Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Demographics Are Fundamental To Investing

Andy Kessler wrote a great WSJ article on Monday about China and demographics, called “Old Age Will Put China To Rest”. It made me remember how excited we were at Morgan Stanley 35 years ago when we started to collect demographic data outside the United States. Today, in 2019, our access to demographic data has grown exponentially. It’s important we…

The Go-To-Market Economy

What exactly is a go-to-market (GTM) company? A GTM company is intensely focused on creating new and innovative strategies to attract new customers. Rather than building new technology or new service models these companies don’t have to have the latest and greatest offering to attract new business. In order to be viable, they have to have a reasonable path to…

A Sample Of One – Politics and Investing

For the second time in twenty years, talk of impeachment is in the air. Like last time, impeachment probably will happen, likely followed quickly by acquittal. The whole show could be over by the end of the year, according to the Speaker of the House. The markets have greeted this news with a giant yawn. Why isn’t impeachment more of…

Investment Anniversaries: What We Can Learn from Historic Days

Not all investment days are created equal. There’s something about the start of Fall today that brings anniversaries to mind. Many people believe August, September and October are cursed times to invest, that stock plunges are inevitable and imminent. A closer look shows that important anniversaries are spread randomly throughout the year; surges and crashes know no calendar. Let’s take…

Financial Repair Continues

Our two mortgage giants, Fannie Mae and Freddie Mac, have been in the news this month with positive comments. Their stocks and other securities have responded with a sharp jump, indicating hope that we will return to a healthy mortgage market and get the government largely out of the mortgage business. The securities are officially worthless but speculators are betting…

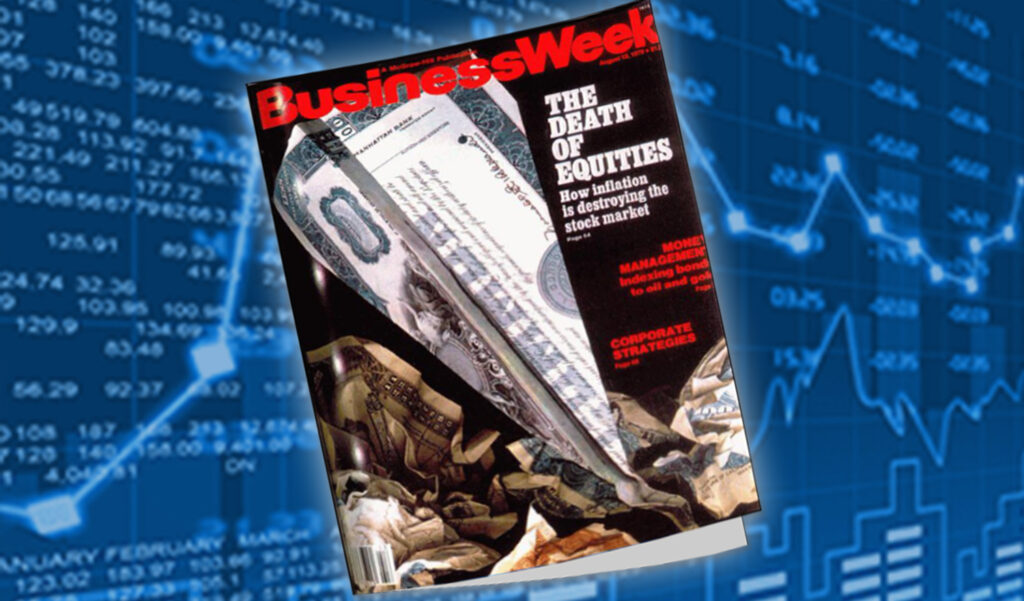

Stocks Are Alive and Kicking

Forty years ago a Business Week cover story announced the “Death of Equities.” The Dow was at 867. In the years since, as the Dow has risen 30x, we’ve seen other forecasts for the tragic demise of stocks, all wrong. In 1979, the doomsayers pointed to inflation and high taxes as the forces that would kill stocks. Healthy skepticism is…

Look at What They Do, Not What They Say

One piece of good news got buried in last week’s falling stock prices and the rush to safety in the bond market. This Bloomberg headline from last Friday says it best: Trump Has Signed Budget and Debt-Limit Legislation. Why is this such good news and what impact does it have on your financial and investment life? Aside from the messy…

Too Concentrated in One Stock?

***We took this article off of the public site because it discusses a partnership structure. It’s a valuable topic, however, the partnership this article alludes to is not allowed to advertise. Their legal team asked us to take it down for their own compliance purposes.*** Please contact us directly if you have any questions. – Osbon Capital Management

Productivity Part Two

Last week Max Osbon wrote about the coming productivity surge. This week I am going to write about how good our current productivity is and the key productivity dates coming this Summer. Three days in July might reveal how productivity and the US economy are doing much better than the conventional wisdom believes. At Osbon Capital we are looking at…