Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Should I worry about bonds?

Yes. When interest rates go up, the value of existing bonds fall. Period. So with rates historically low today, holding bonds may be riskier now than we have grown to expect over the last several decades. Here’s how we got here and how you can get through the future of interest rates without knowing where rates will go or when….

The Osbon Experience: 24/7 Communication

Communication is a critical element of any relationship. If you become a client of Osbon Capital, what kind of communication can you expect? How often? Where? How? Our policy is simple: “Any reason, any time, any way, however your prefer.” Here’s how it works. In-person We’d like to see you face-to-face at least once a year. An in-person meeting is the…

Osbon Capital – The First Ten Years

Osbon Capital turned 10 years old last Saturday, May 2nd. An exciting milestone, this anniversary marks the latest phase in my continuous desire throughout my career to improve the investment experience for individuals. We’ve come a long way, and there’s always room to improve. Here’s a look at where we’ve been and where we’re going. Swimming upstream By the early…

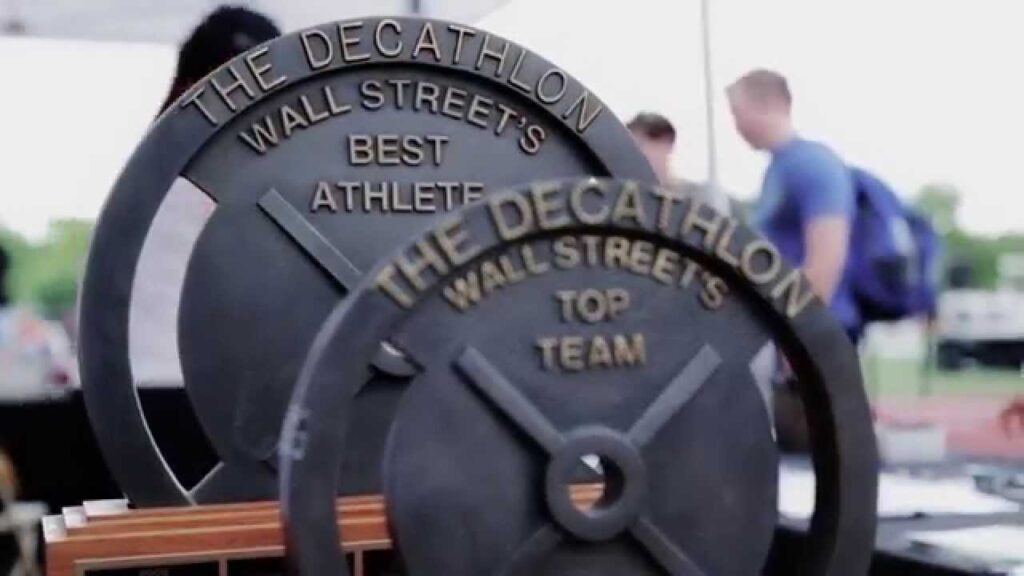

How Charity Makes Us Stronger, Faster and Younger

We all need to find things in our life that push us to do more, try harder, and help others. It’s how we stay motivated, healthy and happy. Over the last few years, that special thing has been The Wall Street Decathlon – an incredible day of running, rowing, throwing and lifting, all for the benefit of the Memorial Sloan-Kettering…

How am I doing?

Can you answer this fundamental question: “How am I doing on all my investments?” Without an industrial strength state-of-the-art system your answer is most likely: “No.” However, with the NEW Osbon Capital Portal, our clients can get that answer, in detail, in realtime, from any device anywhere. Big news. Big picture. At Osbon Capital, performance reports are going digital, interactive and real time, and are now available on…

Investing’s Greatest Graph

This is one of the poignant stories told by the Andex chart. Produced annually by MorningStar, the Andex depicts the major asset classes over the last nine decades, plotting results in relation to interest rates, recessions, presidencies, savings rates, consumer prices, unemployment rates, tax rates, population and much more. We consider Andex to be the most meaningful pictures in the…

What return on my investments can I expect?

Clients and prospects often ask this question, so let’s talk it through. I can’t tell you what your return will be, but still there’s a fair amount I can tell you about what you can expect. Let’s take a look from a few different angles. What we can say and what we can’t Thank goodness for the Commonwealth of Massachusetts,…

It’s all about you, or should be

Do you ever wonder if your investment portfolio is really customized to you? Are you concerned that you might be part of some “mass custom solution” where tens of thousands of people with some similarity to you are thrown into the same portfolio? Do you suspect that your investments are really an assortment of product placements? Fair questions. Let’s look closely…

7 Ways to Raise Your Expectations

Are you completely happy with your portfolio and investment professional? Or are you stuck in the 20th century model where they make, you buy, whether it fits or not? Despite all the positive changes happening in the investment industry, many providers have been slow to give investors the options, transparency and value they deserve. To all those investors, we have…