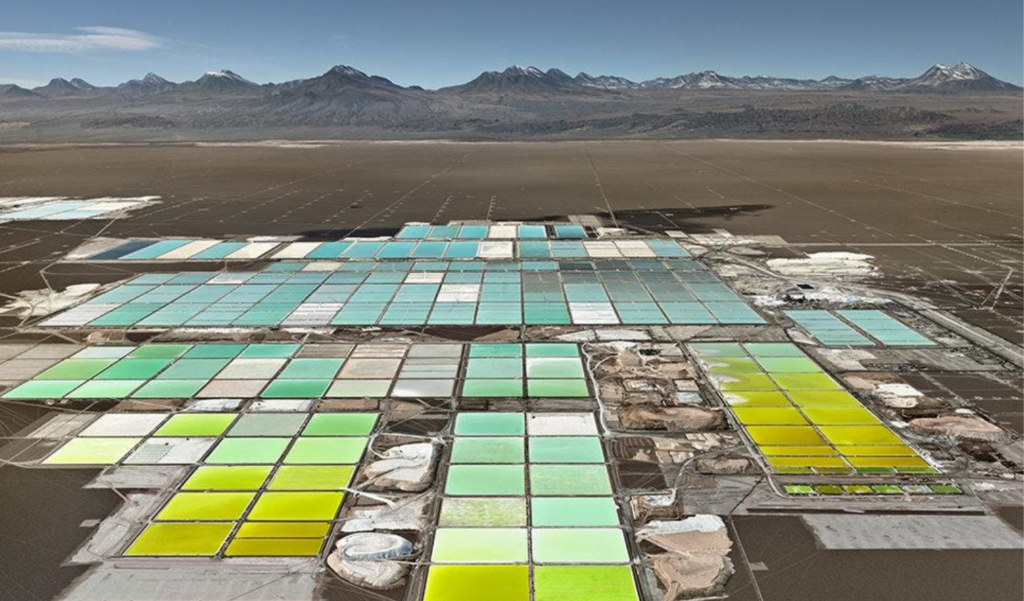

The Fed, Lithium, Merge

The Fed As expected, the Fed raised rates yesterday by .75% to bring the Fed Funds rate to its highest since 2007. As of now, futures markets expect another .75% hike in November to bring the rate to 4% and a peak of 4.75% by March 2023. Commodity prices continue to fall, which will help bring down inflation numbers. Many…

Inflation and Aftershocks

Notes on Inflation Next week brings the Sept 21st Fed rate hike, which is expected to be 75bps. Former Secretary of the Treasury Larry Summers has been outspoken about the reasons for a 100bps hike, namely that we need to be more aggressive because inflation changes are reacting too slowly, if at all. Either way, this next hike brings the…