Weekly Articles by Osbon Capital Management:

"*" indicates required fields

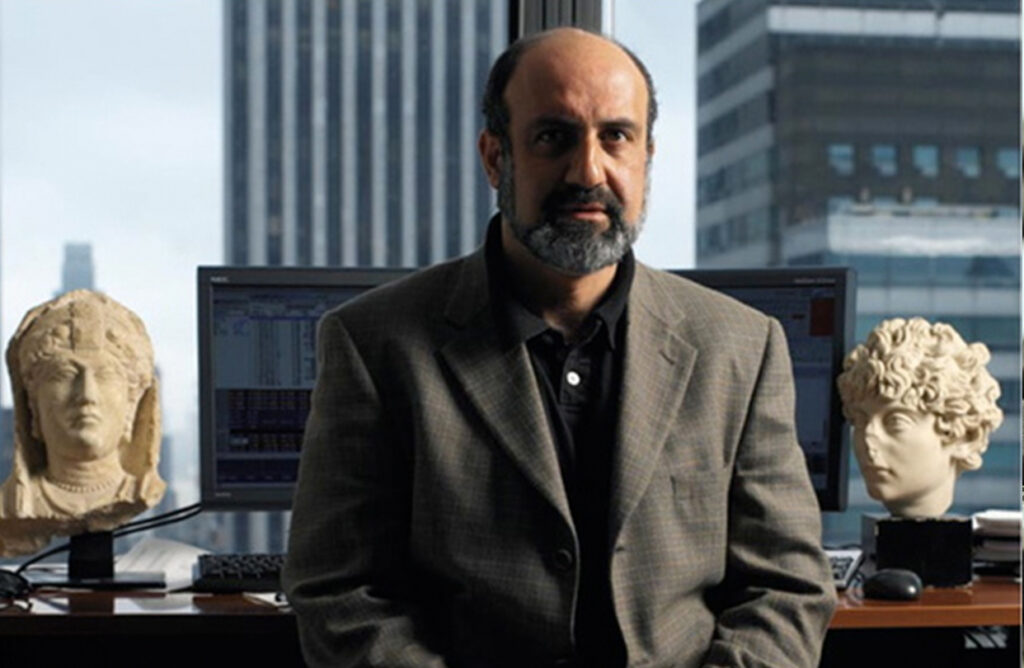

4 Signs of Skin In The Game

Nassim Taleb, the author and scholar best known for The Black Swan (2007), predicted an extraordinary market event would happen because too many players had no skin in the game. They suffered no personal consequences for bad advice, mistakes and greed. His new book, Skin in the Game, drills down on this idea and helps us consider whether your advisor is really on your side.

Why Do Allocations Change?

Good question and one asked frequently by experts and clients alike. When should asset allocations change in a portfolio? The when, why and how of allocation changes should be as transparent as indexing itself, and it is.

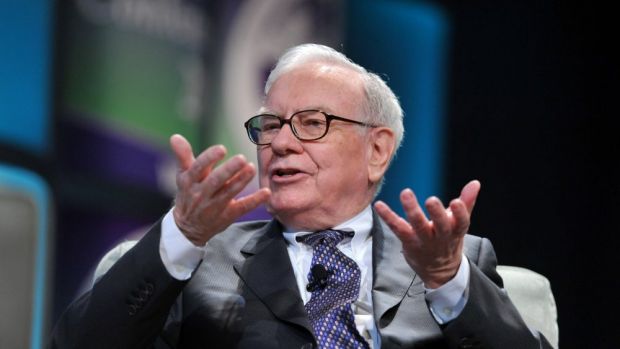

Warren Buffett’s 53rd Annual Letter

Warren Buffett released his 53rd annual Berkshire Hathaway (BRK) shareholder letter last Saturday. The letter is widely read by investors for insight into how to invest better and how to avoid investment mistakes. After 52 letters can Warren say anything new? Yes, he can. Read on for our highlights.

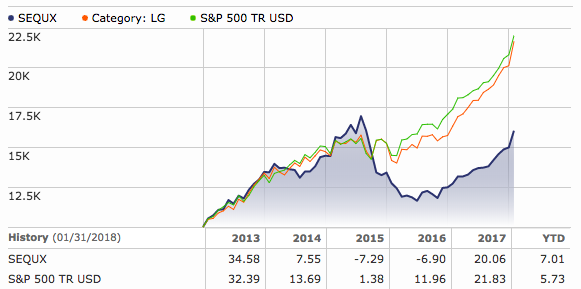

A Micro-Bubble Is Popped

It’s been 20 days since the Dow peaked at 26, 400. After a wild ride, the index is back within a few percentage points of that level. While very little has changed in the diversified portfolio of long-term investors, some casualties of the market flip-flops have floated to the surface. One is LJMIX. Here’s the story of a fund that took a few bad days and turned them into bona fide disasters. What can we learn from its mistakes?

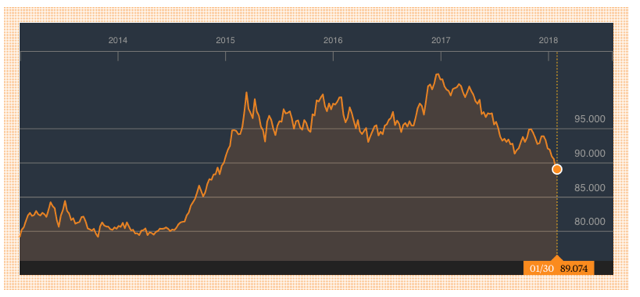

The Road Ahead for the Almighty Dollar

Big changes in dollar strength can have big economic effects at home and around the world. The strong dollar was called into question last week in Davos and emerged unchanged. What will investors be looking for the dollar to do in 2018? Here’s our checklist.

An Old School Melt-Up

Jeremy Grantham is well known as a value investor and a permabear. He buys only cheap value investments. He has been famous for talking down US investments for years. However, on January 3rd of this year, he wrote “a very personal” view of a possible near-term melt-up. Jeremy is well worth listening, especially when he changes his mind.

New Tax Law: 529s and More

I have been spending as much time as possible reading about the newly enacted tax bill, the first tax reform signed in 31 years. All sides agree that the bill lowers tax rates for corporations and individuals. After that, there is little consensus on the broad effect of tax reform, who it really helps or harms, and how long it will last. The devil is in the details. Here are a couple items of special interest to investors.

Why I Am Learning To Code

There is more freely available high-quality financial data out there than ever before. But the quantity of data doesn’t necessarily translate to quality of decisions. Big data can mean big problems when it comes to organizing, filtering, analyzing and displaying it — all of which are prerequisites for using the data to make a decision.

Get ready for 2018 IPOs

The total US stock market size is shrinking due to buybacks and takeovers. (WSJ). Private companies are being acquired before the public can invest in them. What’s the response? IPO! Gaze at the most likely IPOs for 2018, some well known and others not. Should you invest in any of them? If you do, get ready for a wild ride.