Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Ten Years Post-Crisis, What Have We Learned?

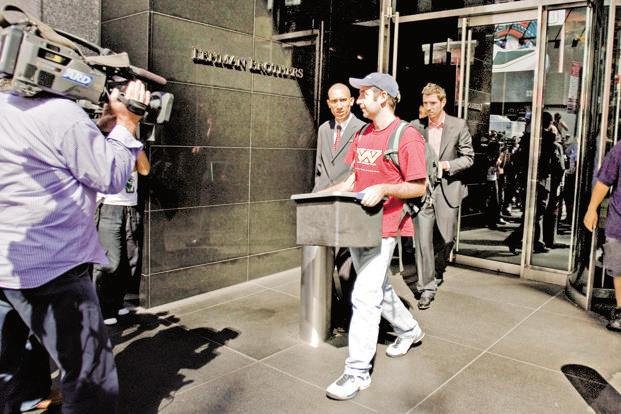

September 2018 is the month to mark – not celebrate – the ten-year anniversary of the financial crisis. The crisis started on three specific days. First, Fannie Mae and Freddie Mac were put into government conservatorship on September 6th. Next, Lehman Brothers filed for bankruptcy on September 15th. Finally, AIG was bailed out by the government on September 16. Just recalling these events can give you the chills. What have we learned since then?

Price Targets Are Obsolete: Why are they still a thing?

Apple is in the news again this week because of its Gathering Round conference where the company announces new products and upgrades. With every event like this comes a new round of price targets and buy/hold/sell recommendations from Wall Street analysts. Our question is why do they bother? Individual price targets are notoriously unreliable and can be dangerously wrong.

Peak Passive? Not so fast.

The FT ran a story this week asking if we’ve hit “peak passive.” Similar to peak oil, peak “X” refers to an asset class hitting a sort of critical mass or market saturation. It also vaguely implies that there is no more room to grow and down is the only direction possible. With millions of investors relying on portfolios of passive index ETFs, this could be a mass catastrophe in the making. Or is it? Let’s take an objective look at the perils and possibilities of passive.

How Big is Too Big?

Apple made headlines around the world last week when it crossed the $1 trillion dollar market value level. Apple’s value now begs the question, how much higher can it go? Is $2 trillion feasible? How about $4 trillion? Or has Apple grown so large it will begin to fade? Is the trillion dollar mark a limit or a launchpad?

Mid-Year Check Up

Where were we one year ago? Have your investments gained value or slid? It’s hard to keep track when economic and political news is so loud. We’ve had two years of market anxiety – from Brexit and nominee Trump to tariff trade wars and non-stop interest rate increases. Fears persist. So let’s take a mid-year time out and figure out which way is up.

Local Companies Hitting Home Runs as Fast as Red Sox

Three local companies were in the national news last week. They are great examples of how local innovators create jobs, opportunity and wealth. By applying new ideas in mature industries, they created two billionaires, revived an old retailer, and established a brand new billion dollar company. I am talking about Wayfair, BJ’s and PillPack.

Raise Your Expectations Again

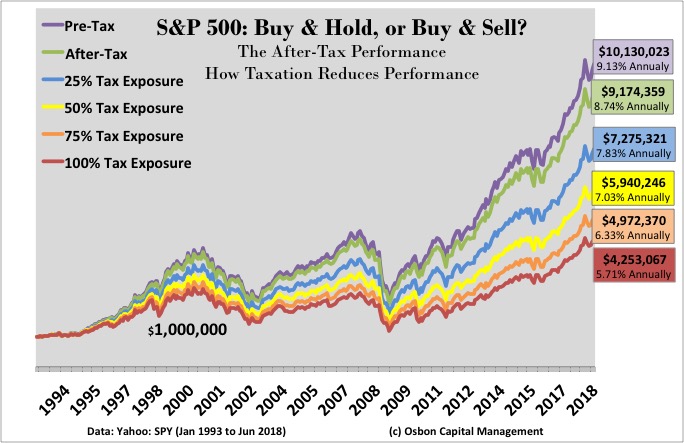

Five years ago I wrote, “Raise Your Expectations.” This week I am again urging investors to look at their after-tax investment returns. This is not the number your advisor or fund company may want you to focus on, but it’s really the only one that matters. Because it’s so important to your investment results, let’s revisit the after-tax topic and see why it’s still a problem the financial services industry tends to sweep under the rug.

Five Reasons Investing Gets Harder as You Get Wealthier

It’s a paradox of wealth. As your net worth grows and you start thinking investing will finally get easier, you may find the opposite is true. It turns out that choosing the right investments and financial advisors can become more difficult, or at least more confusing, as you amass assets. Here are five reasons why. 1. Instant popularity. With increased…

What If Amazon Enters The Asset Management Business This Year

Amazon’s entry is not a joke and it could happen soon according to a Vanguard executive who was in town last week for the Vanguard investment confab. Not only that, a number of prominent retailers could launch wealth management offerings as financial advice is commoditized and scaled even further to reach the smallest investor. Costco and Walmart come to mind. The executive acknowledged that Vanguard is actively planning to compete with technology-driven companies that have never been in wealth management. They take the threat seriously.