Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Cheap Solar Panels and AI Race

Cheap Solar Panels All market prices are fundamentally governed by supply and demand forces. The market for solar panels today is far oversupplied, and that’s creating serious financial instability for suppliers. Access to cheap energy is the bedrock of economic growth, so while this is problematic for the suppliers, it’s generally beneficial for everyone else. To add context, 80% of…

Probability Matching and Nature

This is an esoteric topic this week, but it’s also one that I find really interesting. Probabilities can sometimes predict the future with surprising precision, just like physics models can predict how a car will drive or how electrical current will flow through a system. We know that flipping a coin will always yield 50% heads and 50% tails, maybe…

TBills, Visualizing AI, Bank Fees

John Osbon’s T-Bill Comments: The Treasury Market is Still the Safest Place to Be One subset of the Treasury market, the bill market, remains the safest investment option for several reasons. 1. Guaranteed Returns The T-Bill market is unique in that it is the only place where the SEC allows the use of the term “guarantee” regarding returns. This is…

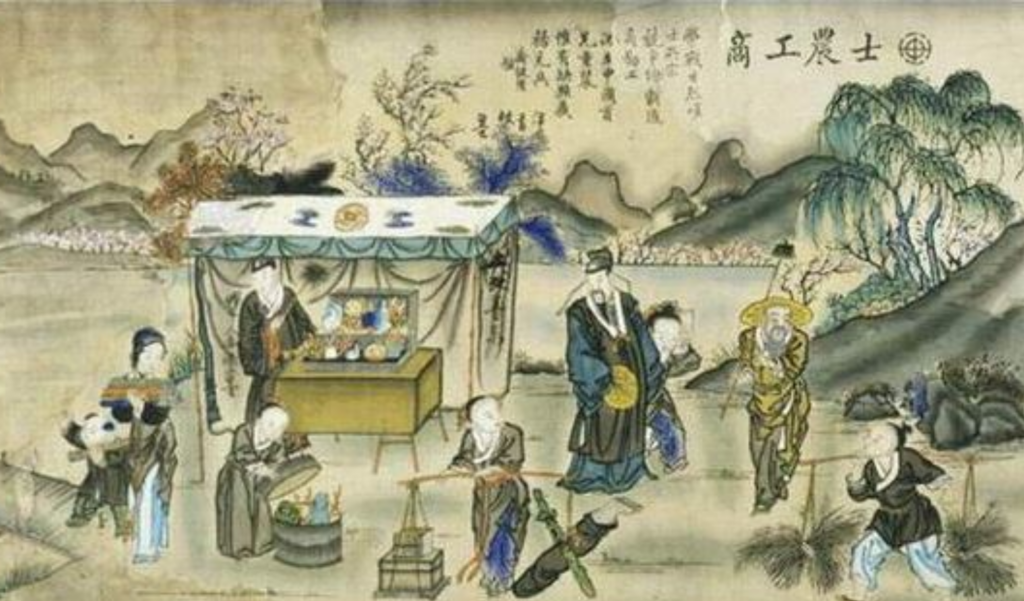

Private Markets Four Areas

Jumping between topics related to tech and markets, this week I wanted to address four compelling areas of the private markets. For each of these markets, we prefer smaller managers with long operating track records. Public markets continue to converge around the US mega cap tech theme. Diversified investors need to find compelling alternative quality opportunities and in public markets…

AI and Coding

What makes AI so fascinating is how flexible it is and how it can be applied successfully to an endless number of use cases. In the past, I’ve asked ChatGPT to create comprehensive meal plans with recipes for each meal and corresponding shopping lists. I also use it as a personal trainer and to answer general health questions. Recently, I’ve…

FDA Approved AI & Inflation

AI Health Care In April, we wrote about evidence that AI was having a positive impact on overall productivity. Intuitively, it makes sense that AI would enhance productivity, but in practice, it’s difficult to quantify results. I recently connected with Michael Abramoff of Digital Diagnostics to discuss this topic. His product, LumineticsCore, was the first FDA-approved AI diagnostics tool in…

NVDA and Private Credit Part 2

NVidia + AI Growth Jumping right in this week. I’ve clearly been far too risk-averse when it comes to Nvidia. I’ve been concerned that their margins will be eroded by competitive forces like in-house design at Meta, Google, Amazon or Microsoft. While that may happen eventually, that’s not something that this market is concerned with at the moment. I’ve started…

Private Credit – More Context & Updates

Private Credit – More Context & Updates One of my continuous motivations for writing each week about markets and investing is to provide the context where it is lacking. Media machines are built on buzzwords and emotion and money is one of those highly emotional topics where the extremes get the clicks. Credit is typically not an extreme topic and…

Khanmigo AI, Public vs Private

Khanmigo AI Example Many of you are already familiar with the online education resource Khan Academy. It’s one of my favorite educational organizations. In the mid-2000s, Salman Khan’s YouTube videos on math education went viral. The Gates Foundation asked him to focus full-time on developing his content into an accessible, high-quality online education platform as a philanthropic endeavor. I remember…