Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Living In The Future

What does the future hold? For optimists, the future is defined by net improvements and net progress. Optimism doesn’t require perfection and human ingenuity is a powerful force. Someday the virus will be gone, we will be able to travel the world worry-free, go to any restaurant at any time, the economy will be chugging along again and those who…

The Bull Cases

Secretary of the Treasury Steve Mnuchin said on April 19th that it will be months, not years, before the US economy is back to its previous strength. He has a big hand in making that happen. The Federal Reserve and the government have introduced record stimulus packages in record time, and clearly they are not finished. In the face of…

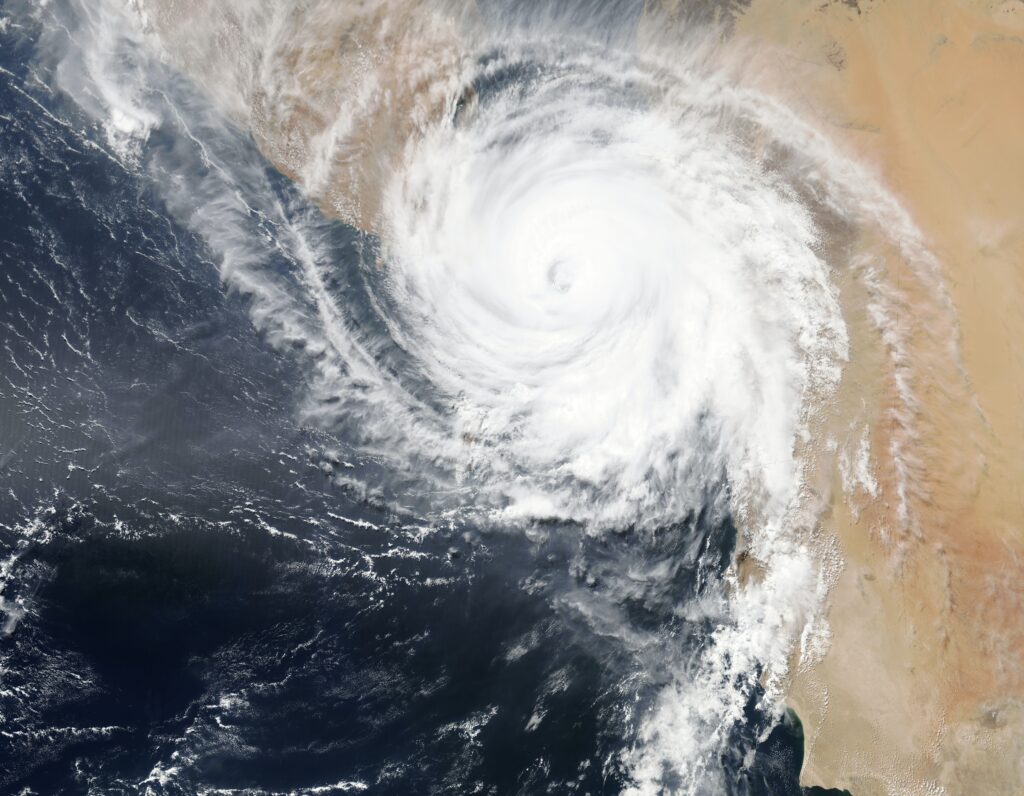

The Eye of the Storm

In the first quarter of 2020, we experienced the first unexpected and unprecedented shock wave from the COVID-19 pandemic. The estimates on what will happen next are open to a wide range of guesses, from a V-shaped recovery (via CNBC) to a brief recession (El Erian), to a global depression (Ray Dalio). There seems to be a consensus that things…

The Crude Story of Oil

Daily global oil demand was 100 million barrels per day in 2019 and was expected to be slightly more in 2020. In the new COVID economy, daily demand is difficult to determine although it is clearly significantly lower. Some say it is 77 million barrels per day. Some say it is much lower, questioning who is driving cars and who…

Not So Fast, Major Obstacles Remain

As of late Wednesday bulls and bears can take their pick from a wide menu of opinions. Bulls say a vaccine is coming and the curve is flattening. Bears point to record Fed and government packages that carry a huge cost. The bears, like Jeff Gundlach and Howard Marks, come from the bond market side. Naturally, they see much more…

Buying Signs In An Uncertain World

Since we have a large amount of cash in client accounts it’s natural that we are looking for signs of when to buy again. It’s important that these signs are real and measurable. There are currently 25 indicators on our internal list in 5 different categories and the list is growing daily. In this article I will mention the major…

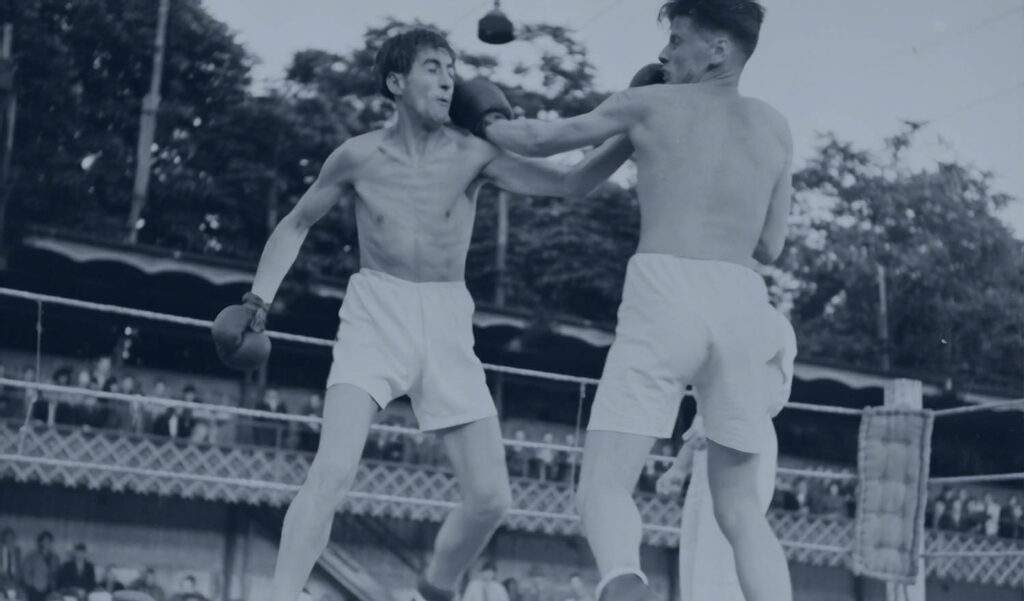

Turbulence Expected or Unexpected

This week we are writing about new developments in Covid-19 and worldwide markets, as there are many. Covid-19 is negatively affecting markets this week because of the uncertainty about when new outbreaks will stop. Over the weekend, a new market – oil – was significantly affected by an oil war between Russia and Saudi Arabia. Additionally, rates in the US,…

When Experts Disagree

For the last two months it seems all we have heard about is disagreement. I am not talking about political disagreement. I am referring to investment disagreements and convincing opposing arguments put forth by experts I read, with mixed signals in the markets as well. Here is a list of the six main points of disagreement and what we are…

When News Lets You Down, Go To The Primary Sources

We live in the Age of Data. There’s an endless stream of data points on every topic, especially in the field of economics. The media and politicians regularly serve up numbers that support their point of view. If you feel it’s hard to trust these data-driven arguments, you’re right. When data is cherry-picked, omitted, conflated or obscured, any conclusions must…