Week 33: SPAC Bubbles, The Metaverse, Lumber, Poly Network Hack, and so on.

Briefing: SPACs are allowed to publish future revenue projections when they go public, which is causing some problems. | The Metaverse can be used to train autonomous robots. | Lumber prices are back below pre-pandemic levels after jumping to extreme heights. | Blockchain technology may prove useful in preventing money laundering.

SPAC Air Bubbles

There have been 359 SPACs so far in 2021 – more than double last year and nearly 10x more than in 2019. Unlike traditional IPOs, companies that go public via a SPAC merger can publish forward-looking revenue projections. This is an important distinction. IPOs are specifically not allowed to do this because it allows any new company to publicly state, “We bring in $0 of revenue today, but we think we can hit $1B in revenue 5 years from now”. The authority of the public market process can easily push investors to value these companies based on future numbers that don’t exist and may never exist.

Misaligned incentives can create bubbles. The underwriting fees to bring a SPAC to market are quite high, and investors have been pushing back. Bill Ackman’s SPAC is being sued for paying “staggering compensation” to directors. When you combine forward projections and high fees, you create a situation that unfortunately will attract bad actors. Nikola (electric trucks) is a good example. Their CEO was indicted by a grand jury last month for “lying about nearly all aspects of the business.” At one point his SPAC was worth $30B. Since then, it’s gone down to $4B, and it’s likely going to zero. AppHarvest (farming technology) is another questionable SPAC that peaked at $4B and is down to $750m as investors question whether the model was ever viable.

With all of that said, the SPAC market can do a lot of good by bringing capital to projects that need the scale of the public markets to grow. The space sector is a good example. It’s still early days for the modern SPAC, and there will certainly be wonderful winners that emerge from this recent cohort. The positive side of the SPAC world is that public market investors can access deals at a much earlier stage, making it similar to venture capital in many ways.

Most investors don’t have to worry about any SPAC bubbles bursting. Multiple bubbles are growing in any market at any time, and they often pop with little impact to the S&P500 or the broader real estate market.

The Metaverse

Most often, the metaverse is associated with video games. However, there is a growing number of practical applications. Unity, one of the leaders in “metaverse software,” recently announced a partnership with robotics software (ROS 2) to create warehouse environments that can be used to train autonomous robots. The requirements for a high-fidelity robotics warehouse metaverse are steep but doable with today’s technology. It’s much faster and much less expensive to discover your autonomous robots’ blind spots in a simulation than it is to have your robots collide or break down in real life. We are really just getting started with the many ways we will use the metaverse for creative, practical uses outside of video games.

Lumber

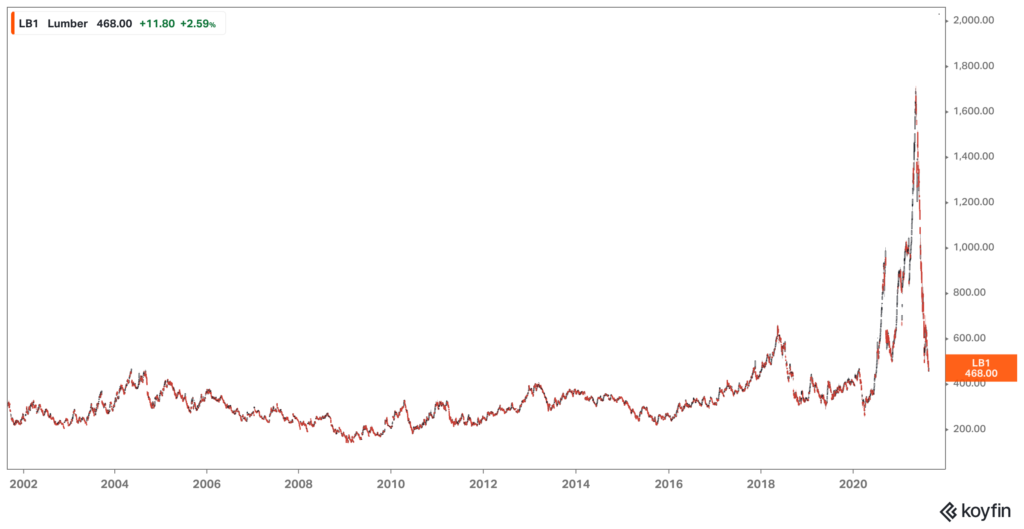

The price of lumber fell below pre-pandemic levels this week. Our original lumber article was published in May, 2 days before the price top. During the height of lumber panic, we wrote that prices would have to fall because there was no underlying shortage of trees. The lumber price shock was due to the pandemic’s effect on labor, supply chains, and shutting down mills. You can expect to see similar price patterns with other commodities as prices begin to normalize and recover from the pandemic-induced global shutdown. This 20-year lumber chart below is really quite amazing.

Poly Network Hack:

How might the blockchain ultimately be useful to society? It’s a fair question that deserves a balanced take. It turns out that blockchain could be beneficial when it comes to financial crime. The other week a hacker stole $600m in cryptocurrencies via Poly Network (which they are in the process of returning). Poly Network offered the hacker a job after he returned the stolen funds. Tom Robin (a leader in crypto compliance) pointed out that even though it’s possible to steal crypto, laundering and cashing out is extremely difficult. The follow-up question asked by Matt Van Buskirk (founder of Hummingbird) is, “when has a thief with a large amount of cash ever returned it out of fear that their transactions would be traced?” Despite popular belief, crypto is not anonymous. Blockchain technology may prove to be a powerful anti money laundering solution in the near future.

Weekly Articles by Osbon Capital Management:

"*" indicates required fields