Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Why Don’t I Invest The Way I Should? 8 Reasons

Reader alert: Don’t worry about the title. This is a no-shame, no-blame, no-guilt article. Read on without worry.

If you are not completely satisfied with your investment progress and suspect it can be better, you’re probably right. Here are the 8 most common investor hurdles we see. And they are all completely curable!

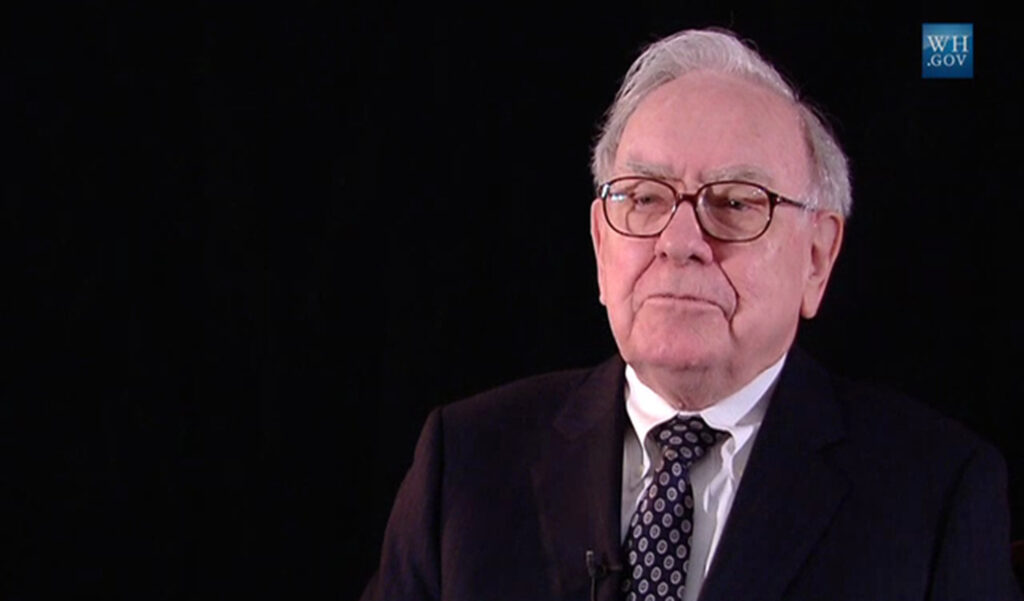

Why Warren Buffett is Optimistic About Your Kids

Warren Buffett’s Annual Shareholder letter is perhaps the most eagerly anticipated, widely read business news report. It came out online last Saturday morning, all 124 pages, and it is fascinating reading since Warren is both a good writer and the world’s third richest person. What stood out most to me was his comment on the economic future of children in America. Many parents wonder and worry if their kids will be better off than they are. Warren says ‘absolutely yes’. Here’s why in his own words.

Buffett vs. Hedge Fund Wager: Year 8

Every year at this time we update the results of a friendly one million dollar wager made in 2008 by Warren Buffett. He took the modest S&P 500 index versus five hedge funds handpicked by prominent NY money manager Protégé Partners. It’s a ten-year bet. With just two years left on the clock, who’s looking good and who’s looking for…

Is It Time To Buy? Five Reasons

It’s been a year to remember for the stock market. And it’s only mid-February. The Dow Industrials have been up or down more than one percent in 20 of the first 30 trading days of the year. As we discussed last week (Is It Time To Sell?), the market’s volatility has many investors wondering what, if anything, to do. How do…

Is It Time To Sell? Four Reasons.

Not only is the news full of dire business and economic news, stocks are going straight down, oil has already tanked, tech is plunging, and the list goes on. It’s scary, no doubt. But is it time to sell? Here are four reasons to sell right now – and they’re not what you may be thinking. OK, how bad is…

Negative Interests Rates – What’s That Got To Do With Me?

The Japan Central Bank shocked markets last week – not easy to do – by lowering the official bank interest rate to negative territory. They are not the first, but are among the biggest. What is going on and why should you care? How is this even possible? It has been long thought that interest rates could never be negative,…

Do You Have The Four Money Mindsets?

Tips are good. Mindsets are better. If you’re trying to reach a fitness goal – losing 15 pounds, for instance – you may get a temporary boost from a diet or exercise tip. If this doesn’t work, you might think that some people have an inherent ability to live healthy and active lifestyles. I can tell you from personal experience…

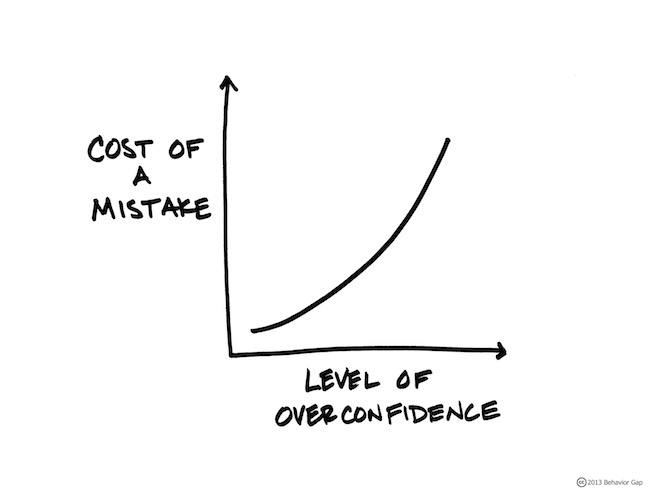

Is Overconfidence Costing You?

Investment overconfidence, that is. If you are managing your own investments overconfidence is very likely costing you. A lot. How can you tell? Just measure in dollars and cents how much you lost or failed to earn because you bought or sold the wrong security at the wrong time. Almost all wrong moves like these have their roots in overconfidence….

Does Your Money Control You?

Money is emotional, both when scarce and when plentiful. You may find that after working long and hard you have more money than you initially imagined, or maybe finally have the money you want. All along the way the exchange of your time and talent for money creates an emotional connection. But what kind of connection? Is your money starting…