Weekly Articles by Osbon Capital Management:

"*" indicates required fields

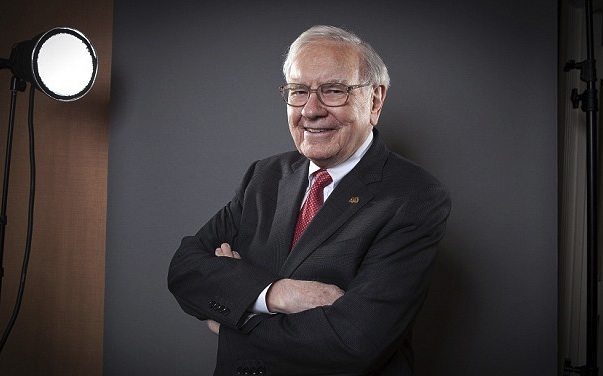

Warren on “you” – from his 50th Annual Report

Warren Buffet wrote his first annual report to investors in 1965, a year before the first Super Bowl and seven years after the S&P 500 index was established. Little could anyone know then how his company and his wisdom would affect modern investing. His 50th report came out online Saturday morning and like many other people I read it with great…

Buffett’s wager on S&P 500 vs. hedge funds: Year 7

How time flies. It’s now been seven years since Warren Buffett wagered one million dollars that an S&P 500 index fund would outperform the picks of a prominent hedge fund manager over a ten-year period. Another year of returns is in. Who’s ahead? Protege Partners must now hate this time of year You may recall this bet. We report on…

Scared? Try this instead.

Predictions of higher interest rates are as common as complaints about snow in Boston this winter. When will it end? We know our record snowfall will end but forecasting the end of low interest rates is no sure thing. Just ask Bill Gross, the Bond King, who guessed so wrong that he lost both his crown and his job with…

Are You “Meaningful?” 5 Ways To Know

True story. “My advisor at (important name firm) told me my account was ‘not meaningful.” I heard this twice in one week from two different potential clients so I decided to write about it. We all want to feel important, as a friend, colleague or client. We all want to matter, to be “meaningful.” Are you meaningful to your investment advisor?…

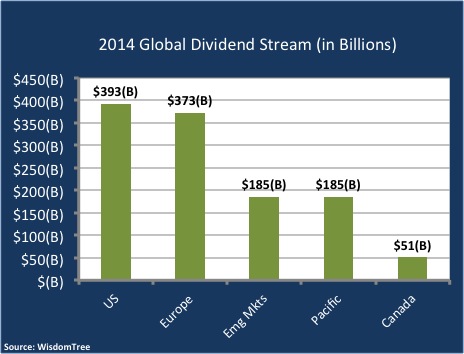

Let your cash flow

In this seventh year of zero interest rates, many investors complain that “there’s just no yield out there.” They must be looking in the wrong place. True, bond yields are dismal, but in the equity world there is a strong and growing dividend flow providing nice annual yields. With $1.2 trillion of dividends paid out worldwide in 2014, where is it coming from…

Don’t do what we do

With so much financial news readily available and so many enticing or obvious investment choices it’s tempting to just “do it yourself.” As a DIY investor you can make investments with a few mouse clicks for just a few dollars per trade. It’s an appealingly simple idea, but I wouldn’t recommend it. Take a look at our day and see…

When You Go Public: the Three P’s

Thirty-two Massachusetts companies went public or filed to go public in 2014 according to IPOMonitor. 2015 could be a rich year as well for those who convert to public from private ownership. If you will be among them, what are the three most important steps to take related to your investments? Public means public! When you are the founder or…

What The &%#?Forecast!!!

Did your investment advisor predict the 50% drop in oil prices in 2014, the surging US economy, the strong dollar and the worldwide decline in interest rates? No? No one else did either. Which begs the question: how is your advisor – and his/her forecasting – working for you? Are you paying a fee for your advisor to guess what…

What would Warren tell you?

If you sent a letter to Warren Buffett asking for some investment advice, what do you think you’d get in the return mail? A board member of the San Francisco employee pension fund found out. What exactly did Mr. Buffett’s handwritten note say? The $20 billion pension fund had been considering an investment in hedge funds. The board member described…