Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Bubbles Are Not Irrational

The word “bubble” can be an emotional trigger for investors, immediately stoking fear and anxiety. Pundits and economists may refer to bubbles as irrational market anomalies, but there’s much more to the story than that. Here is some context so that you can understand the investor mindsets and strategies that spawn them.

6 Reasons To Say No To News

It seems almost self-evident that whoever has the best access to current news sources gains a significant advantage as an investor. Because information is power. Or is it? The business model of the news cycle is increasingly reliant on triggering your emotional reflexes. How does today’s news help or hinder investors?

Busting The Correlation Myth

When securities move in the same direction at the same time, that’s called correlation. If all stocks are highly correlated it doesn’t really matter what you own; all stocks rise or fall on the same fickle tide. “Everything moves together,” many complain. This is a common perception these days, but is it supported by the facts? Has too much correlation killed the markets?

How Often Do You Check Your Portfolio?

The answer to this question can tell you a lot about a person. For many, it is “Always!” Constant market checkers mentally recalculate their net worth every few hours and look for minute-by-minute trends to inform their next trades. For others, it is “Never!” Hoping to find bliss in ignorance, never-checkers leave their assets to fend for themselves. I suggest you find a strategy somewhere between these two extremes.

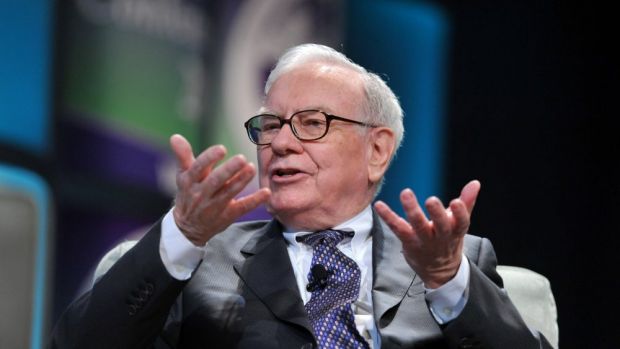

Warren Buffett’s 53rd Annual Letter

Warren Buffett released his 53rd annual Berkshire Hathaway (BRK) shareholder letter last Saturday. The letter is widely read by investors for insight into how to invest better and how to avoid investment mistakes. After 52 letters can Warren say anything new? Yes, he can. Read on for our highlights.

Six Ways To Handle Inflation

Inflation popped its head up in December for the first time in years. Is it a big deal or a big non-event? A little inflation at 2% is generally seen as a healthy metric for the US economy — far better than deflation — but what does it mean for your investments and spending? With inflation back on the radar, what can and should you do about it?

How Yields Have Changed – 2018

It’s week four of the investing year. This week the government reopened. The president and eight cabinet members are in Davos. The news for stocks has been all positive so far this year, but what about bonds? What kind of cash flow can investors expect from fixed-income investments in 2018?

An Old School Melt-Up

Jeremy Grantham is well known as a value investor and a permabear. He buys only cheap value investments. He has been famous for talking down US investments for years. However, on January 3rd of this year, he wrote “a very personal” view of a possible near-term melt-up. Jeremy is well worth listening, especially when he changes his mind.

Thankful Money Mindsets

Gratitude is such an empowering and satisfying emotion, it deserves more than one day on the calendar. And we have so much to be thankful for, both personally and professionally. This is especially true in the investment world. From the perspective of modern investors, here are three things that we can all be thankful for in the spirit of Thanksgiving.