Weekly Articles by Osbon Capital Management:

"*" indicates required fields

A Financial Conversation Framework

With more family time than the rest of the year, the holidays can be an opportune time to talk about money and investing. But where do you start? Before you get into any technical aspects of planning or investing, we recommend you start with goals, values, fears and plans for success for money and life. It’s easier than it sounds. Here is a three-part framework we find leads to great conversations:

Bigger Gifts and Lower Taxes in 2017

2017 has been another big year in a long-running bull market. Your portfolio is probably full of holdings with significant capital gains. To avoid paying the tax on those gains, you may be holding onto securities you’re ready to sell. What to do? Well, if you have any charitable giving goals, consider giving away your capital gains bill in the process.

Thankful Money Mindsets

Gratitude is such an empowering and satisfying emotion, it deserves more than one day on the calendar. And we have so much to be thankful for, both personally and professionally. This is especially true in the investment world. From the perspective of modern investors, here are three things that we can all be thankful for in the spirit of Thanksgiving.

Cryptocurrencies

I get more questions about bitcoin and cryptocurrencies than any other finance topic. Everyone wants to know what to do with crypto. What’s your angle, how much is your allocation and which crypto is the most compelling? Here are some facts to help guide you:

You Can Beat the Equifax Breach

Last Thursday’s announcement of the Equifax breach was a monumental moment for personal financial security. Nearly 44% of Americans had their social security numbers exposed by hackers. Here’s what you can do about it.

What is the Penalty Economy?

The penalty economy’s objective is to guide people into paying more than they intend when they are confused, distracted or too busy to care. It’s not necessarily illegal or even unethical. Have you been spending money in the penalty economy?

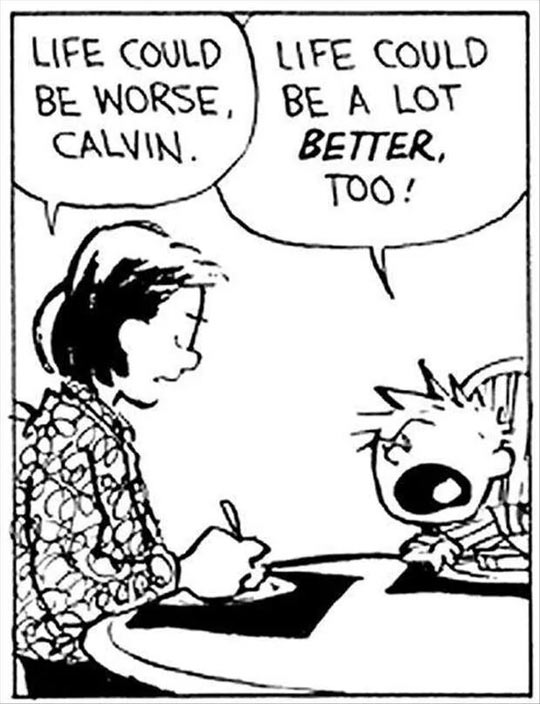

What are Anti-Goals?

Charlie Munger, Warren Buffet’s longtime business partner, has said, “A lot of success in life comes from knowing what you want to avoid: early death, bad marriage, etc.” Charlie was talking about a problem solving technique called “inversion.” We use the term “anti-goals.” Either way, focusing on what you want to avoid is a very powerful tool.

A Peek at the Future

I spent the weekend at an invite-only financial regulation round table hosted by Jo Ann Barefoot, senior fellow at Harvard and a veteran of the financial regulation world. Jo Ann founded the Barefoot Innovation Group. Over the course of the weekend we discussed the symbiosis (interaction) of the old guard and the new in banking, lending, asset management and regtech (regulation technology). Here is what we learned.

5 Summer Investment Goals For Your Kids

Given that the first official day of Summer was yesterday, June 21st, we thought it would be appropriate to suggest a handful of financial and investment goals for your family to explore over the next thirteen weeks. We’re all busy, so I selected these because they’re short, sweet and effective. See if you can manage to tackle all five before September 22nd.