Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Four Ways To Give Up Certainty

In the investment industry, “certainty” is typically defined in terms of a specific guaranteed return. For instance, savings accounts and US Treasury Bills offer certain (but low) returns. T-Bills are finally paying some interest now, a whopping .98% annually. Call it one percent, or $10,000 dollars on $1 million, essentially risk-free.

Four Reasons It’s Time To Sell

We’ve noticed that some clients have two problems: significant cash balances as well as significant capital gains. Clients can sometimes be torn between investing more, or lightening up. On an investment journey, those courses of action seem small now but are crucial over the long run. Here are four reasons you might want to sell.

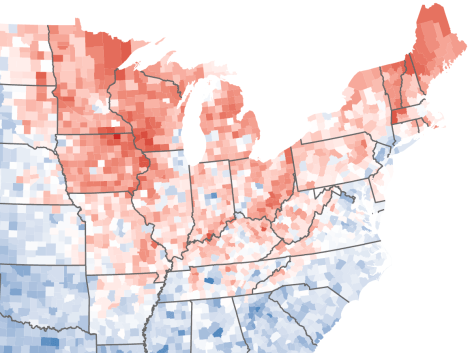

Another Crisis Anniversary

It’s been one heck of a year. Almost one year ago our crisis year began. From Brexit to Trump to Brazil this past year it has been one unexpected event after another. How can a reasonable person invest through such chaos? If we look more closely, you’ll see there’s a way.

The First 100 Days. Now What?

In one way, the United States has been a very stable place for decades. We’ve only had four Presidents in 24 years. They each got their First 100 Days. Now it’s time to focus the lens on our newest POTUS. What has he actually done, and can investors learn anything from it?

Who Are You Investing For?

When you compare who benefits from your portfolio, how does your view of investing change? Investing for your own retirement is not the same as building a surplus that will eventually go to your kids or future grandkids. With different people in mind, you and your advisor may make different decisions about risk, reward and time horizon. Let’s look at a few different perspectives of people living in the future.

How To Prepare For The Crash

Wait a minute. What crash?! No need for panic. I am absolutely NOT saying a crash is right around the corner. But big, scary declines are standard market events that happen, on average, about once a decade. This week is almost exactly the eighth anniversary of the end of the stock market crash of 2008-09. It’s just common sense to ask yourself from time to time how well prepared you are for the next one. Let’s take that opportunity right now and look at the bright side for some benefits.

The Week Ahead

Now that the presidential election is in the rearview mirror, it’s time to look forward and think ahead. What decisions, if any, should you consider in days and weeks that follow? By nature, personal and investment decisions are closely connected, so markets can provide some useful guidance. It’s OK to do a little personal projection. Let’s take a closer look at the post-election guideposts for investment decisions.

Election Proof Your Portfolio: 4 Steps

No matter who wins and who loses, on November 9th, tens of millions of voting Americans will wake up disappointed with the Presidential election result. And markets will react worldwide. In this most unpredictable election cycle, can you protect and insulate your portfolio without knowing the result ahead of time? You can, by taking these four steps.

The Kids and Your Money, Revisited

We first wrote about kids and money in May 2014. Here’s an updated version, circa 2016, sparked by real client conversations. What are parents talking about now? Education – price and value – seem to be top of mind, along with some other topics that may be just what you are thinking about.