Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Osbon Capital hires Resonance Insights

Here at Osbon Capital, we believe everything in the world can and will be made better. That’s why we hired Resonance Insights to help make Osbon Capital a better place for clients and a more attractive option for investors who have not yet become clients. Here’s what we’re doing. Always ready to learn What do people really think? What are our clients’ unspoken needs? What can we…

The Kids

How will your kids learn about money, how to get it, save it, spend it, manage it if they inherit it? Not talking about these topics can leave kids uninformed and unprepared for the responsibilities that come with money.

It’s Decathlon Time!

150 athletes. 10 events. One great cause. That’s the RBC Decathlon, a long summer day of running, throwing, lifting and jumping for the benefit of Memorial Sloan-Kettering Cancer Center. We’ll be there, and you can help. Max has participated in this phenomenal event for the last two years. I joined the fun in 2013. And we’re both looking forward to…

Four Behaviors That Generate Alpha

Last week we discussed Vanguard’s research showing how an advisor can deliver measurable “alpha” – that is, above average performance. This week we dig deeper with four examples of what that looks like. Vanguard identified “behavioral coaching” as the area of where advisors can and should add the greatest value. The research pegged the behavior benefit at around 150 basis…

The Advisor as Alpha

There’s a lot of talk these days about alpha and “smart alpha.” Alpha is basically return in excess of market performance. It’s a lot like happiness – everybody feels they deserve it, but it’s not been so clear where it comes from or how to get it. Fortunately, there’s evidence now about how to get alpha. Vanguard, major ETF provider…

5 Ways that Indexing Cuts Taxes

April 15th has to be one of the least liked days of the year. Not that paying taxes is a bad thing, but paying too much in taxes is. If you have a nagging feeling that somehow you’re paying unnecessary taxes, consider five ways that indexing would cut the tax tab. 1. Buy and hold – The prime source of taxes on…

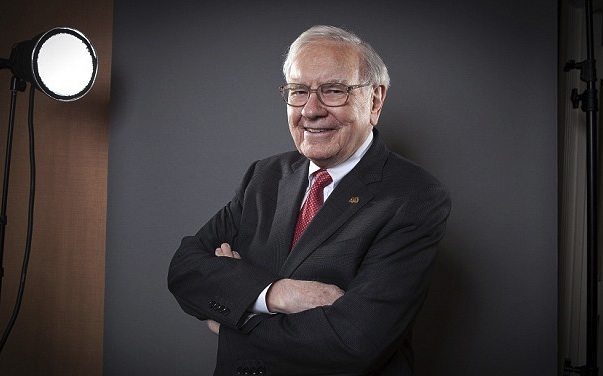

America’s greatest stock picker says “index”

Warren Buffett’s annual shareholder letter – always anxiously awaited by shareholders and others – was published last Saturday. As arguably the greatest stockpicker in history, (Berkshire Hathaway book value has compounded at about 20 percent annually since 1965) why does Mr. Buffett use the letter to recommend that investors take the exact opposite approach via indexing? We can always count…

Good guy. Bad guesses.

Byron Wien is a brave man. Every year the Vice Chairman of Blackstone Advisory Partners announces 10 predictions, ranging from domestic policy developments and global power struggles to market and economic performance. How’d he do in 2013? In a word, awful. By our count, seven of his predictions related directly to investible markets. One of the seven picks – big…

Warren Buffett’s Index Bet: Year 6

Before the great recession, the Oracle of Omaha made a $1 million charity wager that an unassuming Vanguard S&P 500 index fund would outperform a portfolio of handpicked hedge funds over a ten-year timeframe. Six years in, who’s leading and who’s leaking oil? Without knowing it, Warren Buffett and the leaders of hedge firm Protégé Partners picked a great time…