Investing in the Next Fiscal Stimulus

We all know there is a great deal of uncertainty about the next election, who will win, who will have control and who the new players will be. By design, the US experiences a major reshuffling every four years in our political structure. Despite the unpredictable changes, one thing is clear: there will be more fiscal stimulus going forward. There is at least one and possibly more fiscal stimulus plans waiting to be approved as of today. Let’s take a look at how the money will flow and how investors can position themselves.

Swift Action

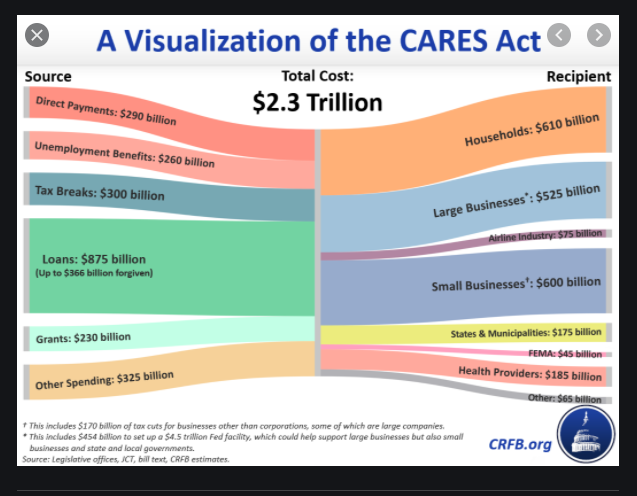

In any discussion about the next plan it is useful to refer to the biggest fiscal stimulus plan, the CARES Act of 2020. In a few short days in March as the US economy suddenly stopped, politicians decided to cast aside the questions of who gets the credit and how much it adds to our deficit to pass the $2.3 trillion act. The act came just in time and the positive effect on the US economy was documented about six weeks later.

Current Plan

The current stimulus plan by the Republicans is set for an additional $1.8 trillion. Democrats indicate they feel the amount is too low while Republicans feel the amount is too high and misdirected. The principal negotiators, Speaker Nancy Pelosi and Treasury Secretary Mnuchin are in daily contact. Markets are awaiting the outcome and appear optimistic that there will be a plan. According to the Brookings Institution, a nonprofit public policy organization based in Washington, many sectors and businesses within the U.S. economy remain weak due to the pandemic and without more fiscal support the economic recovery is likely to falter. Speed and longevity are the major issues for these stimulus plans – how soon do people get the money and how long does the spending last. There are many methods of fiscal stimulus like unemployment benefits, direct payments to consumers and subsidies for state and local governments.

Speed is important

Even the staunchest opponents of any fiscal stimulus agree that the “no fiscal plan” strategy will not work. Going forward we face rising unemployment claims, bankruptcies, special interest pleas for assistance and missed mortgage payments. If we go into another recession quickly the need for action will increase. History is only a partial guide here as it’s been 100 years since the last pandemic. The virus is still the most important variable. Progress on the vaccine leads to the end of shutdowns and distancing and eventually a fully participating economy. Politicians are the ultimate deciders when it comes to the size and speed of the next stimulus package. Once the virus is solved, we expect the stimulus to end and normal business activity to return.

New taxes offset new fiscal plans

We expect that fiscal stimulus will range in the next two years from a minimum of two trillion to a maximum of seven trillion dollars. New taxes directly offset fiscal spending. Even with seven trillion dollars of new spending, hundreds of billions of dollars in new taxes can reduce that amount substantially. The Democrats would have to sweep the Presidency and Congress to get their preferred tax increases. The outlook gets even muddier from there but a bare minimum of 2 trillion dollars is needed after new taxes to get the economy back to pre-covid levels by the end of 2021. You can see why several fiscal spending plans are needed, if politicians want to get ahead of that schedule. In two years, there will be another federal election (1/3rd of the Senate and all of the House) so the time to act before another political reshuffle is brief.

Plenty of Room

Bloomberg points out that there is plenty of room for more stimulus programs in the US.

While the percentage numbers may look daunting for the US both in 2009 and 2020 interest rates remain at zero and there is no inflation in sight. Why aren’t there more stimulus programs then? Again, history is not a good guide because the 2008 crash was induced by price bubbles and too much leverage. This crash has been induced by a virus that is not yet under control and will not be for another year.

On a micro basis, if you read what any small town mayor or any small businessman says, the message is the same: we need help, we need money, don’t worry about moral hazard, don’t worry about people never looking for work again, and so on. As a recent McKinsey study says, economic uncertainty reinvigorates the universal basic income conversation. Fed policy mostly benefits the already wealthy while the fiscal policy discussed in this article helps everyone else.

The turning point

When will a new plan be voted in by Congress? It’s a fair question. Trump supporters expect a new plan just before the election. Democrats would like to see it done just after November 3rd so the election is not influenced. Almost certainly we will get a portion (less than 2 trillion) of the plan before year end. Just as the CARES Act ran out of money in late July, the interim plan will run out of money in a similarly short period. It takes a lot of fiscal stimulus to move a 20 trillion dollar GDP economy. Two or even three stimulus plans are necessary to help the broad economy recover and bring permanent workers back. A true unemployment rate of 5% would be a sign that our 20 trillion GDP economy is back on track and growing again.

As we have said before, more fiscal spending and low-interest rates will help the following areas: the public cloud, the further digitization of finance, e-commerce adoption, the battle for our attention via advertising and content distribution, artificial intelligence and digital healthcare. With a fiscal boost there will be more extra cash to spend and invest.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields