Election Proof Your Portfolio: 4 Steps

No matter who wins and who loses, on November 9th, tens of millions of voting Americans will wake up disappointed with the Presidential election result. And markets will react worldwide. In this most unpredictable election cycle, can you protect and insulate your portfolio without knowing the result ahead of time? You can, by taking these four steps.

No matter who wins and who loses, on November 9th, tens of millions of voting Americans will wake up disappointed with the Presidential election result. And markets will react worldwide. In this most unpredictable election cycle, can you protect and insulate your portfolio without knowing the result ahead of time? You can, by taking these four steps.

Surprises happen

Unexpected news can shake up financial markets. Brexit on June 23 was the most recent and biggest one. Few forecast that outcome, and the market reaction was swift and brutal. There were immediate winners (Treasury prices soared) and losers (the pound). If November 9th is a surprise, you can get ahead of it.

The Big 4

Here are the 4 steps you can and should take before November 8th so your portfolio can withstand a “November surprise.”

- Check if “it’s in the price”: Markets adjust in advance of events based on available information and prevailing sentiment. Has the market already adjusted for election results? Your advisor can easily price multiple scenarios today by checking price history, relationships and spreads. Sounds complicated, and it is, but any experienced professional can do it. This price check works because markets rarely discount the same news twice. Try it with the peso now to see if a Trump victory/defeat is in the price. Repeat with any election day fear/hope you have until you are satisfied.

- Check your liquidity: Quick, what percentage of your portfolio can be liquidated immediately without affecting your long-term investment plan and without triggering taxes? We use 30% as the target for Osbon Capital portfolios. 30% gives you plenty of choice and plenty of time to make changes quickly if you don’t like what is going on in the investment world.

- Check your diversification: Where’s your money? What’s your split between stocks, bonds and alternatives — sorted by dollar and non-dollar denomination? Chart it out and you will have a six-factor grid that shows you how diversified you are. Spreading your assets across diverse investments is always important, especially as a defense against surprises.

- Check your scenarios: Write down three post-election fears you have and give them to your advisor to stress test. Portfolio managers do this all the time, so it is a routine request. Expect specific answers in writing. Example: a Hillary win may lead to tax rate increases; how would this affect my municipal bonds? Knowledge is a great antidote to investment anxiety.

Respect the unknown, but don’t fear it

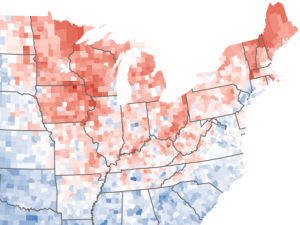

Good and bad surprises come all the time, like changes in the weather. Sometimes sunny, sometimes rainy. Hearty New Englanders say to that: “There’s no such thing as bad weather, just bad clothing.” As the election looms, check your investment wardrobe and make sure it’s flexible enough to handle whatever the final tally brings us.

John Osbon- josbon@osboncapital.com

Weekly Articles by Osbon Capital Management:

"*" indicates required fields