Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Venture Debt Is A Bright Spot In A Low Interest Rate World

We all know about the fabulous returns from venture capital investing. If you were one of the early backers of Facebook, Google or Netflix, your return would be hundreds of times your initial investment. A common complaint among company founders is that early on, they sell too much equity for too little because they need the money for expansion. Venture…

Sky High Expectations For Flying Cars

The future of the flying car, eVTOL (electric vertical take off and landing) has gained considerable attention over the past year. Most recently, several SPACs have helped bring eVTOL technology to public markets at multi-billion dollar valuations. Considering the rapid pace of innovation today, it’s worth considering whether the hype matches reality. How should investors think about this emergent flying…

Investing With Leverage

With the $15B Archegos blowup over the weekend creating headlines, it’s a good time to revisit the role that leverage plays in investing. Leverage is a powerful tool that works both ways as it accelerates wins and losses. With the cost of debt at historically low levels, it can be tempting to borrow as much as possible. What types of…

Growing Opportunities In Health Care Innovation

The global pandemic greatly accelerated the adoption of virtual healthcare. Innovative technology in the healthcare sector offers an opportunity to reduce costs while reaching more people in need. Spending on healthcare goods and services is almost four trillion dollars annually, currently 18% of GDP. Let’s take a look at the near-term trends and contributing factors. Exponential evolution There are a handful…

New Ways Of Getting Your News

In the ongoing campaign for our attention, content providers have had to reinvent themselves and how they deliver information to their users. As a result, a new generation of news gathering and delivery tools have emerged. Traditional news sources are less than effective. New distribution tools allow creative and thoughtful people to better share their diverse perspectives. Here is a…

Earn A Yield By Lending Out Your Investments

In a low-interest-rate environment, the opportunity to generate an extra yield on investments is worth exploring and understanding. As technology has increased access to sophisticated investment tools, individuals with at least $250,000 are able to earn a yield on their investments by “renting” them out to short-sellers. That yield can be as low as .5% annually and over 25% in…

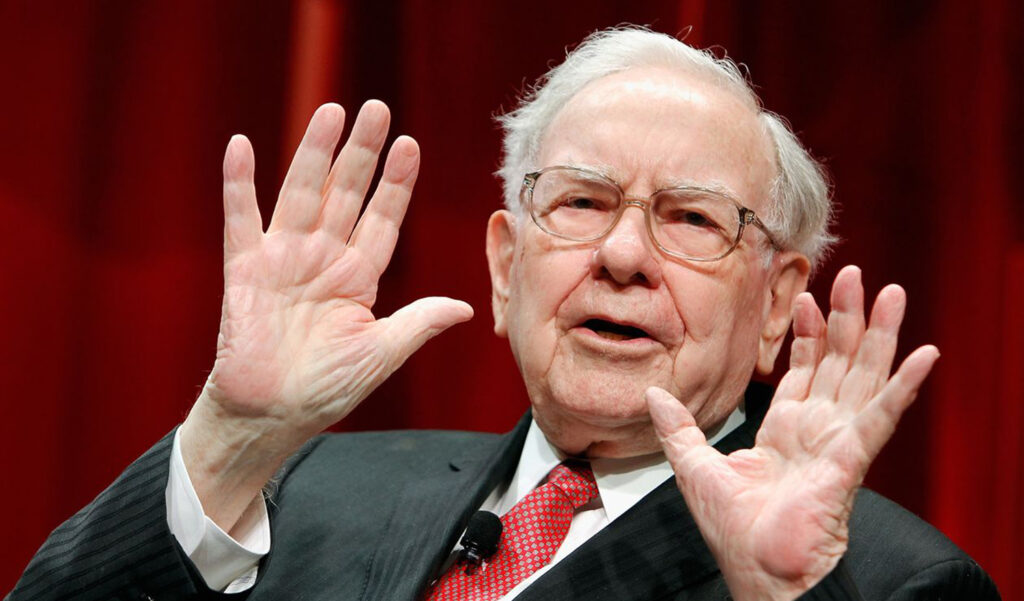

Lessons From Warren Buffett’s Annual Letter

Warren Buffett published his annual Berkshire Hathaway letter this past weekend and as usual, it was full of insights on investment strategy, company culture and robust optimism about the future. Since his very first partnership 1956, his main focus has been on providing compounded returns over time above the S&P 500 for individual investors. What can we learn from Buffett’s…

This Article Is A Store Of Value

If it feels like the world is moving exceptionally fast today, you’re not alone in that feeling. NFTs are the start of a major financial revolution. Over this past weekend, NFTs (Non-Fungible-Tokens), accelerated into the mainstream as well over $100m in NFTs changed hands in just a few days. Since NFTs use a public blockchain, all of the transactions, history,…

Emergence of the Retail Trader

The wild ride with GameStop stock, Wall Street Bets, Robinhood and Melvin capital last month was an incredible moment for retail traders. Retail trading today is defined by ultra passionate investment forums, endless supplies of memes, zero dollar trading costs and easy access to powerful financial derivatives called options contracts. Everyone wants to know where these massive groups of traders…