Weekly Articles by Osbon Capital Management:

"*" indicates required fields

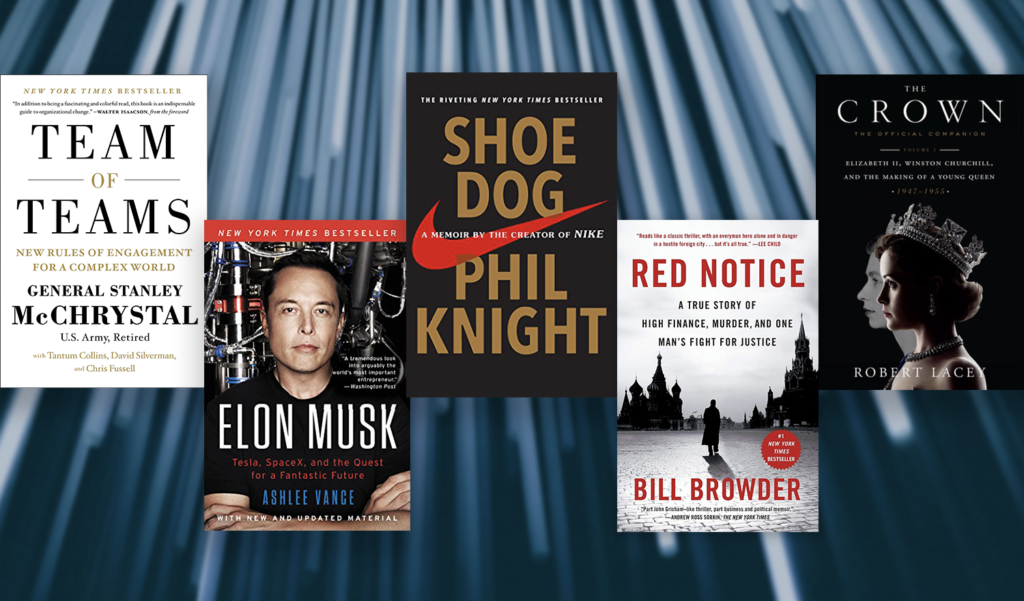

Five Books to Add To Your List This Holiday Season

Elon Musk, Phil Knight, General McChrystal, Bill Browder and the Royal Family have excellent lessons to share on overcoming adversity. When you read about General McChrystal’s experience, you can see that we live in an increasingly complex world where adaptability has become more valuable than efficiency. Here are five engaging books for your holiday reading list covering the theme of…

A Very Happy Thanksgiving To You

In this age of abundance and challenge, the communal practice of giving thanks is something to be grateful for in and of itself. Taking the time to give thanks is an opportunity for a perspective reset. It allows us to step beyond whatever challenge-du-jour we have faced and step into a place of empathy and connection. Words that come to…

An Update On Vaccines

The first case of COVID was Nov 17th 2019, exactly one year ago. Moderna announced a 94.5% effective vaccine this week. Pfizer’s vaccine is 95% effective and ready for emergency use approval by the FDA in one month. We can expect more effective vaccines from Regeneron, Johnson & Johnson, Sanofi and Roche which are nearing new stock price highs this…

A Short Comment on the Bull Case

We have been stuck in a range-bound territory for broader market indices since the beginning of September. The election is imminent and the virus activity in many parts of the world is returning. The lack of the stimulus plan and potential monopoly regulation adds to anxiety, understandably so. Despite all of this, we see a positive road ahead for investors…

Investing in the Next Fiscal Stimulus

We all know there is a great deal of uncertainty about the next election, who will win, who will have control and who the new players will be. By design, the US experiences a major reshuffling every four years in our political structure. Despite the unpredictable changes, one thing is clear: there will be more fiscal stimulus going forward. There…

The Triumph Of Intangible Assets

Over the past 20 years, intangible assets have become the dominant factor in company valuations. Today approximately 85% of the valuation of the S&P 500 is defined by intangibles, while in 1975, that percentage was just 17%. Intangibles are notoriously difficult to value. Given their slippery nature and their power to generate returns, it’s worth paying attention to the qualities…

Deferring Capital Gains With Qualified Opportunity Zones (QOZs)

The U.S. Department of the Treasury Opportunity Zones, created by the Tax Cuts and Jobs Act in 2017, offers unique and creative tax opportunities for high net worth investors with capital gains. In exchange for investing in economically distressed areas, the IRS provides investors with substantial benefits that reduce, delay and avoid taxation. The right partner, the right location and…

Securing Your Portfolio in a Complex World

The traditional risk types of investors – conservative, moderate, or aggressive – were created by the investment industry for the investment industry. It was a way of merely categorizing investors so advisors could efficiently allocate money. These risk models were not created with the customer in mind and are often way off the mark in terms of actual risk. A…

Is Inflation Worry Justified?

Investors today may be worried about inflation. There is little to no official CPI inflation now, and there has not been any for some time. Around the world, the story is similar because major central banks are coordinating with the Fed. Debt growth and money printing has been explosive this year, causing obvious concern. Let’s look at the unstoppable trends…