Four Books for Your Summer Reading List

I chose these books to address four themes that I think are valuable for successful investors. The first will help boost your optimism by viewing our progress as a society through a broader lens and a fresh perspective. The second will inspire you to be more effective when getting together with people to share ideas, investment or otherwise. The third, one of Warren Buffett’s all-time favorite investment books, will help you focus on the most effective attributes of a successful CEO. The last, by my favorite futurist, a local Boston VC, will expand your view on the real-life science fiction that is happening today in biology and genetics. Read more to see how these relate back to investing.

Factfulness: Ten Reasons We’re Wrong About the World–and Why Things Are Better Than You Think

by Hans Rolling (April 2018)

“One of the most important books I’ve ever read―an indispensable guide to thinking clearly about the world.” – Bill Gates

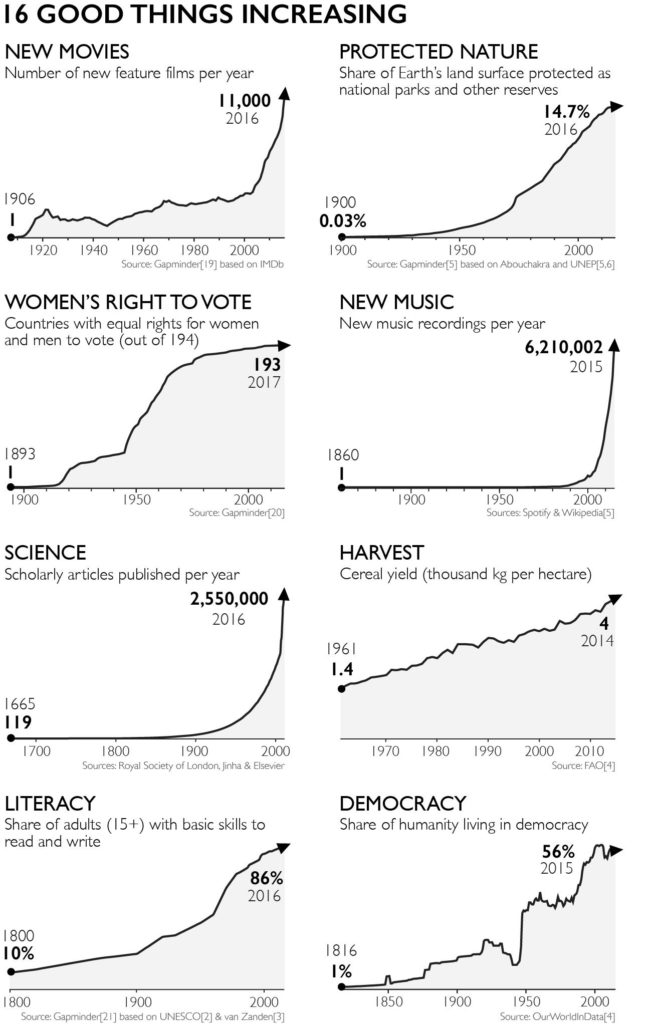

If news or politics have you feeling stressed or anxious, Factfulness will provide an uplifting shot of context by zooming out and taking the pulse of human progress on a larger scale. In his book, Hans covers 16 terrible things that are on their way out and 16 wonderful things that are dramatically improving. There is good news in store for you in the data that Hans presents on topics like oil spills, the cost of solar energy, voting rights, literacy and more. It’s a useful counterbalance to the tiring daily news cycle and helps restore optimism. Optimists tend to do better in their investment portfolio because they are willing to take on more risks.

The Art of Gathering

by Priya Parker (May 2018)

“Hosts of all kinds, this is a must-read!” –Chris Anderson, owner and curator of TED

Priya eloquently presents that there is an art and a science to effectively bringing people together. Whether it’s a meeting in an office, a corporate retreat, an investor’s lunch or a dinner party, intentional gathering will help create deeper and more meaningful connections. In a world increasingly addicted to meetings, this book is valuable for both hosts and attendees. At Osbon Capital, we have been rethinking our own gatherings to make them as intentional as possible.

The Outsiders

by William N. Thorndike (October 2012)

“An outstanding book about CEOs who excelled at capital allocation.” — Warren Buffett

#1 on Warren Buffett’s Recommended Reading List, Berkshire Hathaway Annual Shareholder Letter, 2012

When investing in a CEO’s ability, look for the characteristics outlined in this book. While larger-than-life charismatic visionary type CEOs get the headlines and the hype, it turns out that CEOs who are pragmatic, flexible, opportunistic, frugal and patient produce the strongest results. The Outsiders hatched from a Harvard research project that studied the quiet lives of some of the most successful leaders that you’ve never heard of. This is a must-read for any professional investor.

Evolving Ourselves: Redesigning the Future of Humanity–One Gene at a Time

by Juan Enriquez and Steve Gullans (November 2016)

“We are going from evolution by natural selection to evolution by human design. The game has changed, and this book provides the new rules of engagement.” – Peter Diamandis

Juan Enriquez’s TED talks are some of my all-time favorites. His book tracing the exponential progress we are seeing today in gene editing and biotechnology reads like real-life science fiction. This story covers accelerating trends in autism and asthma; how to dramatically increase life spans; ethical questions around designer babies; de-extinction; and the possibility of creating an entirely new species from scratch. It’s useful for any investor looking to stretch the boundaries of their imagination when it comes to innovation.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields