Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Byron Wein, AI, Quick Bites

Byron Wien History Legendary investment writer Byron Wien passed away this week. John Osbon worked with Byron at Morgan Stanley back in the day. In fact, John credits Byron directly for inspiring the discipline of regularly publishing investment insights to communicate, clarify thoughts, keep records of successes and mistakes and promote continuous learning. Byron was most famous for his annual…

Comments on Automation

Comments on our automated future I recently visited an Apple store to buy replacement headphones. An employee showed me how to self-checkout via iPhone. I didn’t know this was an option. Next time you go into an Apple store, you should know that you can pick an item off the shelf, scan it with your iPhone, double-click to pay with…

Optimism, Talus, Fink

Optimism Markets and economies are complex adaptive systems. This makes them good at responding positively in the long run to the many unique challenges presented over the short run. When we wear the hat of the risk manager, as we are all programmed to do naturally, it’s tempting to get caught up in a string of negative narratives. While it’s…

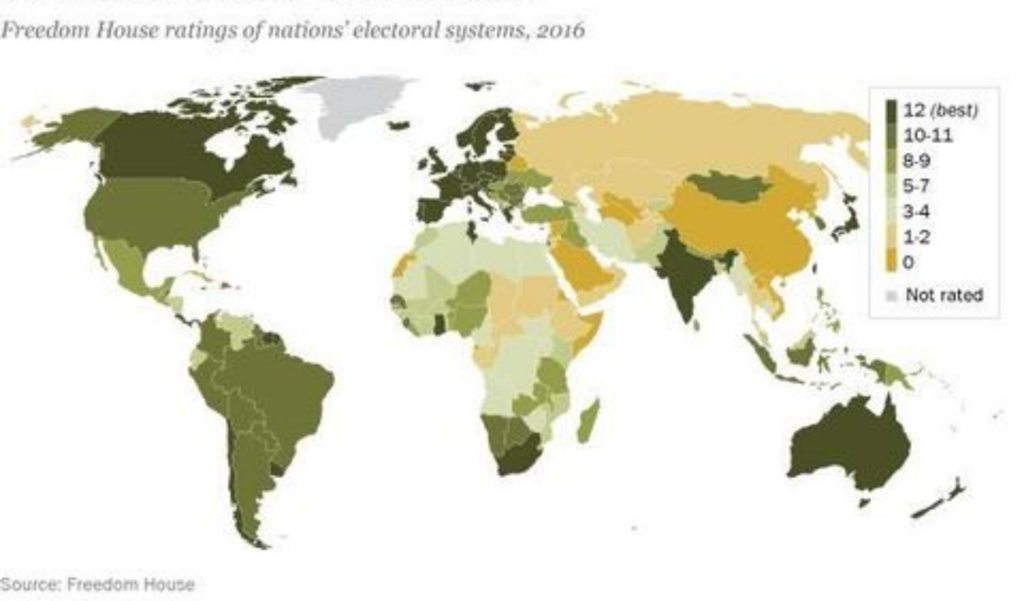

World, Land Value Tax, New Unicorns

World The ongoing events in Israel are horrific and tragic. The difficulty of predicting the onset and conclusion of acts of war is on par with predicting natural disasters. Conflict can end just as suddenly as it started or last a decade. The end of the conflict in Ukraine is similarly uncertain. In 2024, 50% of the world’s GDP will…

Treasury, Michael Lewis, Batteries

Impact of rate moves, serious but manageable For the past few weeks, we’ve been discussing how the increase in the long end of the treasury curve continues to create issues across financial markets. The 20-year treasury bond is currently over 5%, meaning a buyer at today’s prices earns 5% every year risk-free, and anyone stuck holding lower-yielding debt has lost…

Rates, Banks, Poker

Rates and Banks The 20 and 30-year treasury rates are now a hair under 5%, the highest level in 15+ years. TLT is the ETF that tracks the performance of the long-duration treasury bond market. It’s a decent proxy to see the impact of these rate hikes on current outstanding treasury assets. Treasury assets and long-duration bonds have a market…

Not Quite Austerity, OpenAI

Not Quite Austerity The Fed meeting yesterday left interest rates unchanged at 5.25-5.5%. Two more meetings in 2023 are scheduled for November 1st and December 13th. The most likely outcome is that we won’t have any more rate hikes, and the difference between another pause and another hike is marginal. More remarkable is that long-duration treasuries are now at or…

Google, Private Credit, Moon

Google getting competitive I’ve wondered for years why Google didn’t continue to add basic features to their most popular products like Google Docs, Calendar or Chat systems. It could be to avoid feature bloat or to focus only on the highest-priority opportunities. It’s not like they didn’t have the capital or the talent to add features. Still, they ignored particular…

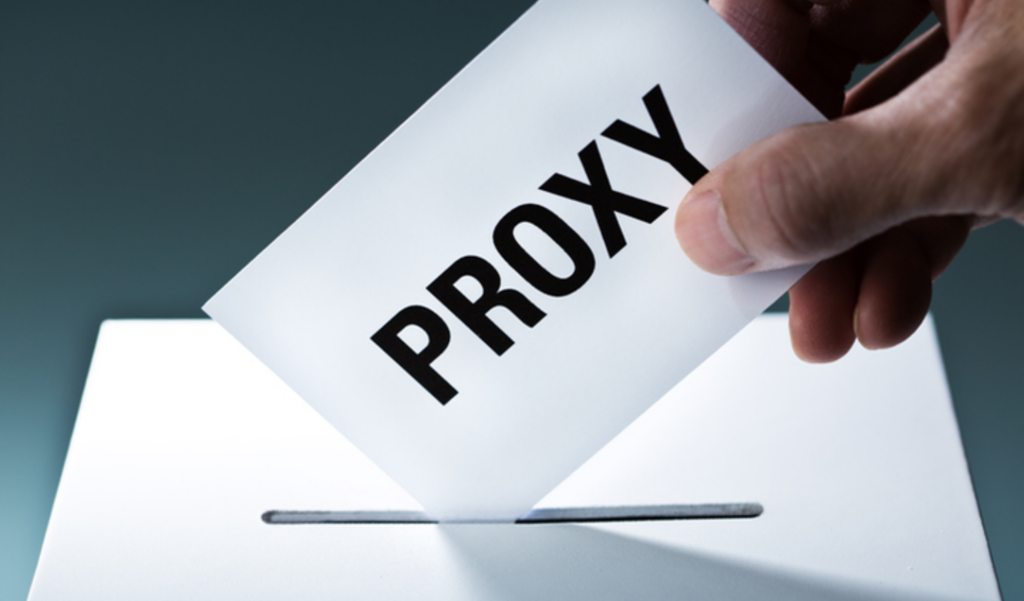

Active Ownership

Osbon Capital launched in 2006 as an index boutique focused on ETFs and the emerging index strategy. At that time, Vanguard had just passed $1 trillion in assets under management and indexing and ETFs were still a relatively young concept. ETFs held just $300B in total assets at the time, and John had the foresight to predict that index ETFs…