Weekly Articles by Osbon Capital Management:

"*" indicates required fields

The second law of thermodynamics and your portfolio

Nobel prize-winning physicist and world-famous lecturer Richard Feynman may be known best by his endless cross-discipline curiosity. This curiosity and exploration into new fields resulted in many novel and useful discoveries. Expanding on the mental models theme we discussed two weeks ago and crossing disciplines into the realm of physics, this article explores the second law of thermodynamics and how it applies to your investment life.

Trade wars and your portfolio – 3 measures

War is a big word and usually cause for concern among investors. I’ll limit this article to the financial aspects of a war because this war I am talking about is overwhelmingly financial. When the word war is mentioned many older people think of the Cold War. The Cold War was much more than financial and ended decades ago. Now the phrase Trade War is in the air. How can you tell the effect on your portfolio of a Trade War?

5 Mental Models To Help You Be A Better Investor

Shane Parish isn’t yet a household name but over the last two years, he’s become one of my favorite thinkers and writers. Here are five mental models from his complete list of 109 with comments on how you can apply them to your investment thinking. The goal of this article is to help you find new answers to old questions by altering the way you look at the problem.

2018 Reasons To Be Thankful

Now is the time of year when we get a chance to step back and reflect on the ways we are grateful. Gratitude lifts, heals, comforts and puts things in perspective. In the spirit of Thanksgiving, here are two simple reasons to be thankful in 2018.

5 News Events to Wrap Up 2018

The final nine weeks of the calendar year have already started. While we can’t predict prices over the short term we can pick out the news stories that will impact markets worldwide until year end and into 2019. Here are our top five picks, listed in order of importance.

How We Approach Investing In Start Ups

Osbon Capital manages client investments like a college endowment would be managed: with capital preservation, growth and longevity as the primary goals. Nearly all of our investments are in highly liquid major publicly listed securities because they fit well with these client goals. However, from time to time unique direct investment opportunities can arise, and when they do, they can represent a good opportunity for a client to step outside of their traditional allocation. Here’s how we look at special situation investments:

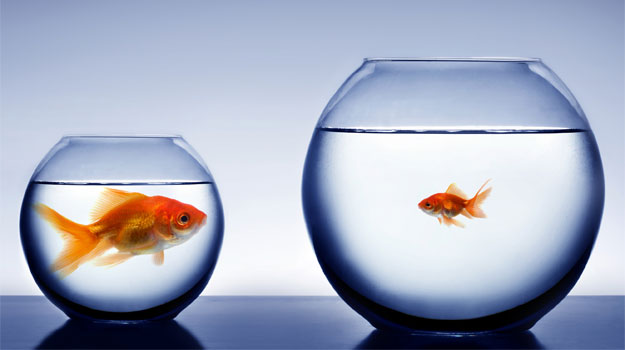

Win with Small Firms — 6 Big Ways

The story of small versus big is as enduring as the David and Goliath legend. Investors who are thinking about changing advisors or picking an advisor for the first time can choose from dozens of big firms and thousands of small firms. So, which is best for you…small or big? Several years ago, Malcolm Gladwell floated the idea that small firms have a real business advantage over larger competitors. We agreed then and feel even more strongly that way now. Here are six reasons why.

Stay with International

US-based investors holding international investments are sorely tested these days. Stock markets outside the US have not been generous in returns recently, certainly not as good as US stocks. Furthermore, the dollar is up 9% this year, wiping out what gains are available overseas. Headlines aren’t helping. Brexit talk, regime change and America First have contributed to the concern for international investors. Have we reached a point where the reasons to abandon international investments outweigh all possible benefits? Here are the reasons to stay with international investments.

Less Gold. More Yield.

Gold remains an important asset class in global investment markets. With 190,000 tons mined and a market price of $1200 an ounce, the market value of gold is over $7 trillion dollars. While gold is a meaningful asset class, it has become smaller compared to the rest of the market because its price has been going down since 2011. Is it time to give up on gold? We say no, and here’s why.