The Tailwinds Behind Semiconductors

If a pandemic like COVID occurred 10 years ago, we would have had significantly more challenges adapting to suitable work from home conditions. Advances in global digital capabilities have allowed the modern world to continue to function at an exceptional level during a complete social shutdown. At the center of all of this digital capability and connectivity is semiconductor technology. Here is how you can think about the industry as an investor:

Why are semiconductor companies so important?

Semiconductors are the building blocks of the information age. When pieced together, semis form the chips that allow all software in the world to operate. Data centers, iPhones, laptops, smart appliances, robotics, etc, all require semiconductors at the core of their operations. Something as simple as watching Netflix at home utilizes semiconductors in your smart-tv, your wifi routers, the data centers at AWS, etc. None of these steps would be possible without the semiconductor technology that sits at each node.

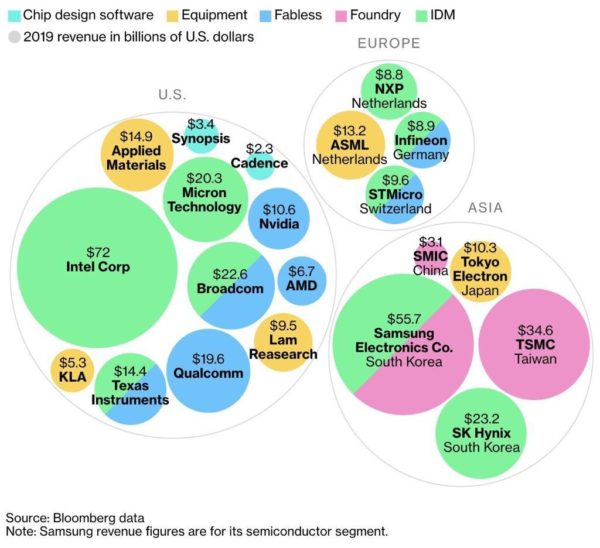

Below is a global map of the major players in the semiconductor industry. Equipment companies like ASML make truly incredible lithography machines that sell for north of $300m (these are some of the most advanced machines ever created).

As you can see from the map below, all of the world’s semiconductors are produced in Asia – which could be considered a threat or an opportunity, depending on how you look at it. The US dominates chip design and Europe has the claim of the most sophisticated equipment.

China would like to design integrated chips themselves, rather than rely on the US. Their “Made in China 2025” program explicitly states that goal. Apple has started designing their own chips, working directly with TSMC and cutting Intel out of the picture. Intel may have lost Apple for now, but it’s still a $70+Billion dollar revenue per year business (the largest in the industry) and will certainly find other opportunities. The fortunes of the existing players can vary dramatically as they battle for market share and proprietary advantage.

Reinvestment, R&D and leaning into the future.

The overall value creation from semiconductors has accelerated rapidly in the last five years according to a recent McKinsey report. The industry will likely continue to consolidate since any new big player would be too difficult to create. 2020 will have the second highest total dollar value of mergers of the past seven years. The US semi industry as a whole allocates 16% of revenue towards reinvestments into R&D. That’s second only to the pharmaceuticals industry at 21%. As for leaning into the future, many of the best semiconductor-related businesses are also cutting edge innovators in Artificial Intelligence and Machine Learning.

Combining defense and offense

Semiconductor businesses are unique in that they have both defensive and growth-oriented fundamentals. Software related businesses now dominate the top of the S&P 500 and most non-technology related industries today are planning on leveraging some form of AI, customer data management or digital central nervous system in order to achieve their visions for growth.

For defense, investing in semiconductors means owning a piece of an industry that is difficult to copy or disrupt and is essential to operating the modern world. In other words, in 2020, we can’t live without it and we want more of it.

For offense, The combination of software and hardware and a rapid cycle of reinvestment into innovation creates a great growth opportunity. The pairing of defensive attributes and offensive opportunities offers a unique combination for investors looking to protect and grow capital.

Tailwinds over cyclicality

Semiconductors used to be considered cyclical because big single product releases would drive up demand that could quickly be followed by dry spells. Today, the demand for electronics is much wider and new digital products are introduced on a near-continuous basis. The integrated role of semiconductors in everyday living is taking some of the cyclicality out of this very capital intensive business.

Today, most of our favorite trends and themes, digital health solutions, public cloud, digital advertising, AI, etc, coincide with a long-term tailwind for the semiconductor industry. In particular, AI represents a large opportunity for semiconductors as some expect the semiconductor industry to capture up to 50% of the AI-related revenue pie. One can reasonably assume that more semiconductors will be needed in order to match the continuous demand for cutting edge technology to support current and future aspirations of current and future entrepreneurs.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields