Weekly Articles by Osbon Capital Management:

"*" indicates required fields

New Technology For Estates

Where do you keep your most important information and documents? Are they secure, easy to access and available to share with others who need them? A new tool from Fidelity just made that whole issue much simpler and more convenient – for you and your family. Fidelity now lets you store, access and share digital copies of your family’s most important documents, at no cost. This is cloud computing at its best and most personal. Read on for simple next steps.

How Big Is Your Financial Cushion?

At some point in your financial life you have more money than you need to live on, so you invest it. But even after you have built a big nest for the money eggs, you still need a cushion, an emergency fund, or some readily available cash that’s always there when you need it. But how much do you need? Here are four ways to help you find the answer.

Is Robotic Investing Right For You?

Is a machine up to the task of managing your money? A lot of venture capital money is betting yes as more and more “robo-advisors” hit the market. Fascinating stuff, but the closer you look, the more algorithms, formulas and artificial intelligence come up short. Technology has a big role in investing, but there are still many circumstances when human touch and insight just can’t be replicated. Here’s a guide for managing your money in the robo age.

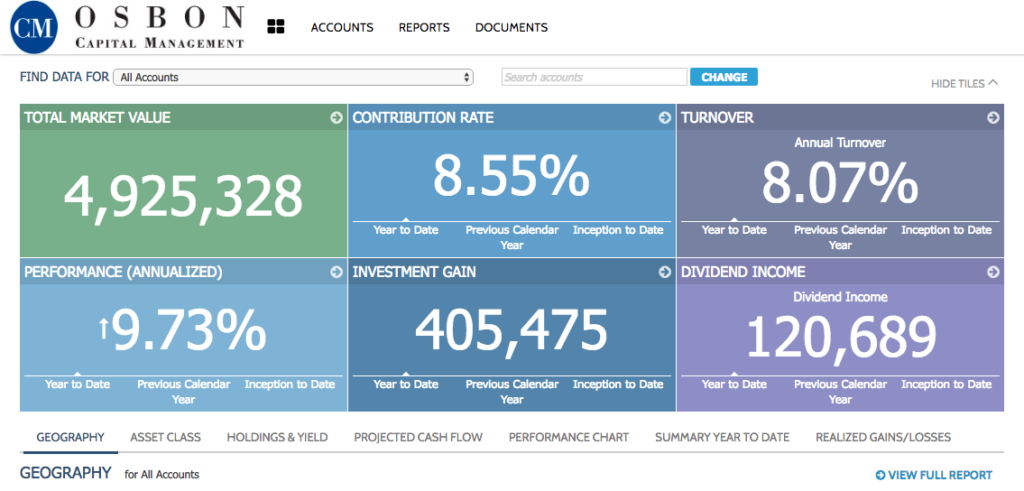

Better Reporting: See Your Finances In A Whole New Light

There’s a big difference between data and insight. The financial world has been great at generating the former, but notably weak at taking the next step by creating insights. At Osbon Capital, we see that as a major shortfall and have invested heavily in reporting capabilities that let you take control of your financial information. With our industrial strength financial portal, our clients have all the information they need to understand where they are and how to reach their goals. Here’s the latest in technology.

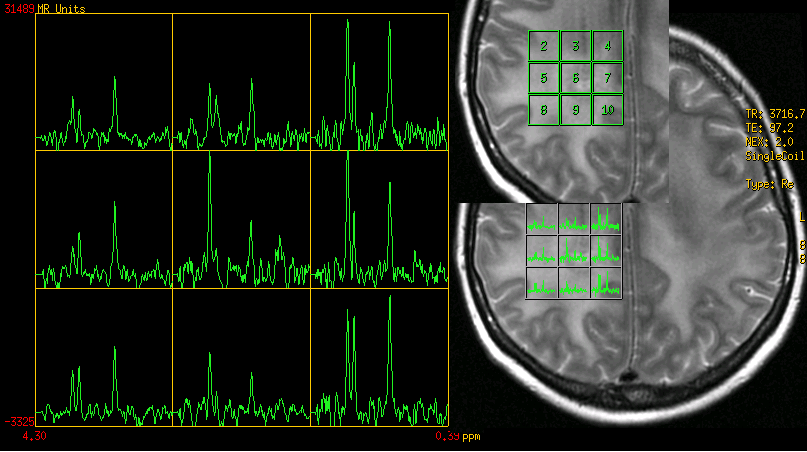

Should You Have An Investment MRI?

Healthcare went through a revolution when MRI (magnetic resonance imaging) became commercially available in the ‘80s, courtesy of GE. X-rays could show bones, but MRIs could show soft tissue all around the bones, and even everything inside the skull. Doctors went from looking at skeletons to looking at whole bodies.

Similarly, we take an investment MRI approach to portfolio analysis, looking past the basics of stocks, bonds, alternatives and cash. Our MRI reveals what is actually happening, why, and how. Here is what we look for:

Five Measures Of Investment Me

We often talk about treating your personal investments the way you would run a business. Knowing your cash flows, profits and losses, and balance sheet keeps Investment Me on track to hit the goals. If that sounds daunting, know that software makes this easier than ever. Once you have this set up (email me to find out how to do this) here are the 5 key metrics you can monitor monthly, quarterly or annually to make sure you investments match your goals.

6 Types of Financial Tidiness

I’ve recently been caught up in the KonMari tidiness phenomenon. Marie Kondo has sold millions of copies of her book, “The Life-Changing Magic of Tidying Up”, and was named on the Time 100 Most Influential People this year. Here’s how you can use her ideas for your money’s tidiness.

Single Stocks And Concentration Risk

Last week we were asked to address this topic for an article – we get our best ideas from clients. As the investment adage goes: you get rich through concentration, you stay rich through diversification. It holds a lot of truth. Knowing what to do and when is a question of matching risk with reward. Consider these concepts and questions if you currently hold a significant piece of your wealth in a single entity or are thinking of doing so.

Why We Use Fidelity

Quick, what’s the first question you should ask of a prospective investment advisor? Hint: not many people ask it. The question is “Where will my money be?” Or phrased another way: “Who is your custodian?” The answer matters. The custodian safeguards your assets, gets trades executed, keeps tax records, and does most of the invisible work behind the scenes to make sure your account holds what it should. We use Fidelity. Here’s why.