Weekly Articles by Osbon Capital Management:

"*" indicates required fields

What’s My Investment Timeline?

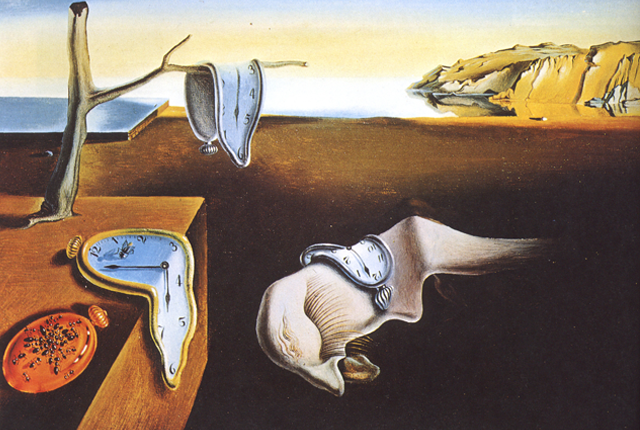

Investing can be broken into three primary colors: rewards, risk and time. The connection between risk and reward is well known, but today we’re going to focus on the third component, time. Time has a big impact on what you can expect of your investments – probably more than you think. Let’s take a look at a series of investment timelines and what you can expect from each.

Be Skeptical Of These Popular Investment Phrases

This week we are happy to offer you a healthy dose of skepticism. We see product pitches, commercials, term sheets that friends, prospects and clients send to us, and all kinds of twists on the same investment pitches. Some of these advertisements have some value; most are just storytelling. Here are some buzz words to watch out for.

Five Measures Of Investment Me

We often talk about treating your personal investments the way you would run a business. Knowing your cash flows, profits and losses, and balance sheet keeps Investment Me on track to hit the goals. If that sounds daunting, know that software makes this easier than ever. Once you have this set up (email me to find out how to do this) here are the 5 key metrics you can monitor monthly, quarterly or annually to make sure you investments match your goals.

Election Uncertainty: What’s It Mean For Me?

On Tuesday, November 8th we’ll finally know who the 45th President of the United States will be. What a campaign rollercoaster it’s been. It’s been so contentious and unpredictable, many investors are wondering what it means for their financial futures. Here are some things to consider as the last 40 days of the campaign unfold.

My 8 Step Financial Routine

We all want to be responsible and efficient when it comes to finances. But how? Where should you start and what should be done? Instead of starting from scratch, I recommend you follow an easy routine. Take the 8 small steps below each month. They won’t take you more than 10-30 minutes and will pay dividends well into the future.

Am I Risk Tolerant?

We see advisors and investment firms do it all the time. They ask you what your risk tolerance is, possibly on a scale of 1-5 or with words like conservative and aggressive. It’s tempting to condense the investment process down to a series of targeted multiple-choice questions. But does that really work? Let’s take a deeper look.

Six Reasons To Call Your Advisor

When should you call your wealth advisor? Whenever you want. Your advisor should always be available and ready to answer questions, pose new forward-looking ideas, or simply discuss what’s on your mind. Here are six situations where you should definitely pick up the phone.

Are My Investments Socially Responsible?

We get this question often, and welcome the discussion. Are my investments contributing to global warming, questionable GMO food practices or gun manufacturing? Will my portfolio help or hurt the next generation? What will I say to my kids/grandkids/friends when they ask me if I invest responsibly? Fortunately, there is a way to know how you are doing, and the responsible choices you have.

How The Local Inaugural Decathlon Makes Boston Better For You

This past Saturday 72 local men and women endured 90+ degree scorching heat to compete in the first ever Boston D10 Decathlon. After eight years of hosting the marquee event in New York City, founder Dave Maloney chose Boston for his next move. He couldn’t have picked a better city. Here’s why: