Weekly Articles by Osbon Capital Management:

"*" indicates required fields

“Average” – More Motto Than Maxim

Average is above average The evidence is overwhelming. Index funds, designed to deliver the market return of an asset class, have consistently outperformed the majority of actively managed mutual funds. Period. Still, many investors and advisors are unwilling to accept this idea. Indexes seem “average.” Average seems lame. And who wants to be lame? It’s a costly attitude. A word…

Early Days For ETFs

What happens when 1,500 people get together to talk about ETFs? Four days of keynote speeches, panels, and booth presentations… and here’s what I witnessed: It’s Early Days Matt Hougan (CEO ETF.com) and Dave Nadig (CIO ETF.com) opened the conference calling for ETF assets to reach $15.5 trillion in 10 years, up from $2.3 trillion right now. That would eclipse…

How Big Is The ETF World?

More than $2.3 trillion is invested in index exchange traded funds. Where is it? How is it allocated worldwide? Our own local State Street Global Advisors publishes a fascinating monthly report that tells all. Global ETF Allocation: By Asset Class: Largest Providers: The Big Three It’s early days Yes, $2.3 trillion is a lot of money. But it’s only a…

Are The Rich Smarter?

If you had more money to invest, would you get better investment results? It’s tempting to think so, and you might be intrigued about the research on exactly that question. 3 top professors did the study, and here’s what they found. Steady there, Eddie… Let’s jump to the study’s conclusion. No, the rich are not smarter investors. They make the…

The Art of Battling Giants

What’s it like starting from zero and operating a small investment boutique, competing against the giants of Wall Street? Challenging yes, but far from impossible. As Malcom Gladwell describes in David and Goliath, a guidebook for newcomers, underdogs and entrepreneurs, there are real advantages in being small. Gladwell’s David and Goliath “uncovers the hidden rules that shape the balance between the…

Wall Street gets a bad rap

It’s easy to blame the monolithic brands of Wall Street for selling us products poorly suited to our needs, or charging fees that empty our pockets to fill their own. It’s easy to blame them for enticing us with hot stock tips, slick hedge funds, exclusive private equity issues, and once-in-a-lifetime IPOs, none of which may be right for us….

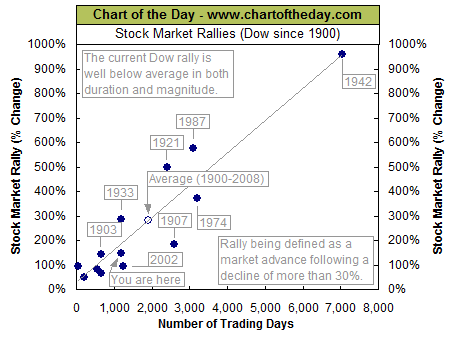

The long, high road for US stocks

How far for how long? It’s been a great year for US stocks, with indexes broadly up 25 percent or more. As the Dow hovers around 16,000, some pundits proclaim “it can’t go up any farther” or “sell everything now!” Are they right? Let’s take a fact-based look. The long, high road We all know that US stocks have gone…

Inflation. Is it CPI or MyPI?

It’s easy to think of inflation as financial weather – something we must endure and can’t control. While it’s true we can’t control the prices that grocers, automakers and landlords charge, we can, and should, control what we spend. We’re all familiar with the Consumer Price Index, or CPI. It tracks the cost of groceries, rent, utilities and other goods…

Bitcoin… There, I said it.

Bitcoin: a currency wrapped in a riddle We don’t expect interest in Bitcoin to wane anytime soon. With a future price that could go to $20,000 or $0, it’s the ultimate speculative vehicle. It might even be the perfect holiday gift for the person who has everything and might be happy with a little bit of nothing. Any discussion of…