Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Overcoming Investment FOMO

Fear of missing out (FOMO) is a natural human feeling. No one wants to miss a big event, or in investing, a big payout. Which makes us wonder: Should I buy Twitter? Facebook? Google? Alibaba? Are there others I should know about but am missing out on somehow? How can I be sure to get in on the next big…

You Have More Than You Think

Where, you might ask? Look at the Social Security website and online benefits calculator from an asset point of view. Since the Social Security administration stopped sending out paper statements to you on your birthday, you can now go online and get personal benefit information along with valuable extras. 13 million people have already registered and collected their data. One…

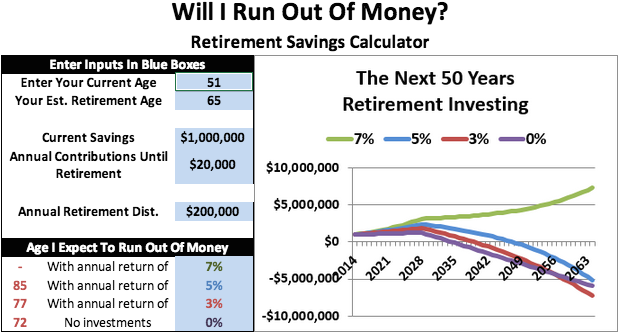

Will The River Run Dry?

There are many ways to gauge financial well-being, but there’s one measure that is universally relevant, regardless of age or income: will my money last longer than I do? Or stated in more drastic fashion: will I run out of money? Will the River Run Dry? The Osbon Labs retirement calculator is a great tool to answer that question. We like…

Three Investment Tools For You

Make it personal If you’ve ever used a power saw, food processor, or lawn mower, you know that the right tool makes any job much easier and faster. That’s the spirit behind the interactive, personalized tools in the Osbon Labs. With a few clicks of the mouse these tools will help you better understand your own financial situation and plan for…

5 Ways to Compare Investment Advisors

The relentless search for “better” is a basic, and essential, human instinct. We want better shelter, better food, better people in our lives. We want better goods and services so badly that entire industries have developed to create, advertise and sell them. We strongly encourage all investors to seek and demand better. Considering the time we spend choosing restaurants, detergent…

When You Are Acquired: the Three R’s

More than 20 Boston area companies have been acquired so far this year. Almost all were privately held. When you are acquired, it’s not just a life-changing liquidity event, it’s validation of your business model and a hard-earned reward for your ideas and long hours. In the big deal, you’ll receive cash, stock and/or incentives to continue working. Then what?Based…

6 Questions to Ask Your Advisor

Are you considering a new investment advisor? Or reflecting on an existing investment relationship? Or just wondering if you are getting the best for your money? Then use this six question investment checkup checklist as your guide. Ask your current advisor and any prospective advisor. By the time you are done, you’ll know if you and your money are in…

5 Healthy Investment Priorities for the Summer

Summer is a great time to accomplish things; it’s more relaxed and you have more time. With time to focus and prioritize, why not put the most important person – you – first? Here are five tasks with long and short-term payoffs for your to-do list. 1. Cut your taxes Let’s get started with the easy steps, like cutting taxes….

Beating a donkey for not being a horse

Active investors are at it again Underperforming, that is. According to the Wall Street Journal, 74 percent of actively managed large cap funds are lagging the S&P 500. The Journal’s story, “Stock Pickers Have Tough Time in 2014” lists the usual reasons active managers underperform such as market timing, high costs, wrong guesses and overconfidence in forecasting. Even the weather…