Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Where To Allocate New Capital

With markets hitting fresh highs, a perennial investment question remains: “where do investors allocate new capital in 2021?” Successful investing today is closely linked to an ability to embrace optimism and celebrate the coming waves of disruption and innovation. Broad skepticism and pessimism have not been winning strategies. As the internet age enters its cloud computing and artificial intelligence years,…

Value Is Where You Find It

In elementary terms, value investing means investing when you feel the price is below what it should be. This value philosophy has created many successful billionaire investors like Seth Klarman, Warren Buffett and others. It’s an intuitive philosophy. One should always seek to invest at levels consistent with the value concept. The challenge today is many traditional metrics of value…

Looking Ahead Towards 2021

The calendar has changed to 2021, but in reality, not much else has. The whole world needs vaccines and that will take all year to deploy. The business models of technology-focused companies will continue to get stronger even though we will be ‘back to normal’ by the end of the year. Bonds have zero to negative yields, the Fed continues…

Themes To Consider In 2021

As we close this calendar year and head into 2021, we have an opportunity to reflect on the major changes taking place. Change is a constant. However, the change experienced this year has accelerated due to COVID. We have included links to five of our most valuable investment articles of 2020 (below) to highlight trends we’ve identified and expect to…

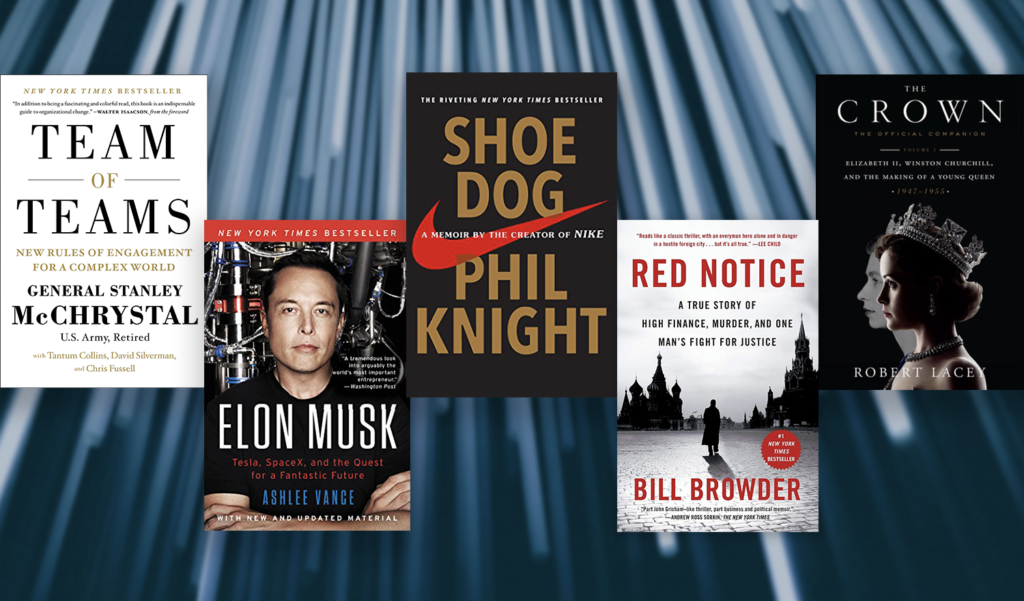

Five Books to Add To Your List This Holiday Season

Elon Musk, Phil Knight, General McChrystal, Bill Browder and the Royal Family have excellent lessons to share on overcoming adversity. When you read about General McChrystal’s experience, you can see that we live in an increasingly complex world where adaptability has become more valuable than efficiency. Here are five engaging books for your holiday reading list covering the theme of…

International Market Opportunities

As the post-Covid digital world continues to find its footing, many of the same growth themes have emerged in nearly every major country. Access to cloud computing, remote talent pools and expanded internet coverage have continued to level the playing field for global entrepreneurs. Here are some of the major trends to consider when investing internationally. Revenue growth Revenue growth…

The Tailwinds Behind Semiconductors

If a pandemic like COVID occurred 10 years ago, we would have had significantly more challenges adapting to suitable work from home conditions. Advances in global digital capabilities have allowed the modern world to continue to function at an exceptional level during a complete social shutdown. At the center of all of this digital capability and connectivity is semiconductor technology….

A Very Happy Thanksgiving To You

In this age of abundance and challenge, the communal practice of giving thanks is something to be grateful for in and of itself. Taking the time to give thanks is an opportunity for a perspective reset. It allows us to step beyond whatever challenge-du-jour we have faced and step into a place of empathy and connection. Words that come to…

An Update On Vaccines

The first case of COVID was Nov 17th 2019, exactly one year ago. Moderna announced a 94.5% effective vaccine this week. Pfizer’s vaccine is 95% effective and ready for emergency use approval by the FDA in one month. We can expect more effective vaccines from Regeneron, Johnson & Johnson, Sanofi and Roche which are nearing new stock price highs this…