Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Are High Frequency Traders Ripping You Off?

High Frequency Traders: Fight Back As author Michael Lewis reminded us this week with the release of his book, Flash Boys, high frequency traders (HFTs) are systematically sucking value out of the markets. Are you a victim, and what can you do about it? First, how does this work? Think about it like this: You call ahead to the supermarket…

Drones, bitcoins on wheels, and the rebirth of privacy

What happens when 75,000 professionals at SXSW (South by Southwest) from 74 countries with backgrounds in music, technology, and film get together for 10 days in Austin, TX? Quite a lot! Normally we write about investing but this week we’ve got a very different topic. I spent a week at SXSW 2014 and here are some of my favorite highlights. Intellectual…

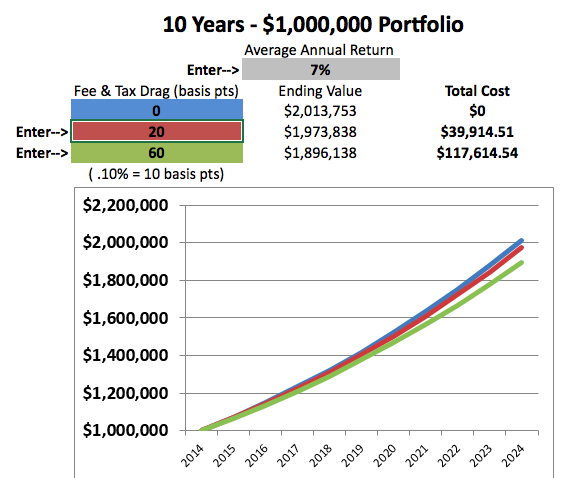

Cost Control Calculator

Small expenses can seem inconsequential in the short run, however inefficient investments with higher fees and poor tax management can take a big bite out of your portfolio in the long run. Focus on the things you can control – fees and taxes. And use our Osbon Cost Control Calculator (below) to see just how much these small improvements add…

6 Reasons To Say No To News

It seems almost self-evident that whoever has the best access to current news sources gains a significant advantage as an investor. Because information is power. Or is it? Does news help or hinder investors? Thanks to Bloomberg, CNBC, Reuters, and other financial media, investors have access to an endless stream of stories about bubbles, high valuations, low valuations, what stocks…

Early Days For ETFs

What happens when 1,500 people get together to talk about ETFs? Four days of keynote speeches, panels, and booth presentations… and here’s what I witnessed: It’s Early Days Matt Hougan (CEO ETF.com) and Dave Nadig (CIO ETF.com) opened the conference calling for ETF assets to reach $15.5 trillion in 10 years, up from $2.3 trillion right now. That would eclipse…

Wall Street gets a bad rap

It’s easy to blame the monolithic brands of Wall Street for selling us products poorly suited to our needs, or charging fees that empty our pockets to fill their own. It’s easy to blame them for enticing us with hot stock tips, slick hedge funds, exclusive private equity issues, and once-in-a-lifetime IPOs, none of which may be right for us….

Bitcoin… There, I said it.

Bitcoin: a currency wrapped in a riddle We don’t expect interest in Bitcoin to wane anytime soon. With a future price that could go to $20,000 or $0, it’s the ultimate speculative vehicle. It might even be the perfect holiday gift for the person who has everything and might be happy with a little bit of nothing. Any discussion of…

Look out. Here come the individuals.

This week’s article is written by guest author, Steve Mott. Steve is a long time editor for Osbon on the Money. Individual investors are pouring money into the stock market again. It’s been a long wait. Many bailed out during the financial crisis at its worst, and have been waiting for it to be “safe” to invest again. Now with…

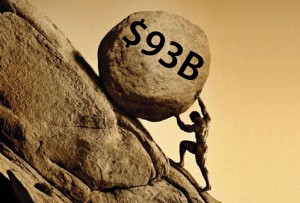

Too Big to Jail?

Nobody’s too happy with the big banks these days. The public distrusts them and the regulators have been levying hefty fines for misdeeds before, during and after the financial crisis. The fines are big, but who’s really paying the price? How does $93B in fines affect you? Fines on the six major Wall Street firms – JP Morgan, Bank of…