Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Inflection Points, AI’s Sydney

Inflection Points There is no shortage of bear market theories circulating in the investment community and media. While there are many intelligent reasons to be negative, there comes the point where reflexive bearishness turns into a blindspot. It seems likely to me that we are at that point today. There are a handful of key inflection points from recent months…

Robotics Growth, AI Sparring, Unicorns

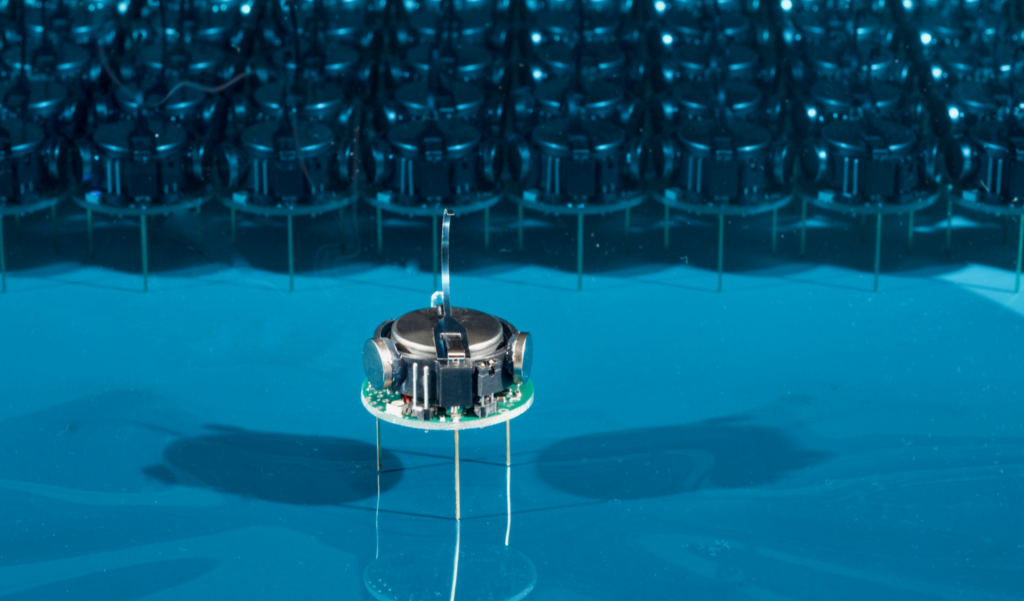

Robotics Growth We wrote a few weeks ago about how global businesses are deploying over 500,000 new robots annually. Amazon alone has 500,000 robots in operation today, along with 1.6m employees. So far Amazon’s pace of hiring and the total robot count has increased in unison, but don’t expect that to last much longer. Companies like Amazon are known for…

Practical AI, Rates

All eyes on rates For the first time since Nov 2021, we are seeing the first real reprieve from the persistent downward pressure on markets. The overwhelming strength of the dollar peaked in October when the GBP hit 1.06, the EUR hit .95 and the Yen hit 150. A weaker dollar will help earnings going forward. As expected, this week…

Status Quo, Innovators, Buffett

Status Quo People and companies typically don’t change unless or until they’re forced to. Christensen’s Innovator’s Dilemma points out how companies often fail to grab new markets because they both fear disrupting their core business and vastly underestimate the opportunity. An amazing amount of innovation gets left on the table when companies follow the status quo. Google invented the transformer…

More GPT, Spikes and Limbo

GPT and AI tools Microsoft recently invested $10B into OpenAI at a $29B valuation. This is reminiscent of Adobe buying Figma for $20B. Both valuations are extremely high, but these companies cannot afford to not participate in the future of these markets. LLMs (large language models) like ChatGPT completely change how we gather, interact with and consume information. Whereas a…

AI Integrations, Debunking, Fed Fights

Let’s start with the bright spots Life.Subtitled. NReal is an augmented reality glasses company from Beijing that’s reminiscent of the success of DJI, the dominant consumer drone company. NReal’s augmented reality glasses look like regular sunglasses, which makes them attractive for public use. The combination of NReal’s AR glasses, Amazon’s Alexa tools powered by AWS and a smartphone app…

Bullwhip, Normalization, Momentum

Bullwhip Effect As we enter 2023, we’re now three years into the substantial and dramatic shifts brought on by Covid. Redrawing the economic landscape is like attempting to redraw country borders after shifting tectonic plates. The path back to homeostasis cannot happen without bullwhip effects and significant, momentum-driven ups and downs across all markets. Earnings volatility reduces valuations. At a…

AI 2023, Automation, Rates

Rates The driving forces of this market boil down to a handful of factors we’ve been tracking all year. Short-term rates are now 4.5%, up from .25% in February 2022, meaning you can earn 3.5%-4.5% on your cash alone. Higher rates make risk assets like equities far less attractive. Why risk anything when you can earn 4% guaranteed? The problem…

Hikes, Productivity, Leaps

Rate Hikes The Fed is doing exactly what it said it would do: raising interest rates rapidly to get inflation under control. This week’s 50 basis point hike brings us to 4.5%, the fastest rate hike in modern history. Notably, the futures market says this could be the final rate hike, with now just an outside chance of reaching a…