Weekly Articles by Osbon Capital Management:

"*" indicates required fields

Four Books for Your Summer Reading List

I chose these books to address four themes that I think are valuable for successful investors. The first will help boost your optimism by viewing our progress as a society through a broader lens and a fresh perspective. The second will inspire you to be more effective when getting together with people to share ideas, investment or otherwise. The third, one of Warren Buffett’s all-time favorite investment books, will help you focus on the most effective attributes of a successful CEO. The last, by my favorite futurist, a local Boston VC, will expand your view on the real-life science fiction that is happening today in biology and genetics. Read more to see how these relate back to investing.

6 Features I’d Add To The Financial Industry

In 2013 Google’s New York office ran an experiment that replaced the normal glass M&M containers with opaque containers labeled “M&Ms.” Within seven weeks the 2,000 person office’s consumption of M&M’s had dropped by over 3.1 million calories. Without changing our willpower or discipline, we can control our healthy habits with simple changes to our environment. We should be able to do the same with our financial health by making small tweaks to our financial environment. Here are six M&M/Google inspired features I would add to our financial lives:

Four Points To Consider When Holding Debt

Owing money makes many people queasy, even if their assets far exceed their debts. Holding zero debt eliminates that unease and fosters a sense of robust financial safety. There’s nothing wrong with that approach if it helps you sleep at night. However, businesses use debt as leverage to increase their enterprise value faster than they could or would otherwise. Investors can use debt in the same way. Here are four points to consider when considering when and how to use debt.

Investing Is Much More Than Numbers And Graphs

I’ve always felt an advisor must do much more than open accounts, analyze investments, trade securities and send quarterly reports. I’ve continually looked for deeper, better ways to relate to and communicate with clients – ways that help both parties understand and maximize the benefits of investing. That’s what led me to a fantastic leadership retreat this past weekend created by ex-Google employee #107 called Search Inside Yourself (SIY).

The Umbrellas Made It Rain

Can a candidate buy an election? Or can a super PAC make the purchase for him? With mid-term elections on the horizon, the effect of campaign spending on election outcomes will be big news again. It makes me wonder if running for office is a voting process or simply an auction. Does spending by candidates and PACs actually predict success? And what does this have to do with investing? Here’s what I’ve learned.

The Heart Behind The Writing

I put a lot of energy into the articles and blog posts written for osboncapital.com. Talk may be cheap and fleeting, but writing lasts. A well-written article can inform, clarify, educate, motivate, entertain and help you see familiar facts or ideas in a new light.

One Month to Tax Day – 4 Questions

Many of the missteps people make related to taxes are errors of omission — simple oversights that lead to higher tax bills than necessary, or even penalties and interest. As we head into the last thirty days of the tax season here are four reminder questions to ask yourself before April 15th.

Why Do Allocations Change?

Good question and one asked frequently by experts and clients alike. When should asset allocations change in a portfolio? The when, why and how of allocation changes should be as transparent as indexing itself, and it is.

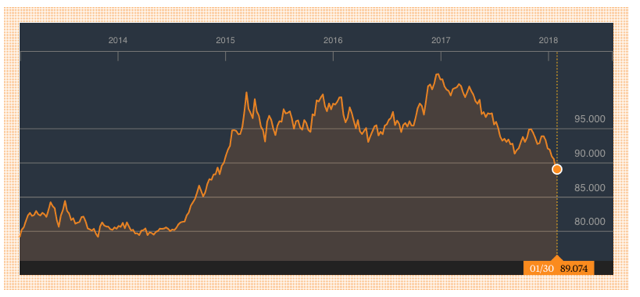

The Road Ahead for the Almighty Dollar

Big changes in dollar strength can have big economic effects at home and around the world. The strong dollar was called into question last week in Davos and emerged unchanged. What will investors be looking for the dollar to do in 2018? Here’s our checklist.