Weekly Articles by Osbon Capital Management:

"*" indicates required fields

6 Easy Steps for Investing With Your Kids

It’s never too early to start educating your children on investing. From their younger vantage point, kids have their own set of investment advantages. This week’s article lays out an easy hands-on process to get kids thinking about investing (versus spending) and help them prepare for the day when they manage their own finances. Here’s how you can start:

The Starr Forum

Now that school is back in session, you may want to take advantage of the intellectual capital available in Boston. Sponsored by the Starr Foundation, the CIS Starr Forum brings academics, public intellectuals and policymakers to the MIT campus for public discussion and lecture.

Hamilton in Boston

You may have heard that the national tour for Lin-Manuel Miranda’s Tony award-winning musical is about to start it’s two month run at the Boston Opera House. The show has mostly sold out, however, there’s still a chance to secure your spot. Broadway in Boston recently announced that they are raffling off 40 tickets priced at only $10 to every performance.

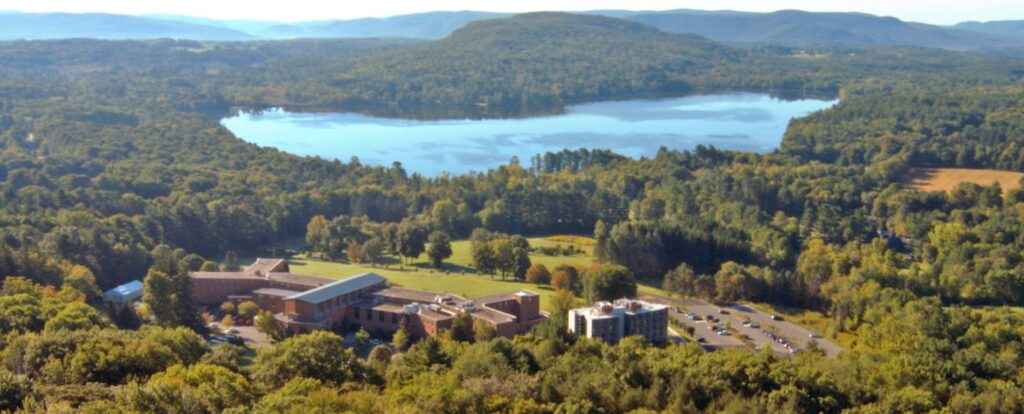

Exercise in Relaxation

September is National Yoga Month. Whether you’re a seasoned yogi, or completely inexperienced, New England has something to offer you this month. Check out the sprawling resort of “Kripalu Center for Yoga and Health.” Located in Stockbridge at the base of the Berkshires, the 150-acre compound is nationally regarded as one of the best yoga retreat destinations for practitioners of all skill levels.

Peak Passive? Not so fast.

The FT ran a story this week asking if we’ve hit “peak passive.” Similar to peak oil, peak “X” refers to an asset class hitting a sort of critical mass or market saturation. It also vaguely implies that there is no more room to grow and down is the only direction possible. With millions of investors relying on portfolios of passive index ETFs, this could be a mass catastrophe in the making. Or is it? Let’s take an objective look at the perils and possibilities of passive.

All Politics is Local

Take the opportunity next Tuesday, September 4th, to have your voice heard in the Massachusetts 2018 primary elections. Voter turnout was less than 50% in the last Massachusetts midterm election however, Boston has a strong record for showing up to the polls; In 2014, 83.65% of the 383,702 registered voters cast a ballot.

Determining your liquid assets

Between boomers wrapping up careers and entrepreneurs thinking about new ones, many are considering retiring from current roles to follow other pursuits, passions and opportunities. For these folks, a critical question is how much cash to hold. Cash reserves provide a sense of security, a buffer against a challenging investment climate and dry powder for interesting one-off opportunities. How much is enough? Is there such a thing as too much? The answer is often a dynamic moving target. Here are some considerations:

Broadway in Boston

The world-renowned Broadway musical, The Book of Mormon is in Boston for a limited time. Deemed “The Best Musical of this Century” by the New York Times, this is definitely a show you should see. Performances will be happening daily until closing night on Sunday 8/26. For ticketing information, click below.

All You Can Eat

This Saturday, August 18th, from 11 am – 3 pm Verrill Farm in Concord is celebrating their 100th anniversary. For just 12$ per person, visitors will have all you can eat access to over 30 varieties of locally grown tomatoes, corn on the cob and vegetable dishes. Live bluegrass and pony rides will also be present throughout the feast!