2018 Reasons To Be Thankful

Now is the time of year when we get a chance to step back and reflect on the ways we are grateful. Gratitude lifts, heals, comforts and puts things in perspective. In the spirit of Thanksgiving, here are two simple reasons to be thankful in 2018.

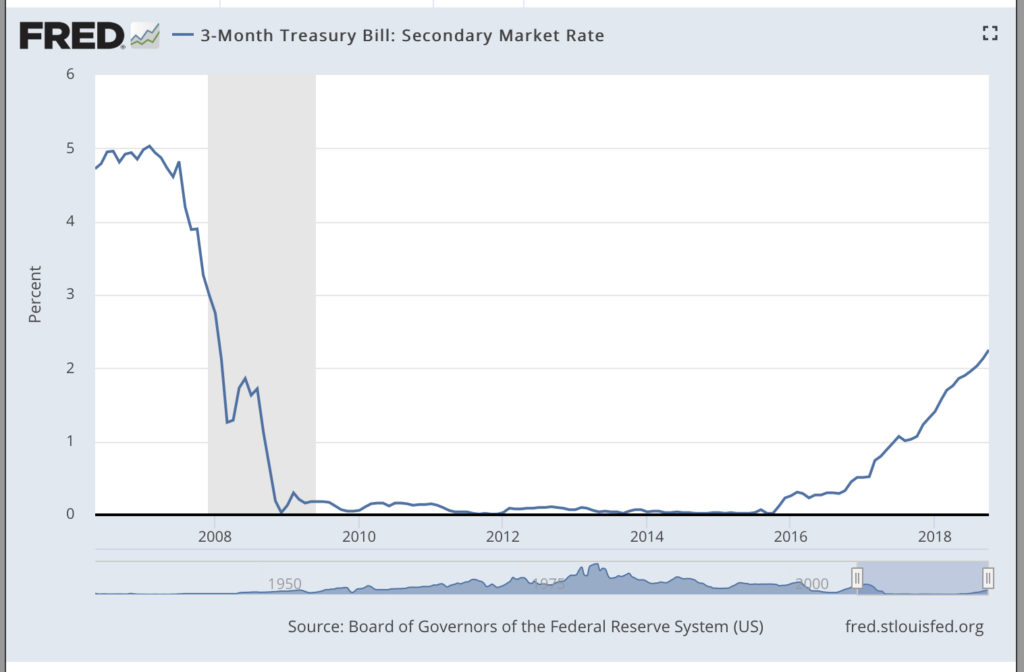

Thankful for new yields

If you read our article from last week on cash, you know that we are excited about the new yields available via TBills. For the first time in over a decade, the 3 month TBill yields over 2%. (2.37% as of today). With 0% interest rates for the last 10 years, there has been a lot of pressure on investors to avoid holding cash. With many investors holding cash on the sidelines, unsure of where it should be invested, this presents an attractive, protected and fully liquid opportunity. If you want to know how this might be useful to you and how you can compare it to inflation, please ask

Thankful for the ability to help others

Robbert Emmons, PhD, professor of psychology at UC Davis has written three books on the psychology of gratitude and is considered one of the world’s foremost experts on the topic. His research demonstrates that gratitude improves sleep (via journaling on gratitude before bed), improves resilience in the face of new stresses, and improves happiness (as measured by forward looking optimism) by a significant margin. Robert says that gratitude, with its many benefits, is a choice and requires an active and consistent effort. You can read more in his most recent book, The Little Book of Gratitude.

One way we suggest exercising your gratitude muscles is by donating your appreciated securities. If you plan to give any gifts over $5,000, consider donating taxable assets with large capital gains. If you need inspiration on new charities you can see the organizations our clients support on our Philanthropy Page. When we donate a stock with a capital gain we make sure that:

1. The charity is allowed to keep the full asset value pre-tax.

2. We can write off that full value against our annual income.

3. We both avoid the capital gain

AMZN might be a new favorite this year given its short and long-term success. The best option isn’t always just the one with the largest capital gain. Make sure that you’re taking your whole allocation into account. There are certain limits and the details matter. We’re here to get the details right.

Happy Thanksgiving from Max, John and the Osbon Capital Management Team!

Weekly Articles by Osbon Capital Management:

"*" indicates required fields